Your credit score is more important than people realize.

A low credit score can seriously affect your financial options.

So what actions can harm your score?

Why is your credit score important?

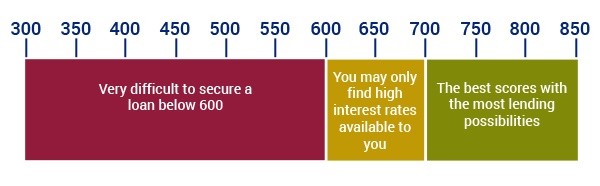

Your credit score is a three-digit number in the range of 300 to 850.

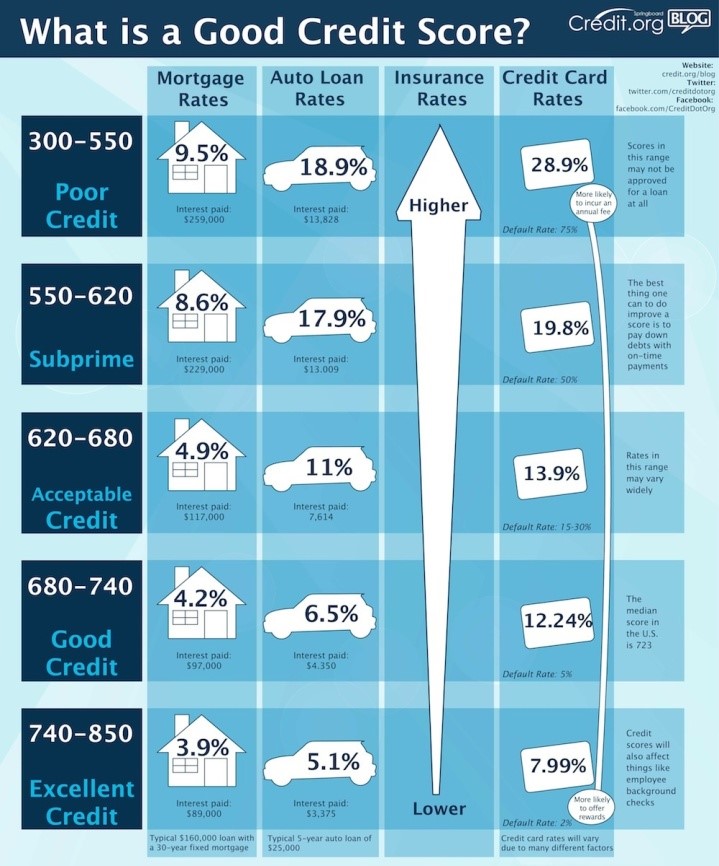

Although there are many different types of credit score, the majority of commercial lenders follow the FICO score.

A good credit score using the FICO system is ideally anything over 700; however, banks are starting to raise their expectations, so more financial institutions are giving preferential rates to those with a score over 760.

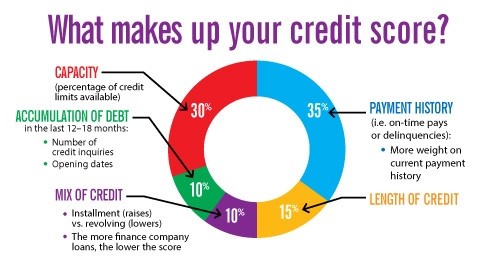

When working out your credit score, lenders are concentrating on your payment history, how much you owe (debt utilization ratio), your credit history, how many types of credit you have, and new credit inquiries.

It is important to not only understand how to build your credit score (paying on time and in full while only borrowing what you can afford) but also what can damage your credit score.

A bad credit score can have a negative impact on your life as it will affect your ability to apply for credit cards, obtain a mortgage, rent an apartment, and you may even struggle to secure a cell phone contract.

Lenders tend to reserve the best rates for borrowers, who have the highest score:

- A score of 740+ will get you the best rates with the majority of lenders

- It is tough but not impossible to get credit with a score lower than 620

- The difference between the worst and best rates can vary by 1.5% points

- Based on a 30 year fixed rate mortgage of $200,000 that can be the difference between:

- 4% interest rate equaling a monthly payment of $954.83

- 5% interest rate equaling a monthly payment of $1,073.64

You credit score can be affected by 60-110 points by missing just one payment.

It is important that you always make payments on time.

High credit balance

It can be tempting to use the full amount of your loan balance, but this can be detrimental to your score regardless of whether you can afford to pay off the entire balance or not.

Those with higher scores will lose more points for any adverse actions.

You should aim to use no more than 10% of your available credit.

Defaulting/ foreclosure, collections, and bankruptcy

Defaulting can be an attractive prospect, but defaulting or opting for foreclosure can affect your credit score by 85-160 points.

Collections can also be detrimental to your score, and once a collection recorded on your report, it will remain there for seven years.

You can avoid groups recorded on your report by contacting your creditors and working out affordable repayments.

Filing for bankruptcy can affect your credit score by 130-240 points and can remain on your report for 7-10 years.

Bankruptcy is the worst thing you can do to your credit score, so it should be the last option.

Opening and closing credit cards

A hard inquiry can affect your credit score by 5-15 points for up to 6 months.

When you apply for new credit, then your lender will check your score, which opens a hard inquiry on your account.

While a one-off hard question may not do long term detrimental damage to your account, applying for several lines of credit in quick succession can cause harm, as each lender will be conducting a hard inquiry on your report.

Closing your accounts will affect your debt utilization ratio, although the effects of this will vary greatly depending on your personal financial circumstances.

Loan modification and balance transfers

Loan modification is an option looked at by people facing default or foreclosure; however, this can affect your score by 100 points.

Balance transfers may appear to be a good idea, but this act can affect your debt utilization even if the card has a low introductory rate.

Not having back up funds

Having no savings or an emergency fund will not have a direct effect on your credit score since credit bureaus do not collect information regarding your savings and income.

However, people who do not have adequate savings or emergency funds are more likely to turn to credit cards and loans in times of crisis (such as illness or job loss).

Not regularly checking your score

It is important to check your credit score regularly as sometimes looking at your credit report is the only way you to alert you about problems with your accounts.

Checking your accounts will give you the opportunity to spot issues, such as identity theft, and rectify them as soon as possible.

If you’d like to speak with someone about your credit, and how it may be impacting you financially, reach out to one of our credit consultants here.

We’re located in Tampa, Fl and have helped over 25,000 people nationwide restore their credit.

Leave A Comment