In order to purchase a home, the majority of us will need to get a mortgage.

However, mortgage lenders are becoming increasingly wary about who they will lend money to.

It is important now more than ever that you understand what a credit score is, and how a low score can affect your mortgage options.

What is a credit score?

A credit score is a three-figure number that lenders use to gauge the trustworthiness of potential lenders.

The lower the figure, the more risk a borrower is considered.

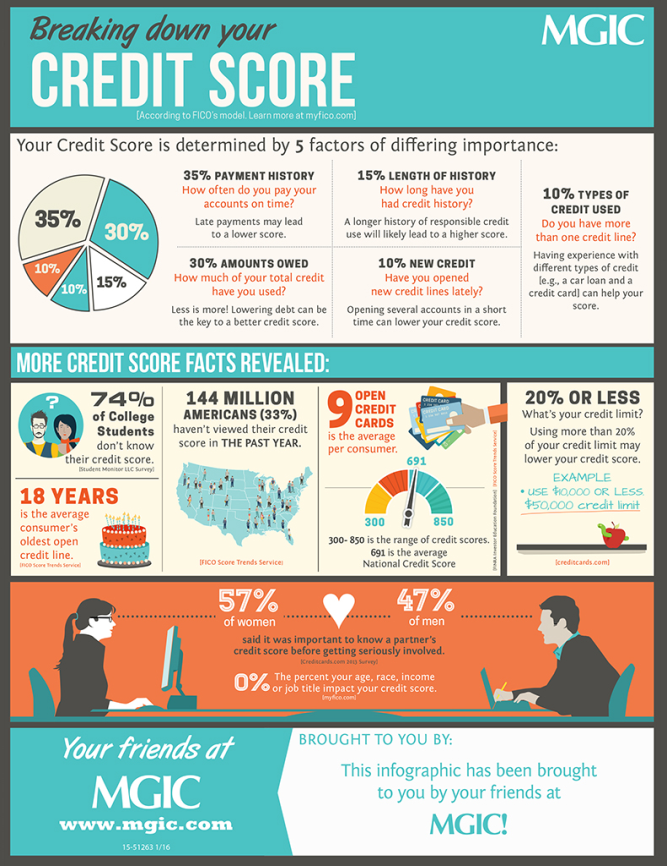

There are many different credit score models, however; most lenders in the United States use the FICO model.

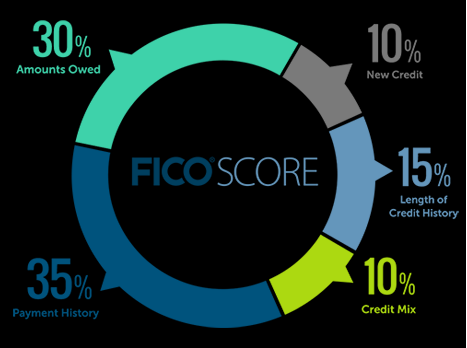

The FICO model takes into consideration many factors surrounding a person’s credit history:

- Credit mix = 10%

- New credit = 10%

- Length of credit history = 15%

- Amounts owed = 30%

- Payment history = 35%

The most prominent aspect of a person’s credit history is payment history.

This is why it is imperative that you ensure you pay off credit on time and in full.

Despite the importance, credit scores remain largely ignored or misunderstood with a staggering 74% of college students unaware of what their credit score is, and 33% of American failing to check their credit score in the last year.

What do mortgage lenders look for?

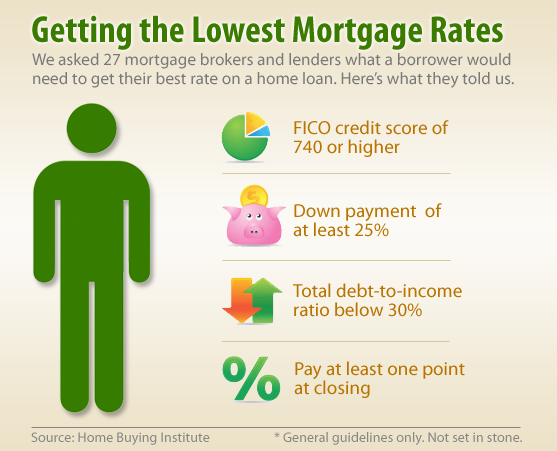

When looking for a mortgage, it is important that you ensure your finances are in order.

It is important that you know and understand what lenders are looking for, and what they require.

Mortgage lenders typically are looking for:

- A credit score of at least 740+

- A down payment of at least 20%

- Debt to income ratio of 30% or below

- Ability to pay at least one point at closing

How does your credit score affect your mortgage?

The higher your credit score, the more credit options will be available to you.

If you have a high credit score, you are more likely to be accepted for credit cards and loans, and you will be offered the lowest interest rates.

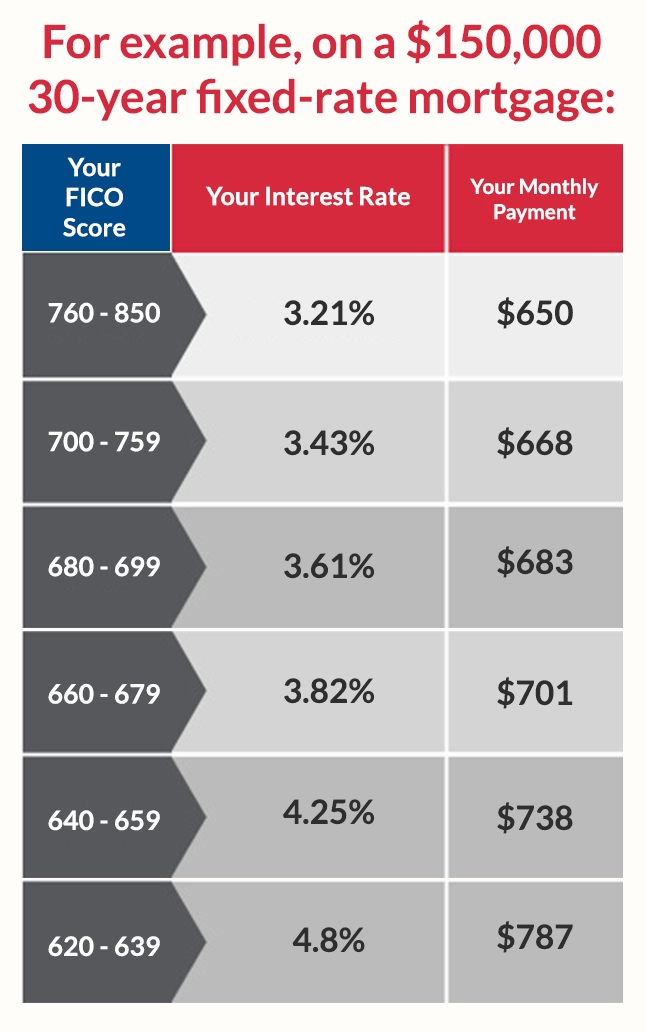

This will be especially important when applying for a mortgage, as lower interest rates can significantly affect your monthly payments.

A higher interest rate can save you $137 per month, which may not seem like a lot, but when you factor in a 30 year fixed term mortgage that is a total saving of $49,320 over the full term.

The minimum credit score requirements

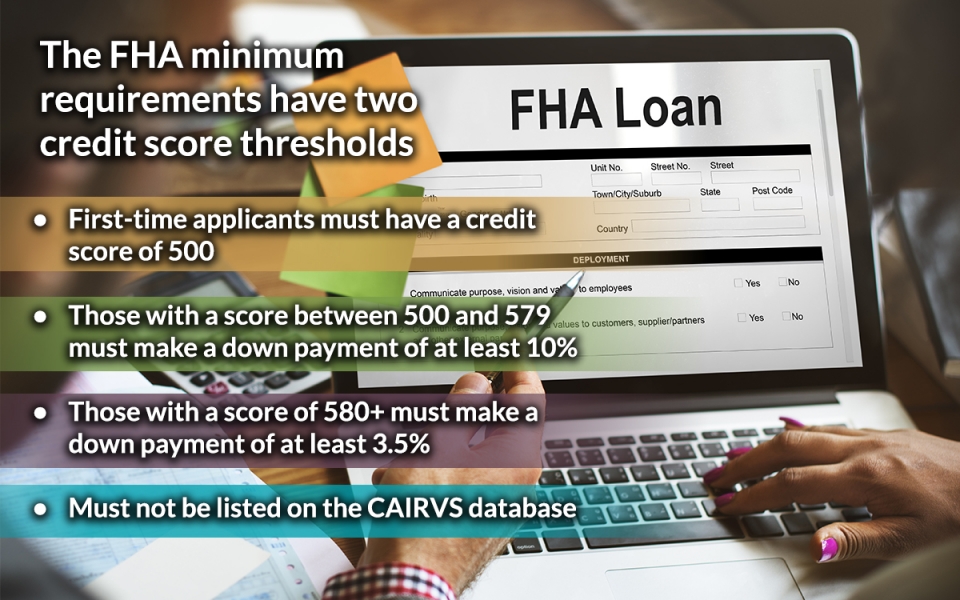

The FHA, Federal Housing Association, is set and governed by federal law.

There is no minimum credit score with either VA or USDA loans; however, both agencies also check the CAIRVS database.

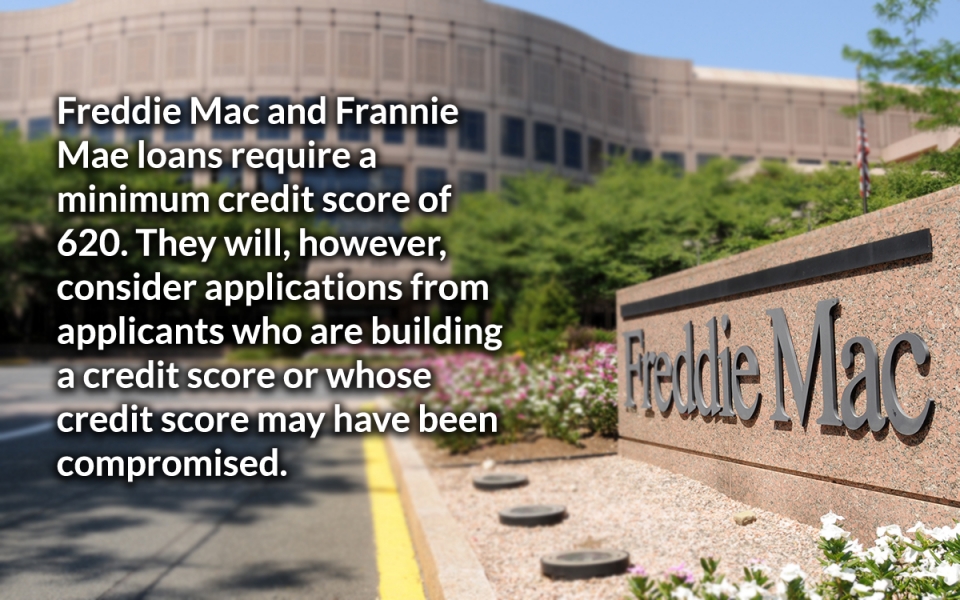

Other mortgage insurers may set their own FICO credit score requirements.

However, many of them changed their requirements to a minimum of 700 a few years ago.

It is important to note however that just because you meet the minimum requirements, this does not guarantee that you qualify for a mortgage.

Many lenders are cautious about who they will lend to as they :

- Do not look at the cause of low credit

- Do not want to lose their government funded loans by accumulating too many defaults

If you do not meet the minimum requirements or if you do not have a good credit score then you may still be approved.

However, your mortgage may need to be underwritten by a human as appose to an underwriting company.

Conclusion

A credit score is critical as many lenders use your score to determine how trustworthy a potential borrower is.

Someone with a high score is considered reliable while someone with a low score is considered a significant risk.

The FICO model is used by the majority of lenders in the US.

A large proportion of Americans either do not know their score, or have not checked their score in at least a year.

The minimum requirements to obtain a mortgage can vary from 500 to 700 depending on the lender.

However, even if you meet the minimum score, this does not guarantee you will qualify as banks are becoming extra cautious.

If you’d like to speak with someone about your credit, and how it may be impacting you financially, reach out to one of our credit consultants here.

We’re located in Tampa, Fl and have helped over 25,000 people nationwide restore their credit.

Leave A Comment