We often hear that credit utilization is important to our credit scores, but what is it?

Why is it so important?

And how can you make it work in your favor?

What is credit utilization?

Your credit utilization is a measure of how much credit is available to you vs how much you are actually using.

It is referred to as a credit utilization ratio, or balance-to-limit ratio, and expressed as a percentage.

How is it calculated?

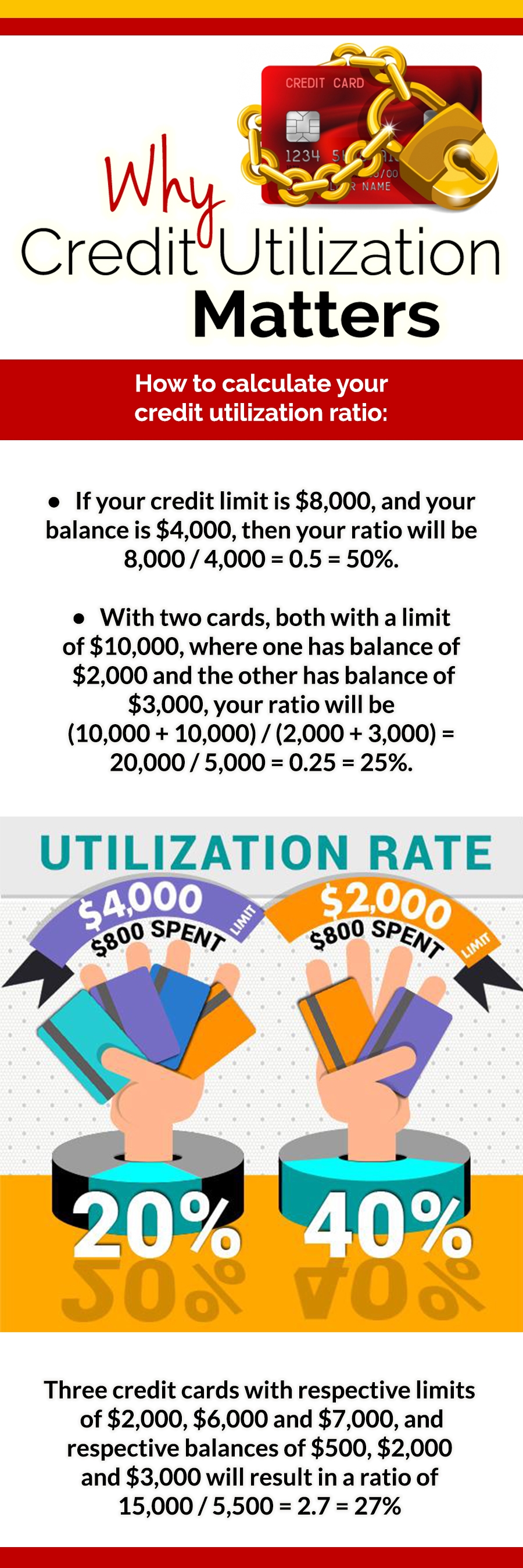

You can find your credit utilization ratio by dividing your credit limit by your current balance.

If you have more than one credit card, use the sum of your credit limits, divided by the sum of your balances.

How is it used by credit bureaus?

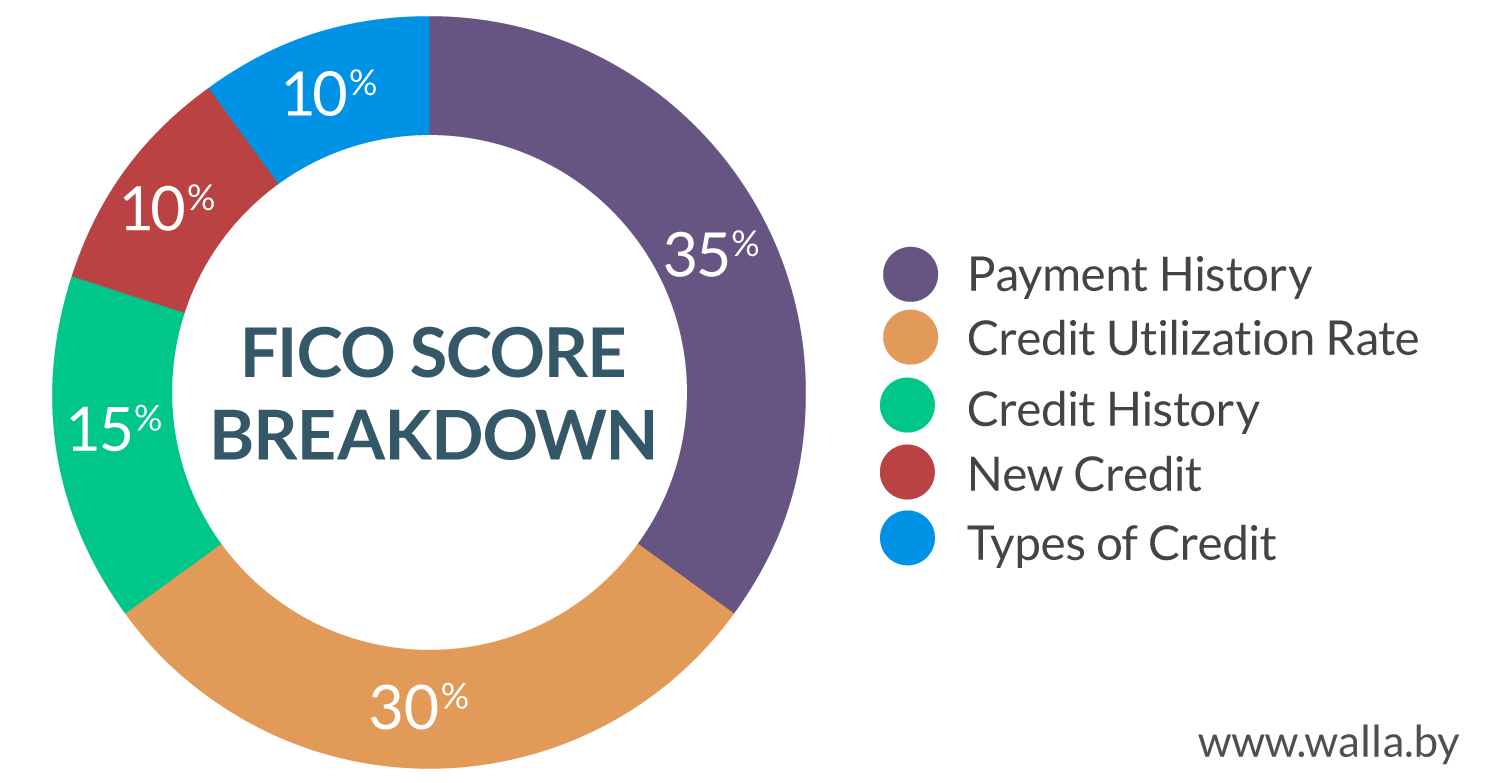

Credit bureaus use your credit utilization ratio as part of the calculation to find your credit score.

It is usually described as ‘amounts owed’ and given a significant weighting (30%) in this calculation (see chart).

The credit bureau Experian explains here that they use a consumer’s utilization ratio as a measure of risk.

A higher ratio suggests that the consumer could have financial difficulties and might struggle to pay back credit.

How does it link to my credit score?

There is no absolute link between utilization ratio and credit score, since many other factors are also part of the credit score calculation.

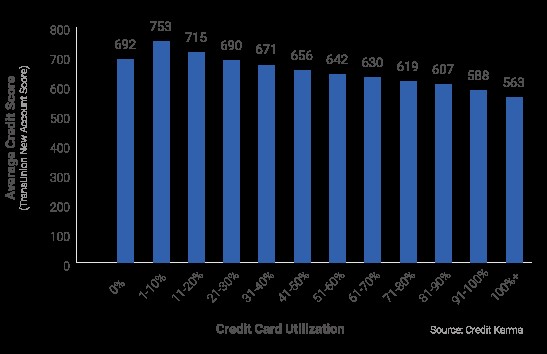

However, a study undertaken by Credit Karma Inc. in 2014 showed a very clear correlation between utilization ratio and credit score (see table below and full article here).

This study showed that utilization that is low but higher than zero correlates to a better credit score.

Utilization below 20% seems to be ideal, although most experts agree that keeping the ratio below 30% is a reasonable goal to aim for.

Furthermore, as the utilization ratio grows higher, the credit scores get lower.

The anomaly that a ratio of zero is linked to a worse credit score is caused by the fact that zero utilization means that the consumer has not used credit and so has not shown that they can manage it in a responsible manner.

Improving your credit utilization ratio

If you find that your ratio is above 30% and want to avoid a negative effect on your credit score, it is important to take steps to remedy the situation. Fortunately, this is one of the easier credit issues to solve.

Here are some ways in which you can improve your credit utilization ratio.

For more information on some of these suggestions, see here.

Balance awareness and prompt payment

You should make a point of checking your credit card balance(s) regularly, to ensure that your utilization ratio is not creeping towards the ‘magic’ 30% mark, and paying it off before it reaches that stage.

Reporting date

It doesn’t matter if you pay off your credit balance fully every month if you do this after your data for that cycle has been reported.

You can solve this by contacting your credit company to find out when this report is sent so you can ensure that you pay off your balance before this date.

Making two payments per credit cycle can also be of use in this regard.

Card limits

If you regularly exceed 30% of your credit limit, it may be helpful to raise the limit on that card.

This would mean that you could spend at the same level, but use a smaller proportion of your credit limit.

Bear in mind that this could cause a brief negative effect on your credit score, but that good credit practices should be able to remove this quite quickly.

Spread credit out

Since your ratio is based on your total credit limit and total balance, having several credit cards each with a low balance may actually improve it.

This means that you should not cancel a card that you don’t use regularly since this will reduce your available credit and make your ratio higher.

However, opening a new credit card will not automatically improve your credit score, since applying for it will have a short-term negative effect.

It is not recommended to open an extra credit account in order to improve your credit score.

See here for more information.

Conclusion

As we have seen, your credit utilization score is an important factor in your credit score.

But it can also be easily improved.

Making small but significant changes to your financial habits can pay handsome dividends for the health of your credit score, and can make things easier for you.

If you’d like to speak with someone about your credit, and how it may be impacting you financially, reach out to one of our credit consultants here.

We’re located in Tampa, Fl and have helped over 25,000 people nationwide restore their credit.

Leave A Comment