An individual’s credit score constantly keeps changing.

The reports issued by credit bureaus are just a snapshot in time.

Lenders use these to decide whether or not they will accept an applicant because credit scores are unbiased methods to assess the risk associated with every consumer.

Credit Bureaus and the FICO Score

The three leading American credit bureaus are TransUnion, Equifax, and Experian.

Each calculates a credit score in a unique way, but all three use guidelines from FICO.

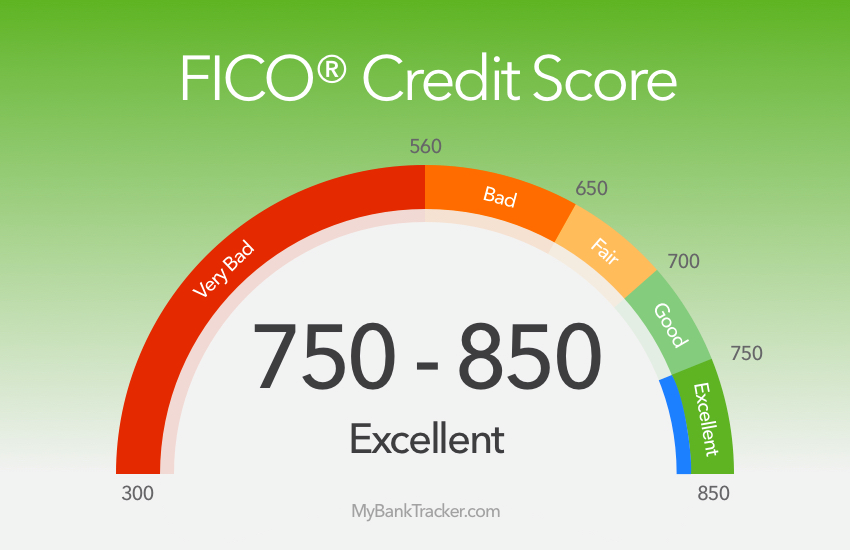

The score is generally in the range of 300 to 850.

For a consumer to have a credit report with FICO, at least six months of credit history shall be reported to a credit bureau, and he/she should not be declared deceased.

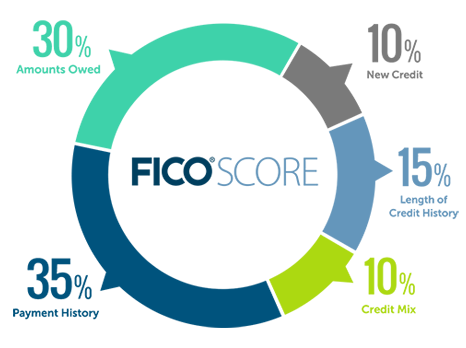

FICO bases its system on five topics:

- The length of the credit history, including the age of the oldest account and when the accounts were last active.

- The types of credits that are used, for example, credit cards, loans, and finance accounts.

- The quantity of new credit that is being generated. In general, when several accounts are opened in a short amount of time, the consumer is considered to be a risky spender.

- The payment history across all accounts, including late payments.

- The amount owed on all accounts and the percentage of credit that is being used per billing period. A lower percentage of credit used is favorable for lenders. Experts suggest between 10% and 30% of the total credit limit per cycle.

While FICO has decided upon these five aspects when calculating credit scores, they have not specified the influence of each topic.

That is considered a trade secret, and can also change with time.

Some Caveats Regarding Credit Reports

Each of the aforementioned credit bureaus allows one free credit report every 12 months.

Some experts suggest spacing these out over the course of the year.

The credit score itself is not free.

However, consumers who purchase their score are often given hints on how to improve their score.

When a credit card is no longer used, or the account is closed, the information from that account can remain on the credit report for up to 10 years.

If consumers want to remove the information sooner, they must contact the credit bureaus.

However, there are advantages to having an old account on a credit report.

If a consumer is denied credit due to a report, they have 60 days to file a request for a copy of the report from the same issuing agency.

It is the consumer’s responsibility to verify that the information on the report is correct, and any errors are fixed.

However, nothing can be done to remove accurate information, even if it is negative.

The Advantages of a Good Credit Score

Credit reports are assessments of the risk level of the consumer.

Credit scores are based on unbiased factors instead of things like gender, race, age, religion, nationality, or marital status.

Good credit is generated when payments are made on time, and can be enhanced when the consumer has several borrowing plans.

Bad credit is when payments are not made, and the consumer is considered to be a risk to lenders.

A higher credit score can lead to shorter wait times when applying for loans.

This is because lenders can easily tell if the consumer is within their range for low-risk loans.

As such, those consumers will have easier access to loans and credit, as well as lower rates.

Retail stores will also use credit scores to offer clients special credit cards affiliated with the company.

Having a high credit score does not mean that the consumer has been perfect forever.

It is possible to have made bad credit decisions in the past, but because of the time elapsed, these mistakes have less importance.

The credit score will normalize all credit information, both good and bad.

A recent increase in positive payment habits will have a greater impact than decade-old mistakes.

Consumers who borrow more can improve their credit score.

To do so, they must be making payments on time, all the time.

Additionally, they should not be charging more to credit cards than they can pay back.

Leave A Comment