As a first-time homebuyer, there are a lot of things that you will need to consider. It can be quite an overwhelming experience to purchase your first house. In fact, it can be so overwhelming that you may end up spending more money than you intended to. That is why we have decided to put together this guide for you. We don’t want you to overspend. We want you to save money, and we want the buying process to be as simple as possible.

Check Your Credit Score

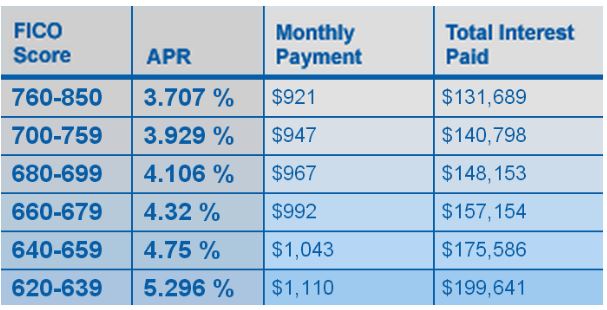

When it comes to saving money on a property, your credit score is everything. Unless you are rich, you are going to need a mortgage. The interest rate that you get with the mortgage will be dependent on your credit score. The higher your credit score, the better your interest rate, and the less money you will need to pay back over the course of the loan. Below is a sample chart. There is no guarantee that you will get the interest rates listed here, but it certainly shows the difference between scores. Even a small improvement in your credit score could save you thousands in the long run.

Source: http://sphoey.visualdns.net/credit-rating-mortgage/

There are several websites out there that you can use to check your credit score. Once you have your credit score, you can work on improving it. Here are some simple tips that will give you a nudge in the right direction:

- Pay your bills on time. Delinquencies on your report can remain in place for years.

- Learn about proper credit utilization.

- Contact your creditors if there are any mistakes on your credit report.

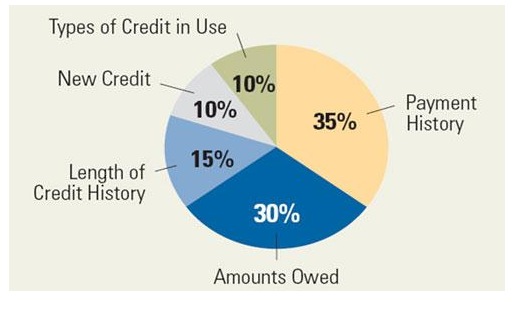

This chart demonstrates what has an impact on your credit score:

Source: https://blog.metrobrokers.com/2013/08/05/what-really-influences-your-credit-score/

Payment history and the length of your credit history will have a large impact on your score. These are things will take time to build a solid history. So, it may be beneficial to wait a couple of years to purchase your first home so you can qualify for the best interest rate possible.

Negotiating the Price of Your Home

Chances are that the listing price of your home is not going to be the price you pay.

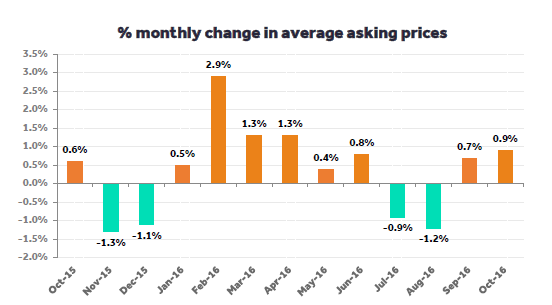

Click to tweetTo start with, you need to look at this graph:

Source: http://www.rightmove.co.uk/news/house-price-index/

Why are we showing you this chart? Well, because it demonstrates just how volatile the housing market is. Prices of properties do change with great regularity. The price of a property this month may be different than the price next month.

You have to remember that the buyer’s realtor is in it for their client. They are not there to offer the best price to you. They want to make the most for their client. Your job is to look at the market trends. Ignore what the property is listed for. This means nothing. Instead, you will want to see what properties in the area have sold for.

Bear the following in mind:

- Don’t bid too low. You will insult the seller and they may be less likely to sell to you in the future.

- Always bid as close to the market value as you can reasonably afford. Remember, the seller will probably choose the highest price offered, so if you are not close to this, you aren’t going to succeed.

Be Organized

Be as organized as you possibly can when it comes to applying for a mortgage. For starters, it is important to work out how much you can afford in terms of repayments each month. Keep in mind that you will want to build an ‘emergency fund’ into your budget. You don’t want all your cash tied up in your mortgage. There are a number of mortgage calculators online which will help you to determine how much you can afford.

You will also need these documents to hand when you are looking to apply for a mortgage:

- Recent pay stubs

- The last 2 bank statements

- The last 2 years’ of W-2s

Showing that you are organized may actually improve your chances of loan qualification.

Leave A Comment