A high credit rating is important if you are trying to boost your chances of being approved for a loan or other forms of credit.

There are several different ways in which you can boost your credit score.

One of the best methods is through using a credit card.

What is the importance of a credit card?

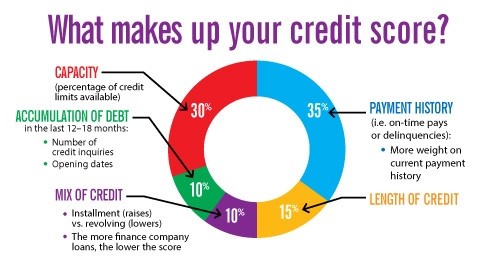

To understand why it is important that you use a credit card, it would be wise to look at this chart.

This chart gives a breakdown of the various factors that are influential when it comes to calculating your credit score.

The main company that produces these scores is FICO, which is what this chart is based off.

As you can see, your payment history is a major determining factor.

If you have not shown a steady record of making on-time credit payments, then you can’t really build up your credit score.

Since it would be tough to obtain credit without a high credit score, your best option is to use a credit card.

Pay On Time

According to NerdWallet.com, the most important thing you can do is pay your credit card on time each month.

In fact, you should be paying off the full balance each month.

Remember, the whole idea of building your credit score with a credit card is to show that you have the ability to pay debts off on time.

This is what lenders wish to see.

Of course, the main benefit of paying the credit card off in full is that you will not have to pay interest on your borrowing, and we all know that the interest can get high if you are not in full control of your expenses.

Credit Utilization

It is important that you do not use all the funds on your credit card, particularly if you are not planning to pay the cash back quickly.

The less credit you have available to you, the lower your credit score will be.

This is something known as credit utilization.

Having credit is good.

Fantastic to have credit, in fact.

However, it is a bad thing to tie up all of your credit.

This is why it is just so important that you pay back your credit card quickly.

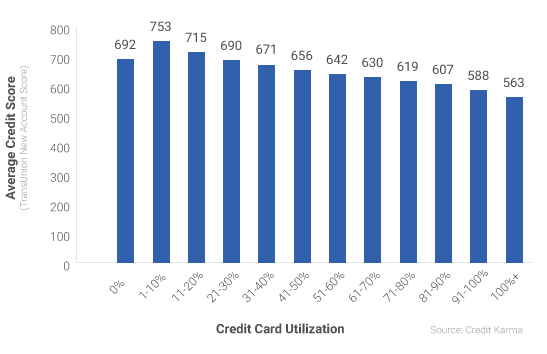

If you look at this chart, it will show you how credit card utilization impacts your credit score.

To find out more about the relationship between credit utilization and your credit score, just head to Credit Karma.

Keep your credit card accounts open

Refer to that chart listed right at the start.

As you can see from it, the length you have had an account will be a deciding factor in your credit score.

It is, therefore, important that you keep your credit card accounts open.

Choose the right credit card for you

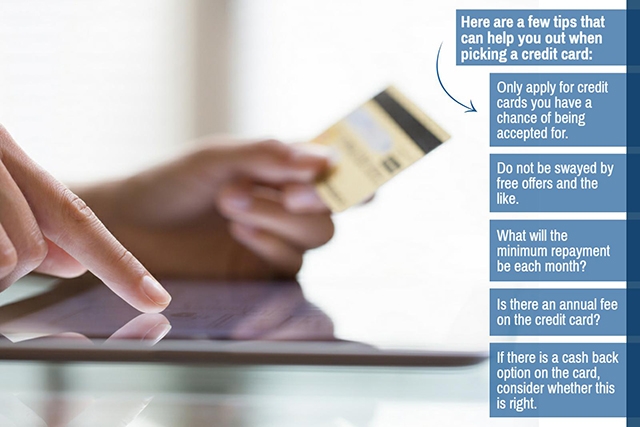

Finally, it is important that you choose the right credit card for your needs.

As mentioned previously, you should not be obtaining several cards if you are not going to use them.

The Balance is a website which really stresses this.

What is the benefit of doing this?

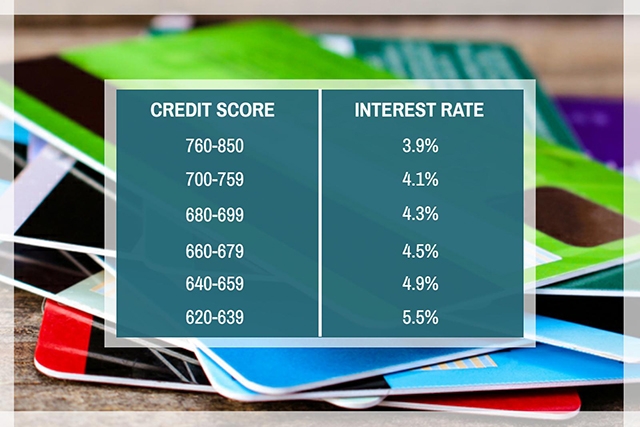

It would be wise to wrap up with information about what you are working towards when you boost your credit score.

The chart above demonstrates the fact that the higher your credit score is, the lower the average interest rates are.

If you put effort into using your credit card responsibly, then you will notice huge savings in the future.

If you’d like to speak with someone about your credit, and how it may be impacting you financially, reach out to one of our credit consultants here.

We’re located in Tampa, Fl and have helped over 25,000 people nationwide restore their credit.

Leave A Comment