No matter how amazing you think you are at using a credit card, chances are you going to make a mistake eventually.

The truth is that everyone eventually makes a mistake.

The rules never stay the same.

In fact, the rules for the end game are changed by lenders every day.

Make sure that you avoid these credit traps and keep up with the constant changes.

Below is some information about credit card debt:

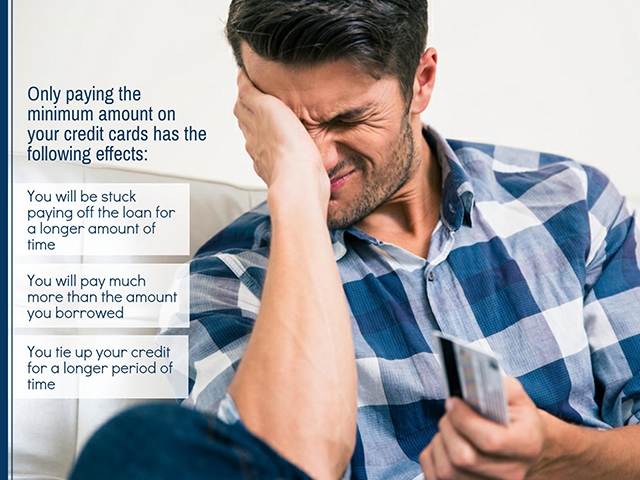

Only Paying the Minimum Amount

The fact is that most lenders will go out of their way to ensure that clients perceive obtaining credit debt as a cheap and reasonable option.

They want you to believe that there is not a better option in the world.

They provide individuals with this perception through charging tiny monthly payments to pay off the amount.

The minimum amount normally ranges somewhere between twenty-five to thirty dollars.

However, you need to realize that only paying the minimum amount is not a good idea.

In fact, you end up paying more thanks to the interest rates when you pay only the minimum balance.

Lenders want you only to pay the minimum amount.

The reason that they want you to pay the minimum is that it allows them to make more money.

Every time the minimum is paid, then they charge interest on the unpaid balance.

The more interest they can charge; the more money they make.

You want to ensure that each payment you make is more than the minimum amount.

However, this is usually not a likely solution.

The reason that this is unlikely is that lenders are known to loan more money than what a person can ultimately pay off in a month.

The best thing that you can do is ignore the limit they give you.

Instead, set your own limit.

Make sure that this limit is a number you can afford to pay completely off when your bill is due.

Once you reach your limit, pretend your card is completely maxed out and don’t use it.

Then, when the bill is due, pay it off, and start again.

Credit Cards Are Not an ATM

It may seem tempting to use the cash advance on your credit card to get yourself out of a tight situation.

However, what many individuals fail to realize is that the interest charged on a money advance is outrageous.

Cash advance fees are charged by companies for generally around 3% of the amount that you borrowed.

Most of the time credit card companies have higher interest rates associated with cash advances.

This outrageous amount is usually at least twenty-five percent (if not more).

As soon as you pull out the money, this interest is charged.

The only time that a money advance is a good idea is if you know you can pay it back immediately.

If you find yourself in a real emergency, then you can ask someone close to you to loan you the money, rather than taking out a cash advance.

Personal loans are also an option if you have the credit to be approved for one that has a very low-interest rate associated with it.

Make sure that you avoid paying off your credit card debt in a risky way.

You should never use a payday loan to pay off a regular loan.

This is because there are even larger interest rates associated with payday loans.

If your only other option is a payday loan, you may consider taking out a cash advance.

Just make sure you do not take out so much that you will not be able to pay it back.

Foreign Transaction Fees

There is no reason that you should be stuck paying foreign exchange fees as you travel overseas.

Numerous credit card companies offer no fees for purchasing goods from an international seller.

Make sure that you look at your options before you decide to travel.

Find a card that will not charge you fees for foreign transactions.

Credit Limit

Frequently, card companies provide you with a credit limit much larger than what you are going to be able to pay back.

The goal is to ensure that you cannot pay off the entire amount in a month’s time.

However, if you max out the card and only make the minimum payment each month, you could find yourself in debt for years to come.

There is another major reason that you should avoid maxing out the credit card.

Maxing out your card will damage your credit.

You want to try and keep your card at 30% of the available balance.

This means that if you have a $ 10,000 credit limit, you should try your best to maintain the charge around $3,000 each month.

Of course, you also need to remember that the less you charge, the more likely you are to be able to pay it each month.

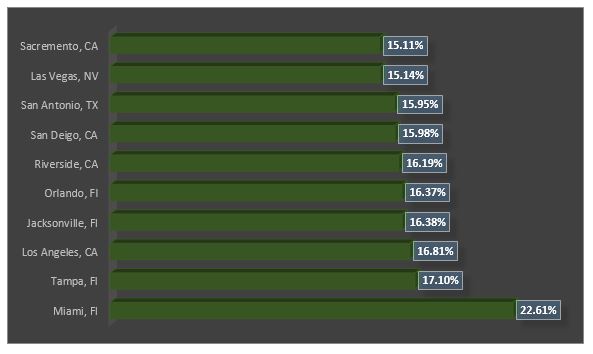

Below are the top ten worst cities for credit card debt:

Recap

When you are the owner of a credit card, you should ensure that you are doing the following:

- Pay more than the minimum payment amount.

- Try to avoid cash advances

- Find a card that doesn’t charge for foreign transactions

- Seriously consider your limit.

Leave A Comment