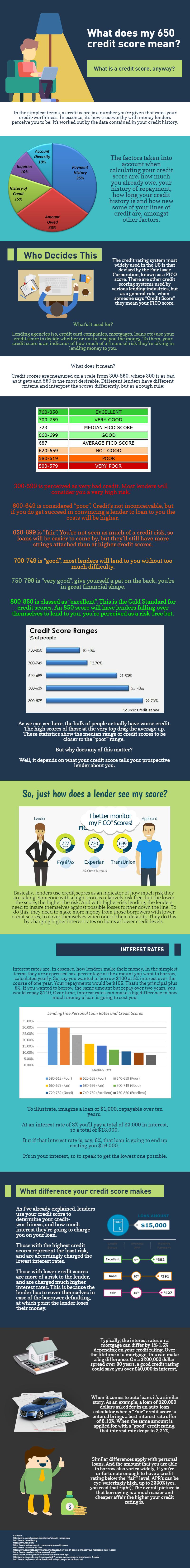

What is a credit score, anyway?

In the simplest terms, a credit score is a number that rates your creditworthiness. In essence, it’s how trustworthy lenders perceive you to be with money.

It’s calculated by the data contained in your credit history.

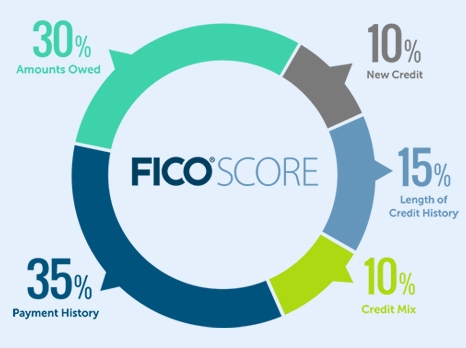

The factors taken into account when calculating your credit score are:

- Payment History

- Amounts Owed

- Length of Credit History

- New Credit

- Credit Mix

Who decides this?

The credit rating system most widely used in the US is devised by the Fair Isaac Corporation.

You might know it as your FICO score.

There are other credit scoring systems used by various lending institutions. But when someone says “credit score,” they are most likely referring to your FICO score.

What’s it used for?

Lending agencies use your credit score to decide whether or not to lend you money.

To them, your credit score is an indicator of how much of a financial risk they’re taking in lending money to you.

So anytime you apply for a credit card, mortgage, personal loan, etc. they will ultimately use your credit score to make a decision.

What does it mean?

Credit scores are measured on a scale from 300-850, where 300 is as bad as it gets and 850 is the most desirable. Different lenders have different criteria and interpret the scores differently, but as a rough rule:

300-599 is perceived as very bad credit. Most lenders will consider you a very high risk.

600-649 is considered “poor.” Obtaining credit is not inconceivable. If you do get succeed in convincing a lender to loan to you, the costs will be higher.

650-699 is “fair.” You’re not seen as much of a credit risk, so loans will be easier to come by. They’ll still have more strings attached than you would at a higher credit score though.

700-749 is “good.” Most lenders will lend to you without too much difficulty.

750-799 is “very good.” Give yourself a pat on the back, you’re in great financial shape.

800-850 is classified as “excellent.” This is the Gold Standard for credit scores. An 850 score will have lenders falling over themselves to lend to you. You’re essentially perceived as a risk-free bet.

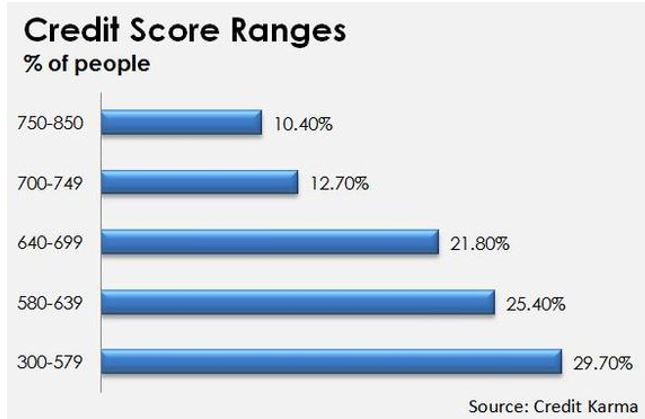

To put this into some sort of perspective, the average FICO score in the U.S. currently stands at 695. This is at the top end of fair, and bordering on good. However, this isn’t the full picture.

As we can see here, the bulk of people are actually on the low end of the spectrum. The scores of those at the very top are bringing the average up. These statistics show the median range of credit scores to be closer to the “poor” range.

But why does any of this matter?

Well, it depends on what your credit score tells your prospective lender about you.

So, just how does a lender see my score?

Basically, lenders use credit scores as an indicator of how much risk they are taking.

Someone with a high score is relatively risk free.

The lower the score, the higher the risk. And with higher-risk lending, the lenders need to insure themselves against possible losses further down the line. To do this, they need to make more money from those borrowers with lower credit scores. This helps them cover themselves when one of them defaults. They do this by charging higher interest rates on loans at lower credit levels.

Check out the infographic below for more details:

Interest rates?

Interest rates are, in essence, how lenders make their money. In the simplest terms they are expressed as a percentage of the amount you want to borrow. Over time, interest rates can make a big difference to how much money a loan is going to cost you.

How big of a difference can interest make?

Imagine a loan of $10,000, repayable over ten years. At an interest rate of 3% you’ll pay a total of $3000 in interest. So a total of $13,000. But if that interest rate is, say, 6%, that loan is going to end up costing you $16,000. It’s in your interest, so to speak, to get the lowest one possible.

What difference your credit score makes

As I’ve already explained, lenders use your credit score to determine your creditworthiness, and how much interest they’re going to charge you on your loan.

Those with the highest credit scores represent the least risk, and are accordingly charged the lowest interest rates.

Those with lower credit scores are more of a risk to the lender, and are charged much higher interest rates. This is because the lender has to cover themselves in case of the borrower defaulting, at which point the lender loses their money.

Typically, the interest rates on a mortgage can differ by 1%-1.5% depending on your credit rating. Over the lifetime of a mortgage, this can make a big difference.

When it comes to auto loans, it’s a similar story. Let’s say you’re looking for an auto loan of $20,000. If you use an auto-loan calculator and rate your credit as “fair,” your best interest rate offer is 3.19%. When the same is done, but with a “good” credit rating, the interest rate drops to 2.24%.

The similarities continue when it comes to personal loans. And the amount that you are able to borrow also varies widely. If you have a credit rating below the “fair” level, APRs can be eye-wateringly high, up to 2330%. Yes, you read that right.

Plus, the amount that you’ll be able to borrow will vary based on your credit score. The overall picture is that borrowing is a much easier and cheaper affair the higher your credit rating is.

Best Credit cards for a 650 Credit Score

But if you’re one of the majorities of people in the “fair” credit category, this need not be a barrier to you being able to get credit; many credit cards cater to those with a credit score around the 650 mark.

The key thing to remember when applying for credit cards is to keep an eye on the interest rate and other charges. Some charge an annual fee. It’s also worth keeping an eye on what other services they may offer you. Here’s our pick of some of the best cards for those with an average credit rating of 650:

Capital One’s Quicksilver One has an APR of 29% and an annual fee of $39. One benefit of this card is 1.5% cash back on purchases made on the card. There is also the chance of an extension to your credit line with regular repayments.

The Credit One Platinum Visa offers 1% cash back. The APR and fee vary between 15.65%-24.15% and $0-$99 depending on your score, but there is the opportunity to see if you pre-qualify without harming your credit score.

The Indigo Platinum MasterCard also offers the chance to pre-qualify without impacting your credit score, with an APR of 23.9% and a variable fee.

The Capital One Platinum card has the same APR as the Quicksilver, 24.99% but, crucially there’s no annual fee. However, it doesn’t offer any cash back.

How to raise your credit score

Raising your credit score, as we have seen, gives you access to better terms at lower rates. For example, all the credit cards above have an APR above 20%. If you can get that credit rating up to 750, the APR drops sharply, with some cards offering as little as 8%. Loans and mortgages also come cheaper.

So how do you go about building that credit score? Well, there are a number of ways. Responsible credit card use is a good and easy way to build credit. Regular repayments on a credit card show you to be a responsible person, and your credit score will slowly increase over time.

It’s important to remember that there’s no quick fix for this, building credit is a time-consuming process.

Good credit scores arise from long histories of regular repayments.

It’s best to have just one or two cards that you use for purchases, even if the balance is slightly higher. A number of cards with small balances will adversely impact your credit score.

Do some financial spring cleaning: ensure you pay your bills on time, and bring your overall level of debt down. Don’t close any cards on which the balance is cleared. Remember that a large part of your credit score is your successful payment history, so closing successful accounts is rather like getting a good grade in school, and then throwing the test in the trash.

Raising your credit score is a time-consuming process, and requires discipline. But if you stick with it, over time that credit score will increase. And as it increases so do your opportunities for good credit, and the terms of your borrowing will become easier.

So stick at it, you’ll get there in the end.

Leave A Comment