Buying a house is a long, tiring, and expensive process.

The cost of the purchase of a house can be daunting, and while the final total cost will be different for everyone, you can roughly estimate the total cost.

Housing sales are on the rise

Housing sales are currently up 25.4% from a year ago.

Reports have shown moderate gains in house prices in May, and first-time buyers especially are benefiting from affordable housing.

Sales of new homes have been increasing in 2016.

In the last month, sales have increased 3.5% to 592,000 units.

This is the highest levels since February 2008.

Home resale values are currently experiencing a 9.5-year high, with single-family homes experiencing a significant boost in June.

There is, however, a constant shortage of previously owned homes available on the market.

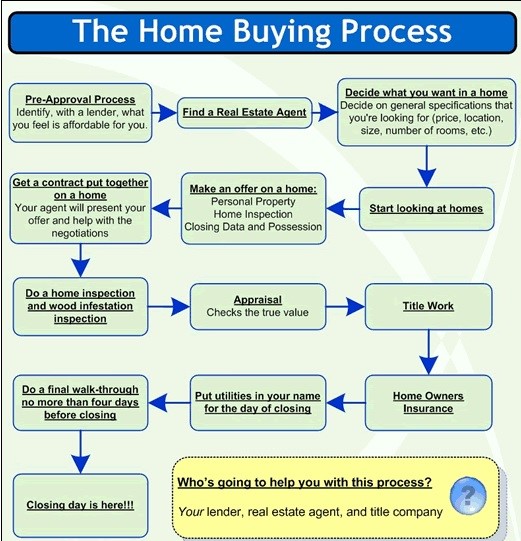

The house buying process

Buying a house is a long process, and it requires a lot of time and effort.

However, buying a home does not have to be overwhelming.

It is important before you start that you do your research.

Look up real estate listings online, in newspapers, or magazines.

As well as looking for potential properties, also keep an eye on local trends.

See how long houses stay on the market for, and any changes in asking price.

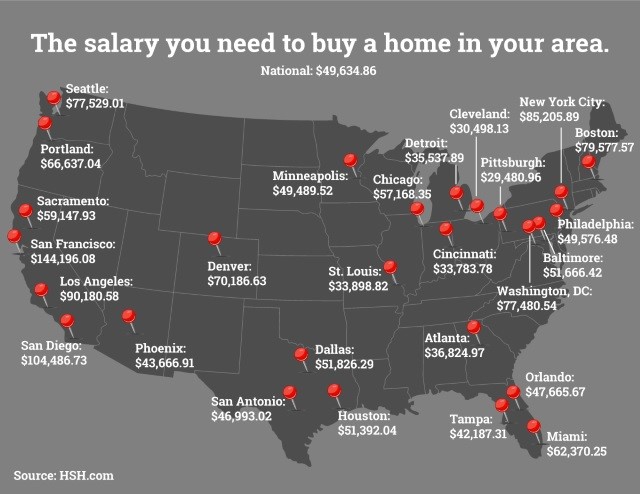

You will also need to work out how much you can afford; typically lenders advise people to look for homes that are no more than 3 to 5 times their annual household salary, if you are seeking to make at least a 20% down payment.

This, of course, will change depending on your family’s financial situation.

There is more to buying a house than the down payment.

Aside from the down payment, have you considered the additional costs involved in the purchase of a house?

How much does buying a house really cost?

There is no definite answer as it depends on many different variables such as the size of your house, where you are living etc.

These are just rough estimates and the cost could be less or more depending on your circumstances.

Home inspection and appraisal

A home inspection will cost $300 to $500.

This is a vital investigation as it determines if the house meets the legal requirements as required by your state.

The inspection will determine how much you are willing to offer.

It is important that you know what exactly was inspected as you can request further aspects of the home are checked if they are left out.

A home appraisal will cost $300.

A home appraisal is usually required, unless you are paying in cash.

The appraisal is an estimate as to how much a property is worth.

Usually, the seller will pay for an appraisal, however; this is not always the case.

Survey and flood determination

A study will cost $335 to $650.

The study verifies the boundaries of the property; this is important to know in the event you wish to make any additions to the property, as it will ensure that you do not cross over onto neighboring property.

Flood determination will cost $20.

Lenders will want to know if the property is located in a flood zone.

If the property is located in a flood zone, then the law requires flood insurance on the property.

Escrow costs

Escrow costs will be one sixth or two months’ worth of your property tax and mortgage insurance payments.

The lender will estimate the expenses required for insurances and taxes, this money placed in an account.

The bank will then take out what is needed from the account before your loan is closed.

Lenders title and homeowners insurance

Lender’s title insurance costs vary depending on your bank and state.

This will be required to secure a loan that will protect your lender against any problems that may arise with the title.

This insurance specifically protects the lender only.

Homeowner insurance costs start from $300.

There are several coverage options available.

Primary coverage will protect you against property and liability against theft, fire, etc.

Some lenders may be willing to add on protection against natural disasters.

Title search

Origination fees

Loan origination fee will be 0.5% to 1% of your total loan amount.

This covers all administration for your loans such as underwriting, loan processing, and paperwork.

General moving costs

Your general moving costs will be on average $700.

This covers all costs that are required to run a household from one property to another.

This cost can be quite low for those who need little to no help, but can be considerably higher for those who need lots of assistance.

Conclusion

House prices for new and existing homes are increasing; prices are already 25.4% higher than they were last year.

The process of buying a house is time-consuming and requires a lot of effort; however, it does not need to be complex.

It is important that you do your research before you start house hunting.

It is imperative that you work out how much you can afford.

The down payment you make will depend on what percentage of the house price you want to go towards your down payment and your household income.

You will also need to consider the additional costs of buying a home.

Such as home inspection fees, home appraisal fees, survey costs, flood determination fees, escrow costs, lenders title insurance, homeowners insurance, title search costs, loan origination fees, and general moving costs.

Leave A Comment