When it comes to obtaining new credit, having a good credit score is vital.

A good credit score could potentially save you thousands of dollars over the course of a loan.

You can’t pay off a bill one day and expect it to be reflected in your credit score the next.There is a bit of lag.

But how long is this lag? How often does your credit score get updated? Read on to find out!

What is reported on your credit score?

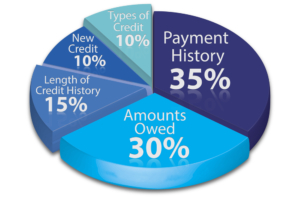

It is worth knowing what is reported on your credit score.

Whenever one of the elements of your score changes, it is likely that your score will be updated shortly, usually within a month.

Obviously, some of the elements of your credit score are not under your control. For example, the length of credit history. But others definitely are, and you should pay attention to make sure you’re on top of everything:

Payment history: whenever you make a payment on your credit or even miss payments.

Amounts owed: how much you have left to pay on accounts.

New credit: if you apply for new credit and whether you are accepted or rejected

Types of credit: car loans, mortgages, credit cards, etc.

Do not expect huge changes in your credit score

Your credit score is not going to change all that much on a month to month basis. It may take you well over a year to get to the point that you need it to be.

At the most, you’ll probably see a difference of a couple of points from month to month.

There are some situations where you may see a massive change in your credit score. These are rare, but they do happen:

• If you are delinquent on payments then you may see a huge fall. If you miss just one payment by a couple of days, it won’t cause that much of an issue. However, if you are more than thirty days late on it, your credit score will plummet. You will need to rectify the problem as soon as possible.

• If your credit utilization changes too much

• If a legal matter has been resolved. For example, if a civil case is decided against you, it will probably be reported on your credit report. The drop tends to be very steep.

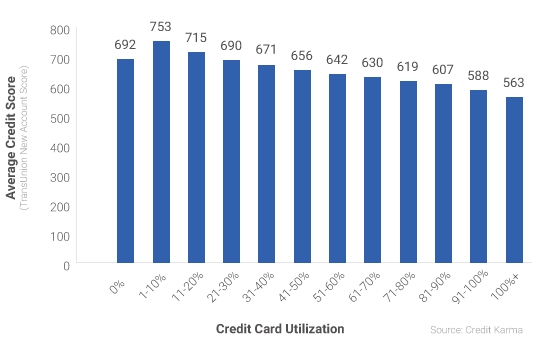

Take a look at the chart below. It shows you the enormous impact that credit utilization will have on your credit score.

You could see drastic changes in your score on a monthly basis, particularly if you obtain more credit cards.

Credit Karma goes into a lot of depth on the relationship between credit card utilization and your credit score.

Source: https://www.creditkarma.com/article/CreditCardUtilizationAndScore

Source: https://www.creditkarma.com/article/CreditCardUtilizationAndScore

How often is your credit score updated?

Usually, the companies that you have credit with will report back to the credit agencies on a monthly basis. However, they may not report to all agencies at the same time.

As a matter of fact, some credit companies may never report to all agencies.

That is why it is important that you regularly check your score across all the different credit scoring agencies. This is the only way in which you will be able to find out what your overall rating is.

You should also consider the fact that credit companies may not update on the same day either. You can only expect them to report your information on the first day of the month.

Typically, it takes a few days for scores to go through.

In most cases, if the score has not been updated within a month of you making a change on your credit report, then get in touch with the credit company and find out why they have yet to make the change.

A good thing to know is that some changes will occur on your credit report instantly.

These are known as ‘hard inquiries.’

If you do any of the following, then it will be immediately reflected on your credit score:

• Applying for a loan: This includes student loans, auto loans, and personal loans.

• Applying for a credit card

• Applying for a mortgage

You may find that identity verification will also be reflected on your credit report instantly, but this does not always happen.

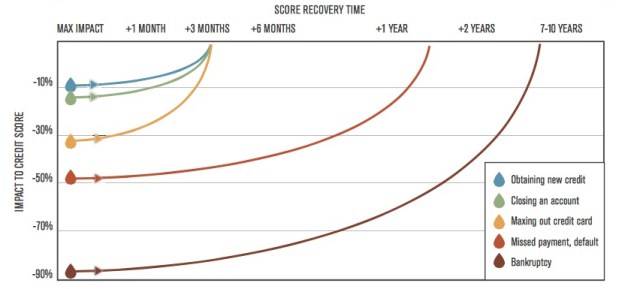

Recovering from a drop in your credit score

Have a quick look at the chart below.It shows you just how long it may take you to recover from a drop in your credit score, even with regular updates to your report.

This is why it is important that you avoid becoming delinquent with your bills:

Source: http://moneynation.com/late-payments-affect-credit-score/

Source: http://moneynation.com/late-payments-affect-credit-score/

Leave A Comment