When it comes to your credit score, the way in which you use your credit cards should be considered. In fact, correctly using credit cards is essential to maintaining a good credit score. On this page, we are going to look at how credit cards have an impact on your credit score.

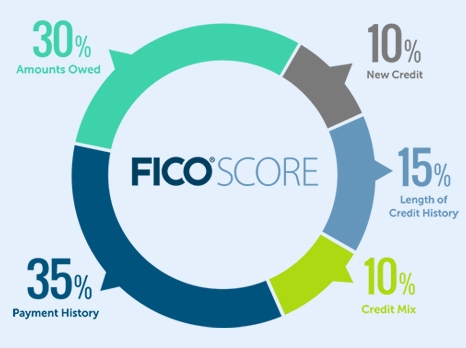

How is your credit score calculated?

Your credit score is determined by a number of different components. The most ‘used’ method for determining credit score is the one devised by FICO:

Source: http://www.myfico.com/crediteducation/whatsinyourscore.aspx

Owning a credit card is a factor in many of these components:

- Payment History: Making credit card payments on time will boost your credit score.

- Length of Credit History: The longer you own a credit card, the more it will benefit your score.

- Credit Mix: Owning multiple types of credit will boost your credit score. So, combine loans with credit cards for the most impact.

Credit card searches

Many people will be tempted to apply for as many credit cards as possible. However, it is important that you do not follow the crowd.

Whether you are accepted or rejected for a credit card, a mark will be left. This mark would not look good on your credit report. Those who tend to be applying for a plethora of credit cards look to be in dire need of credit. These people are more likely to get into financial trouble, which negatively influences the chances of you being granted a loan.

Here are a couple of tips to help you out:

- Only apply for credit cards that you genuinely need.

- Do not apply for too many credit cards in a short period of time.

- Look for credit cards that you gain ‘pre-approval’ for. This way you know that you are going to be accepted even before the search is carried out on your credit report. Of course, pre-approval will be based on whether you are telling the truth about your finances or not.

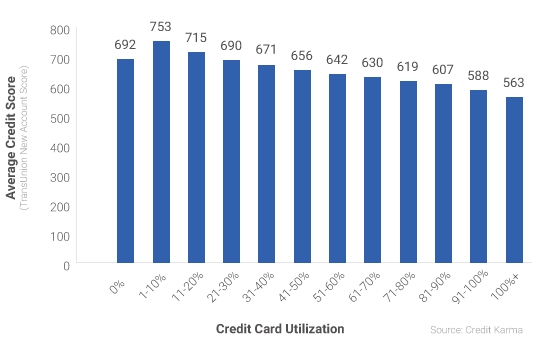

Credit Utilization

According to TheBalance.com, credit utilization is all about the amount of available credit you have used, compared to the amount that is available to you. If you look at this chart, you will see that you should ‘ideally’ be using somewhere between 1% and 20% of your available credit. This is the ‘sweet spot.’

Source: https://www.creditkarma.com/article/CreditCardUtilizationAndScore

Just as a note here, you can’t ‘trick’ your credit score into believing that your credit utilization is low. Your credit utilization will be determined at the time that your bill is issued, so you can’t repay that in full and say, “Yes. My credit utilization is just 10%”. If you have used up 90% of your available credit when the bill is issued, then that is what will be recorded on your credit report.

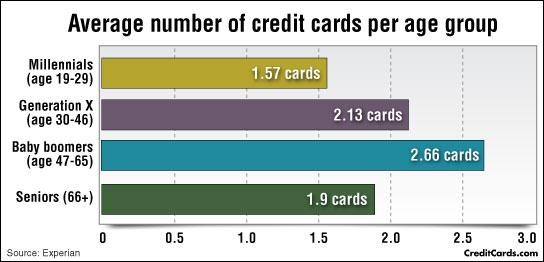

Number of credit cards owned

There is no real ‘fixed limit’ on the ideal number of credit cards you should own. If you look at this chart, it will tell you the average number of credit cards owned per person in the United States:

It does not matter much how many credit cards you have provided you do the following:

- Keep your credit utilization low

- Do not apply for too many credit cards, particularly if you are frequently being rejected for them.

- Make payments on time.

Adverse consequences of owning a credit card

As mentioned previously, you should not apply for too many credit cards as this will have a negative impact on your credit report. It has also been noted that you should not over-utilize your credit.

However, there is one more important thing to note.

You need to make payments on your credit card on time. It can be tempting to get numerous credit cards, but missing just one payment on one of those cards will harm your credit score. It could take months, if not years, to recover from this.

Leave A Comment