Divorce isn’t fun for anyone, especially your wallet.

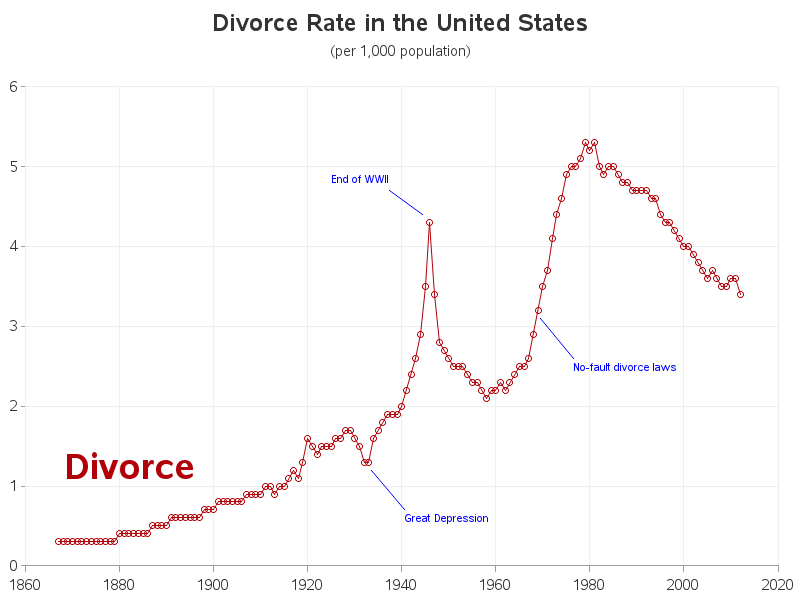

And the divorce rate in the United States is at an all time high.

If you’re going through a divorce, you should always carefully consider your finances, no matter what stage you’re in.

This mainly applies to your credit score.

There’s a big chance that you have a joint account open with your current spouse.

This can make matters tricky in court, especially when the account is a joint credit card account.

Decisions over who will take their name off the account, or who will take care of the remaining balance, must be made.

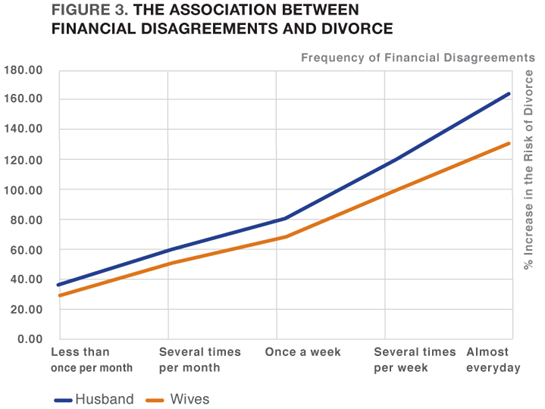

While some soon-to-be divorcees can resolve financial matters peacefully, others may not come to such a happy agreement.

In either case, it’s a good idea for both parties to educate themselves on how to protect their credit.

Read on to find out how to maintain financial health during the divorce process.

Attempt to keep things civil with your ex-spouse

This may be easier said than done, of course.

But the best way for both parties to maintain a good credit score is to approach the divorce proceedings with a level head.

Try to work together when it comes to sorting out your credit accounts, loans, or other debts.

Contact your lending institution and alert them of the divorce as they may have ways of assisting you throughout the process.

Don’t open any new credit accounts

Your financial profile will change as a result of your divorce.

Additionally, one in five female divorcees falls below the poverty line.

These statistics may not end up affecting you, but you’ll want to safeguard yourself against them by not opening any new accounts.

Doing so may affect your partner’s credit as well, especially if they still have loans or accounts open in both your names.

Obtain your credit report

You’ll want to make sure there are no errors or inconsistencies in your credit report before you go to court.

You’ll want to check to make sure there are no open joint accounts of that you’re not aware of.

Any of the three federal credit bureaus will provide you with a copy of your credit report once a year at no charge.

You can visit AnnualCreditReport.com, which is the official and secured federal site, or call their toll-free number.

Come up with a budget

The first year of divorce can be the most difficult in many ways, including financially.

You’ll want to sit down and create a realistic financial plan to carry you through those first twelve months and, preferably, beyond.

If you and your spouse have mostly shared money in a joint account throughout your marriage, getting used to the lack of extra funds will take time.

You’ll want to make sure you have some money in your name so that you can take care of your debt.

This will help improve your credit.

Pay your debts in full and on time

This is especially important if you’re going to be moving out of the house or giving up the car.

If you aren’t running out of the house, the mortgage payments may fall solely on your shoulders.

No matter the case, having a good credit score is pertinent.

You’ll want to make sure your credit score is in the right shape before you decide to take out a short-term loan to help you handle the extra burden of the mortgage.

This will help you prevent taking additional debt until you need to.

Divorce and Finance Resources

Even if things go smoothly with your divorce, the process is bound to be stressful by nature.

But you don’t have to do it alone.

Resources exist to help you plan for your future financial post-divorce.

Here are some of them:

- You can use the budgeting worksheet in this PDF to determine your collective employment information, assets, property, accounts, debts, and more.

- Experian offers a divorce page, which contains a multitude of financial advice tailored specifically for divorcees.

Divorces can be scary; particularly when it comes to the monumental changes, it will cause for your finances.

As long as you stay proactive and focused, you’ll be able to keep your credit score where you want it during and after your divorce.

Leave A Comment