Achieving a good credit rating can be difficult.

Without a credit history, it is hard to get a credit card, a loan, or even an apartment.

It is a catch twenty-two situation.

It is hard to get credit without a credit history.

Yet, credit is required to get a rating.

However, don’t despair, there are ways of going about it which we will examine.

Many people go through their twenties debt-free.

They prefer to pay for everything in cash.

While they do not have to be concerned about floundering in debt, they are behind others when they need to borrow money.

This could be when buying a first home.

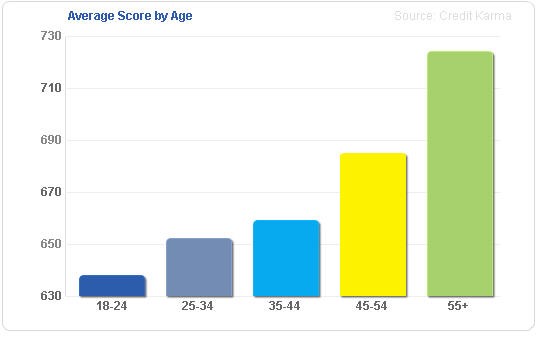

The graph shows credit scores by age.

It makes sense that you will rate higher as you get older.

This reflects a lifetime of borrowing money for different reasons.

They may include promotional offers and rewards.

However, they usually have lower limits and higher interest rates.

Different Scores

Fico Score: You will need an account opened for at least six months. Also, at least one creditor who is informing the credit bureau of your activity. This would be over a six-month period.

A Vantage Score – This is the main competitor of Fico. The score can be generated quicker than the Fico Score.

Tools to Help You Build a Credit History

Your credit is safeguarded by a bank deposit with the lending institution.

If you are applying for a credit line of $1000, you have to deposit $1000.

It is a temporary measure to earn an unsecured card.

These are easy to access and can assist customers to save money at the stores.

However, like student credit cards, they have low limits and high interest rates.

Usually offered by small financial institutions.

The borrowed money is deposited in a saving account.

You are unable to gain access to it until you have completely repaid the loan.

When the loan is repaid, the lender will send a good report to the bureau.

It is important for the co-signer to be aware that he/she is ultimately responsible for the amount owed.

Also, the co-signer may not be entitled to other credit, and it is difficult to be removed.

You will be able to make the most of having access to the credit card.

Also, you will develop a credit history.

It is important to work out an agreement for your use of the card.

Rental Kharma is one rent reporting service.

It uses your rent bill on your credit report.

On-time payments result in a positive history.

It is good to strive for an excellent credit score to reap the benefits.

Loans will be available with low-interest rates.

In the course of a lifetime, people with better scores pay over $100,000 less in interest than people with mediocre scores.

People with poor scores have to contribute even more.

It takes a number of years to establish good credit, and it requires 10 or more years to establish excellent credit.

Negative Credit Reports Affect Other Areas of Your Life.

At present, employers may be able to access credit reports when considering an applicant for a position.

This is true for future employees who come in contact with financial accounts.

According to companies, they believe this will prevent theft.

Some employers may consider you as lacking in financial responsibility when dealing with clients.

47% of US companies conduct credit checks.

However, 80% of businesses hired an applicant who had a negative credit report.

A law is about to be passed in a number of states to prevent this practice.

If you plan to borrow money at any stage in your life, you should work towards building a good credit history.

Choosing an option can be a difficult decision.

Selecting a loan or a credit card should be done with consideration.

Access reviews to determine what people are thinking about the various options before making a choice.

It will be worthwhile in the long run to choose the right option for you.

If you’d like to speak with someone about your credit, and how it may be impacting you financially, reach out to one of our credit consultants here.

We’re located in Tampa, Fl and have helped over 25,000 people nationwide restore their credit

Leave A Comment