According to Forbes, there are several ways in which a person can boost their credit score.

One of the best is through the responsible use of credit cards.

The problem is, without a decent credit score already, it can be tricky to obtain a credit card.

Thankfully, there are several cards on the market designed specifically for this purpose.

They may not attract the best interest rates due to the inherent risk in issuing one of these cards, but they certainly will help improve interest rates on other credit accounts a person obtains in the future.

Why build your credit score?

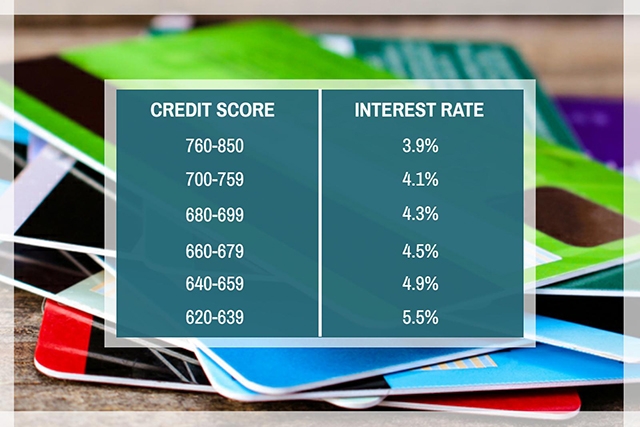

The simple graph below indicates just how much money you can save on interest rates as you improve your credit score.

On the bigger loans, even boosting your credit score by a couple of points could get you thousands of dollars in savings over the course of a loan.

So, if you are planning to obtain a mortgage in the future, it would be worth considering ways to improve your credit score.

What should you think about when obtaining a credit card for bad credit?

According to The Simple Dollar, there are several things that you will need to consider when you seek a credit card and have a bad credit score.

The first thing you will need to do is work out whether you have a poor credit score in the first place.

To do this, you will need to register for the many credit rating agencies out there.

Many will offer a free trial.

Once you have signed up and confirmed who you are, you can see your score.

Compare your score against this chart:

If your score is between 300 and 699, you will probably benefit from a credit builder card.

Those with a ‘fair rating’ may even wish to apply for a loan without improving their score, but if you are looking to apply for those bigger loans e.g. a mortgage, then you may want to try and build that score first.

Remember, each point helps.

If you try and apply for some of the best credit cards on the market, you will have your application declined.

Your credit report will be marked with the fact that you have applied for a card.

This will lower your score even further.

Basically, you will be working against yourself by applying for a multitude of cards.

Using your card effectively

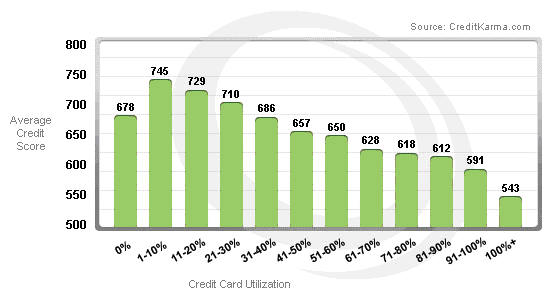

Before we look at the best cards for bad credit, it is worth looking at this chart.

It is necessary to understand how to use your credit card effectively.

To build your credit score, you need to ensure that you are not maxing out your cards.

You must have credit available.

Generally speaking, you should be using about 10% of your available credit at all times for the optimal amount of benefit.

Capital One Secured MasterCard

Capital One is known for providing some of the best credit score building cards out there.

This option is particularly brilliant for those who have a seriously poor credit score.

This is because the card is secured.

You will have to provide your property as security.

Remember, you risk losing your property if you default on your repayments.

The major benefit is that with a secured card, you are much more likely to be approved.

Benefits of this card include:

- There is no annual fee.

- You will receive a credit of $200 at the start. You will need to make a security deposit in the range of $49 and $200.

- After you have made five payments on time, you will have your credit limit raised.

Indigo Platinum MasterCard

This is an unsecured credit card.

As with other MasterCard products, you can use your card anywhere in the world.

The main benefits of this card include:

- You have the option to be pre-approved for the card. Pre-approval means that no check will need to be carried out initially, which means there will be no impact on your credit score.

- You can apply for this card even if you have been bankrupt before.

- You can manage your card online, which makes budgeting far easier.

Credit One Bank Cash Back Rewards

This is a unique credit building card because through this you can earn cash back rewards.

This is very rare for a card which is made specifically for credit building. Benefits of this card:

- 1% cash back when you purchase gas or groceries. Of course, terms and conditions apply to this offer.

- Pay on time for a certain period and you will have your credit limit increased.

- Unsecured card

- Can pre-qualify you without affecting credit score

First Premier Bank MasterCard Credit Card

If you need a slightly higher credit limit than what the previous cards offer, this may be the right option for you.

Benefits include:

- A minimum $300 credit limit. However, depending on your credit score this may be $400 or $500 at the start.

- You will regularly be sent your FICO score. This means you can see how your credit rating is improving through your use of this card.

- Simple application. You could be approved for the card in minutes.

If you’d like to speak with someone about your credit, and how it may be impacting you financially, reach out to one of our credit consultants here.

We’re located in Tampa, Fl and have helped over 25,000 people nationwide restore their credit.

Leave A Comment