Most people nowadays seem to check their credit score on a regular basis.

This is good.

However, some studies appear to indicate that many Americans are confused as to what their credit score means.

None of these are true.

However, as long as people continue to believe that information, managing credit history is going to become a whole lot trickier.

What is your credit score?

Your credit score mainly identifies just how likely you are to pay back cash if you have debt on hand.

The higher your credit score, the better.

A high credit score means that you are going to be trustworthy.

When you are trustworthy, you can look forward to the following:

- Higher approval rates for loans

- A Higher credit limit on credit cards

- Lower interest rates on any borrowing

The method for credit score calculation will vary amongst different credit score companies.

However, most of them use this breakdown:

The following factors will never be considered in your credit score.

This information also comes from FICO:

- Personal information including skin color and religion.

- Age

- Job details

- Where you live

- Interest rates on current credit accounts

- Child support obligations

- Certain checks on your credit report.

What is a good credit score?

It varies from one company to the other.

However, if you look at this graph, you will see a good range of credit scores.

The closer you are to the ‘green’ area, the more chance you have of being approved for credit.

If you are in the red area, or maybe even the orange, then you will be turned down by most companies.

It is a myth that checking your score lowers your credit rating

Many people believe that they should not check their credit history too frequently.

This isn’t true.

These are known as ‘hard checks.‘

They will leave a mark on your account.

If you are applying for too much credit, then your score may quickly go down.

This implies that you may be in some sort of financial difficulty.

However, checking one’s own credit score is a ‘soft check.’

It will be noted, but it will not count against you.

Check the inaccuracies on your report

Most people will just look at their credit score and call it a day.

Do not let that happen.

You will be surprised at just how inaccurate some credit reports can be.

In fact, many companies have blatantly stated that they look at the accuracy of the data before they even look at the credit score.

Therefore, check the following on a regular basis:

- Personal information.

- Incorrect reporting of any payments that you have made.

- Account balances that are not up to date.

Too many credit cards is not always a good thing

There are some websites out there that will tell you that having a number of credit cards is a good thing.

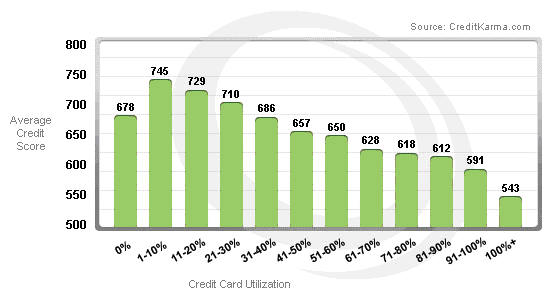

They may give you a graph like this:

This chart shows that if you have a lot of credit cards available, but you are not using all of the credit, then your credit score is going to be higher.

However, you also have to remember that if you have a lot of credit at your disposal, lenders are going to wonder why they need to lend to you when you have so much cash there to use already.

It isn’t good for them.

They will not want to take the risk.

Three credit cards seems to be the ‘sweet deal’.

Moreover, having lesser credit cards also removes a large chunk of your stress.

When you have limited number of credit cards, you are bound to abstain from splurging.

This has it’s own positive effects.

Consumers do not put effort into having negative marks removed from their account

Negative marks will remain on your credit account for around seven years after you have had to deal with the late payment.

So, a few late payments five years ago may still be impacting your score now.

You have to remember that paying the debt will not remove the mark from your account.

If there are incorrect negative marks on your report, then make sure you get in touch with the company that placed them there and ask them to be removed!

In fact, it is believed that one in four Americans has a mark on their account which is inaccurate.

So keep a watch on your credit report.

Stay informed and alert, so that you don’t get into a worse situation later in the future.

Get professional help

While the FICO scoring model (which is the model most credit agencies use) is designed to be simple to look at, it is quite tough to understand.

If you are analyzing your credit score on a monthly basis, you may start to notice that certain things that you do can push that score up and down.

However, there is no real substitute for getting a professional to do the job.

A professional will be able to look at your credit score and analyze your spending and saving habits.

They will be able to determine what needs to be done to manage that score properly.

This way boosting your credit score will be a breeze and no longer a ‘guessing game’.

It will be a game that you have complete control over.

Hiring a professional will help immensely, but it may cost you some money too.

However, in the long run, you are bound to save a whole lot more money due to the lower interest rates that you will get due to a better credit score!

Leave A Comment