In the United States, the way in which credit scores are calculated is undergoing a bit of a revamp.

The Fair Isaac Corporation, or FICO for short, are introducing a new system known as FICO 9.

This new method for calculating a credit score is designed to make them a bit more of an accurate reflection of the financial viability of the loan applicant.

Many lenders have now adopted this system in their calculations, so it is worth knowing a little bit more about how it works.

What does your credit score mean?

For those who are unaware, your credit score is a reflection of your ‘trustworthiness’ when it comes to money.

It is a quick way for lenders to work out whether their loan applicants are likely to have the ability to pay back a loan or not.

It is not everything that a lender will look at, but it will hold a substantial amount of sway.

The chart below shows the ‘credit score’ range that you can fall in.

This is the ‘range of scores’ that most lenders will use.

What does your credit score cover?

As you will see soon, what the FICO 9 system covers has not changed.

Instead, some of your credit histories will hold less sway than other aspects.

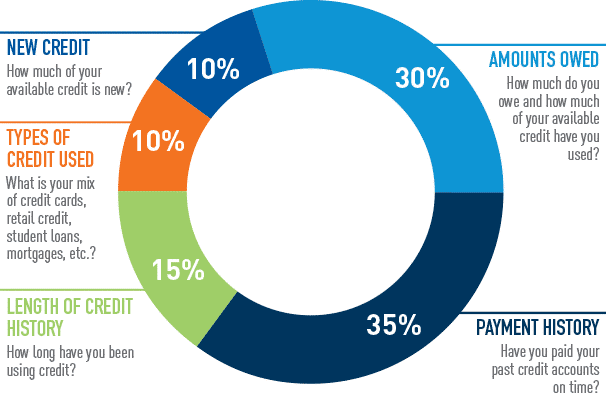

Generally speaking, though, your credit history will always cover the following in the following proportions:

According to Forbes…

Change One: Medical Debt

Medical debt in the USA is out of control.

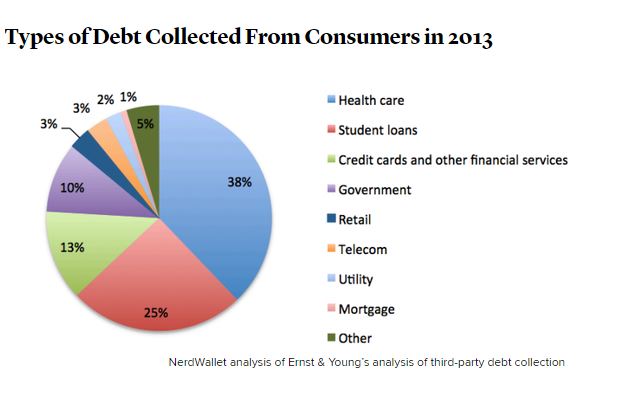

Take a look at this chart.

As you can see, medical debt is by far one of the biggest debts that a person could have.

It poses a major problem because, for the most part, you don’t have that much control over your health.

So, let’s find out the biggest change that FICO 9 is set to make.

This new system is going to put less of an emphasis on unpaid medical bills and the like.

They will impact your credit rating on a smaller scale, but nowhere near the amount of impact that other debts have.

FICO is taking the view that unpaid medical bills don’t really affect the credit risk of a potential borrower.

In fact, according to FICO, the best way to build an accurate credit score is by not putting an emphasis on unpaid medical bills.

Everybody has them, sadly.

Since you have no real control over your health, you never know when a medical bill is going to pop up for you.

So planning to manage them is difficult.

However people may try, but you just can’t plan for a bill totaling thousands upon thousands of dollars.

You can, however, prepare for paying money you owe back on a loan.

Do keep in mind that unpaid medical bills will still have a limited impact.

So, it is always worth bearing the following advice in mind:

- Try to cover medical bills as soon as they come in.

- If you can’t cover the whole of the bill, make as much of payment as possible.

- Work with the medical establishment to come up with a payment plan. Most will be more than happy to work with you. If you have a payment plan, and you are not missing payments, it can’t go on your credit report.

Beware of Paid collections – You don’t want to spoil your score!

Eventually, your account will be passed to paid collections.

This will have an impact on your credit score.

It means that you will have unpaid bills on your account.

With FICO 9, things are going to change here.

If your account gets sent to collections, and you pay back in full, then the collection matters will not have an impact on your credit score.

Of course, for that to happen, you need to remember the following:

- Try to pay bills on time always. It is not worth going to collections as this can significantly increase the amount you need to pay back.

- If your account goes to collections, pay it back in full as soon as you can.

- If you can’t pay back in full, set up a payment plan.

What you need to know about the effect of Rental Payments on the new scoring method.

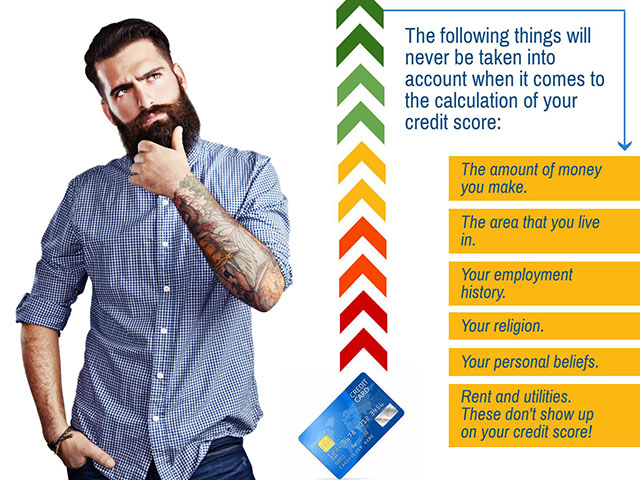

As mentioned previously, rental payments are not taken into account on credit reports.

However, FICO 9 may change this.

If your landlord reports payments that you make to a credit bureau, then these payments will be included.

This is a pretty good thing for many people.

As you may well know, to get credit, you need to have a credit history.

This is a bit of a catch-22.

This new system will, however, record rental payments.

This is going to be very useful for those who may have no credit history, and are looking to build it up.

The Future

While a few companies are currently using the FICO 9 formula, most are not.

They are using the older system due to the set-up that they may have.

This can make obtaining your FICO credit score a bit difficult.

That being said, there are many different options at your disposal.

This website, for instance, allows you to see which credit card issuers will enable you to view your FICO credit score for free.

It is worth checking them out.

You will only be able to check your score if you have an account with them.

They only other method is through FICO themselves.

So keep an eye on these upcoming changes in the FICO scores.

It’s always better to stay updated than being ignorant about something that matters to you so much.

So, work towards getting a better score by knowing how you can improve your credit score.

Leave A Comment