Have you been flooded with invitations to increase your credit limits? There are some real benefits to increasing your credit limit, as long as you don’t go overboard! Below are some of the benefits you’ll experience with an increased limit.

It’s Easier and Also Cheaper to get More Credit and Additional Loans

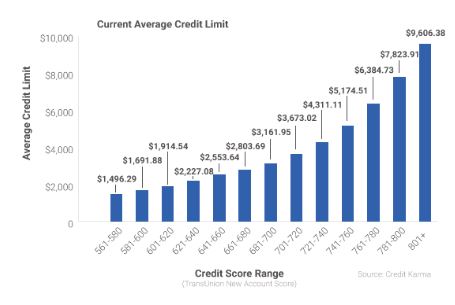

This is the biggest and most obvious benefit of increasing your credit limit. The less proportion of your available credit you are using, the lower your debt-to-credit ratio is. That means your credit score goes way up, and it’s easier to qualify for loans and get a lower interest rate. Check out the graph below to see how a higher average credit limit means a higher credit score:

If you increase your credit limit, but use the same amount of credit as you did previously, you will now have less debt which means a higher credit score. You’ll be able to get a lower interest rate, and it will be easier to qualify for mortgages, car loans, and even new credit card accounts.

This is all an example of credit utilization, and this is reflected in your FICO score, which lenders (and sometimes even potential employers and landlords) can see when deciding if you are a good candidate.

Increased Credit Limit, Increased Rewards!

If your credit card offers rewards for using it (which it certainly should!) a higher credit limit can lead to more rewards:

- As long as you never carry over a balance, or as long as you pay off your balance each month, it will not cost you any interest to use your card.

- That means you get the benefits of spending on your card without the negatives of having to pay interest on your purchases.

- Then you can use your increased rewards points to pay for a fun night out or basic expenses.

Make Your largest purchases even more efficiently.

If you have a high credit limit, it means you can make big purchases like cars or plane tickets without having to try to split the purchase on multiple credit cards. Some cards like MasterCard even offer their warranty system for using cards for big purchases like these, leading to even more benefits.

Having a high limit is helpful in an emergency

In the unfortunate case that you have to use your credit card to pay off an emergency, like a big hospital bill or a car repair, it is much easier and quicker to deal with these problems if you have a credit card with a high limit. You can take care of your emergency quickly, without having to try to use many accounts to cover your emergency expenses. It will also be easier and less confusing to pay off in the long run.

However, it is best to keep an emergency fund in your savings so you are not put in the unfortunate scenario of having to use your credit card on a high-cost emergency.

Make sure the offer is clear and free

Sometimes companies may try to trick you by making offers with strings attached. Make sure your credit limit increase is provided with no additional terms, and read the offer details very carefully. You can always call your lender to make sure you understand the terms of the offer. If the offer truly is a free increase, then you should accept it, because it can only help your credit in the long run.

However, remember that just because you have a higher limit doesn’t mean you should go crazy and spend more than you were spending before! The bank wants you to use more of your credit because it benefits them, but don’t do it!

Requesting an increase is kind of a different scenario

The best time to get an increase in your credit is when the lender is offering you an increase. Requesting one if less recommended, but you can still do it. The thing is, if they are not offering you increase, there is probably a good reason. Are you already utilizing too much of your credit already?

The process of requesting an increase might hurt your credit score in the short-term because they have to perform a hard credit check, which lowers your credit score.

However, it is ultimately up to you to make the informed decision of whether it will benefit your long-term credit score enough to request the increase in your credit limit.

Leave A Comment