Most who have a poor credit score are young.

It might be because you’ve just started building it up.

Or maybe you’ve ruined your score and would like to start over.

Now it’s getting easier and easier to apply for a credit card with bad credit.

According to the New York Federal Reserve Board, more people are taking advantage of it too.

But should you?

There are still some factors to consider.

Understanding Your Responsibilities

Everyone wants to have a credit card.

It’s so satisfying to swipe a card.

But there’s much more to it than just a swipe.

You are buying on credit.

That means you’re borrowing money from the credit union or bank.

There’s a grace period of around a month before you must pay it back.

Otherwise, you’ll have to pay interest.

Fees To Pay

As mentioned before, you must pay the bank back.

If you don’t, there will be interest in addition to your debt.

The fees will be shown in the Schumer Box.

Reading The Schumer Box

This box appears on credit card applications to tell you the most important information about the card.

Here are a few terms relating to credit card that you should know:

- APR for purchases: this is the interest rate if you owe money from the previous month

- APR for transfers: you can be charged if you transfer debt to another card

- APR for cash advances: there is an interest rate for cash advances with no grace period

- Penalty APR: this is charged when you miss a payment

- Grace period: this is the time given to pay the debt before interest is charged

- Minimum interest

- Annual fee

- Foreign transaction fee

- Penalty fees

- Late payment: if the minimum isn’t paid within the grace period, you will be charged a fee

- Over-the-limit: you will be charged if you go over the limit

- Returned payment: an extra fee if your payment for the credit card bill doesn’t work

Then it will obviously be harder to apply for a new card.

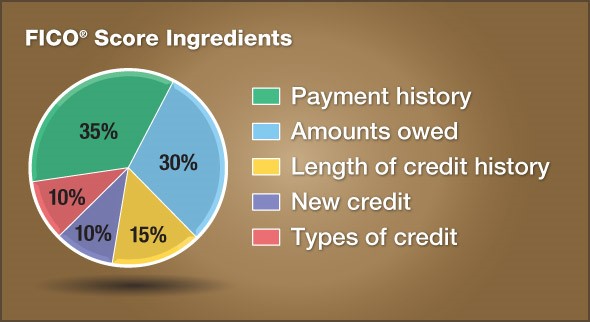

What Affects Your Credit Score?

- Payment history: this makes up the biggest part. Paying bills on time can raise your score substantially. Missing one payment can make it drop significantly.

- Amounts owed: this is the debt you owe to your creditor. All your debts and loans are under the scanner. However, the most important is your credit card debt.

- The length of credit history: the longer the history, the better. It looks at all your accounts and when they were opened. Cancelling a card can reduce the length of credit history.

- New credit: whenever you apply for new credit, an inquiry will show up in your report. Too many inquiries in a short period will lower your score quite a bit. These inquiries remain on your report for two years. But only the last 12 months are reviewed.

- Types of credit: it’s important to have a variety of credit. This includes credit cards, car, student and mortgage loans.

Check Your Score

So, you already know you have a bad credit score.

But if you think it’s too low, it might be because there are errors.

According to the Federal Trade Commission, one-fifth of Americans have errors.

It might be because of unimaginable things.

Maybe your name is too common.

Maybe it is misspelled on the report.

You can fix this by contacting the major consumer credit bureaus.

They are Equifax, TransUnion, and Experian.

Your score might increase significantly after fixing the problems.

Also, It is good to know the components of a credit score as depicted in the graph above.

Source Of Income

You don’t need a job to qualify for a credit card.

But according to the 2009 Credit CARD Act, you do need a source of income.

Here are some examples of how you can qualify:

- You don’t have a job but take care of household finances. If so, you can list your spouse’s salary as your own.

- You receive Social Security, child support, or other payments.

- Significant savings can be listed as income as well.

Choose Your Card Wisely

Different companies take different minimum scores.

They also don’t reveal their requirements.

So you should look for one for which you qualify.

Take your time and research.

If you can’t find one or aren’t confident, try applying for a secured credit card.

They are designed for people with poor credit.

But beware. They require a cash deposit for approval. Some also have high fees and hidden terms.

You’ll be legally bound to it, so be clear about what you agree.

Compare All Your Choices

Once you have some options, you should compare and contrast.

Try to find the best fit for you.

Some things to compare are interest rates, fees, rewards, terms and more.

Read the fine details of each one.

Call the company if you aren’t sure.

Don’t Splurge On Your Card

Once you have a credit card, try to control your spending.

Do not go on shopping sprees.

Do not go crazy with it.

The more you spend, the more you’ll have to pay back.

And if you can’t, add on the interest!

It might be common sense, but it’s easier said than done.

Still, a reminder won’t hurt.

So here’s your reminder: do not overspend on your credit card.

Be Prepared For Some Debt

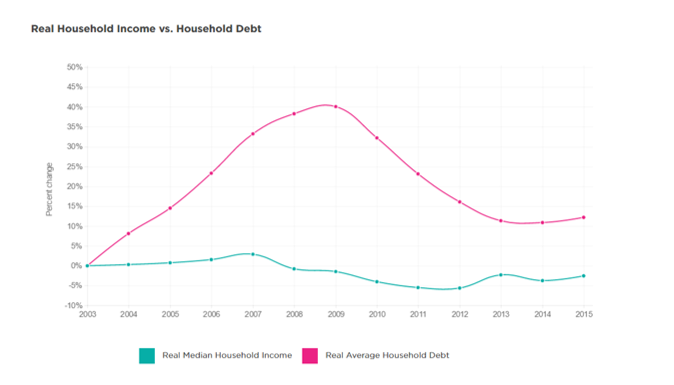

Though debt has dropped a little, it’s still much more than household income.

This can be seen in the graph below.

Contrary to what you might think, more money doesn’t mean less debt.

Because higher income means you can have more credit.

And more credit usually leads to more debt.

Try some basic ideas to cut down expenses.

Things will be much easier if you can pay off your credit card balance.

If you think you can qualify for a credit card, feel free to apply.

Just remember that applying too often can hurt your score.

You can also choose to wait and improve your credit score first.

The above tips will hopefully put you in a better situation to work out ways to obtain a credit card while maintaining a good credit score.

Leave A Comment