The three major credit bureaus have huge amounts of information about the American consumer which can have a profound influence on his or her life.

Here are some things they don’t want you to know about how they work, and a few ways to ensure that the information they hold is as positive as possible.

How can credit bureaus affect my life?

Credit bureaus not only track the credit history of consumers, but also hold a wide range of other pieces of information, such as past addresses and employment history.

These can be obtained by lenders (at a price – selling consumer information is a major source of income for credit bureaus) and used to decide whether or not to issue a loan, and at what rate of interest.

These records can also influence your ability to rent a new apartment (many landlords look at credit history before accepting an application) or even affect a job application, since federal law allows employers to pull credit reports on applicants for jobs.

About 47% of employers admit to having done this when appointing new personnel.

Accurate reporting?

Given the huge impact of a negative report, you might hope that extreme care would be taken in ensuring that reports would be accurate.

However, this isn’t always the case.

A study by the Federal Trade Commission showed errors in the credit reports of 1 in 5 consumers (For examples, see here and here).

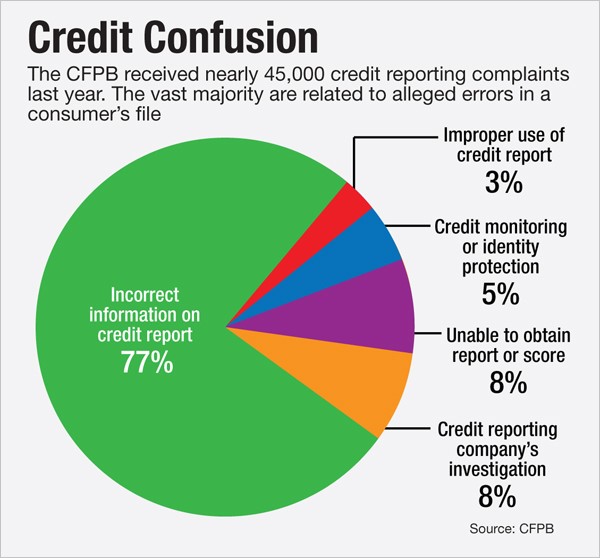

The chart above shows the main reasons given for consumer credit reporting complaints to the Consumer Financial Protection Bureau in 2014.

As you can see, they related overwhelmingly to incorrect information on credit reports.

Another source of complaints concerns credit reporting company’s investigation.

Those borrowers who wish to fight the findings of a dispute investigation can face a lengthy battle to reverse the decision, with some such cases lasting up to 10 years.

Some of these will sell a borrower their credit score for a small fee.

If you decide to do this, carefully check what score you are actually receiving.

In some cases, it can be an ‘educational score’ which will not be the same as the score shown to a lender.

This can cause difficulties when applying for loans and lead to unexpectedly high interest rates.

Checking your credit report

It is recommended that consumers check their credit reports regularly.

You are entitled to see this once every 12 months and can find out how to do so here.

If you check your report and find a mistake or a negative item that may be affecting your credit score, you are entitled to contest it under the ‘Fair Credit Reporting Act.’

The terms of the Act

You have the right to contest inaccurate entries on your credit report at any time.

When challenged on an item, the credit bureau has to investigate the matter free of charge and within a 30-day period, unless they give notification of delay.

Any item contested in this way must be either be confirmed with written proof by the creditor, or if an error is found, corrected or deleted immediately.

If the credit bureau and creditor cannot or do not confirm the result of the dispute within 30 days, the item must be removed from your credit report.

If the creditor’s investigation finds that a disputed item is accurate, you have the right to include your own Consumer Statement on the file.

This should, ideally, be shorter than 100 words.

Further possibilities

It is generally not possible to dispute accurate, but negative information on your credit report.

Such information will stay on your report for seven years (10 for bankruptcies).

Should this information appear on your report past this point, you are within your rights to dispute this with the credit bureaus and ask that it be removed.

For more information, see here.

Should you choose to dispute a negative but accurate piece of information, there are several key things to think about.

What to dispute

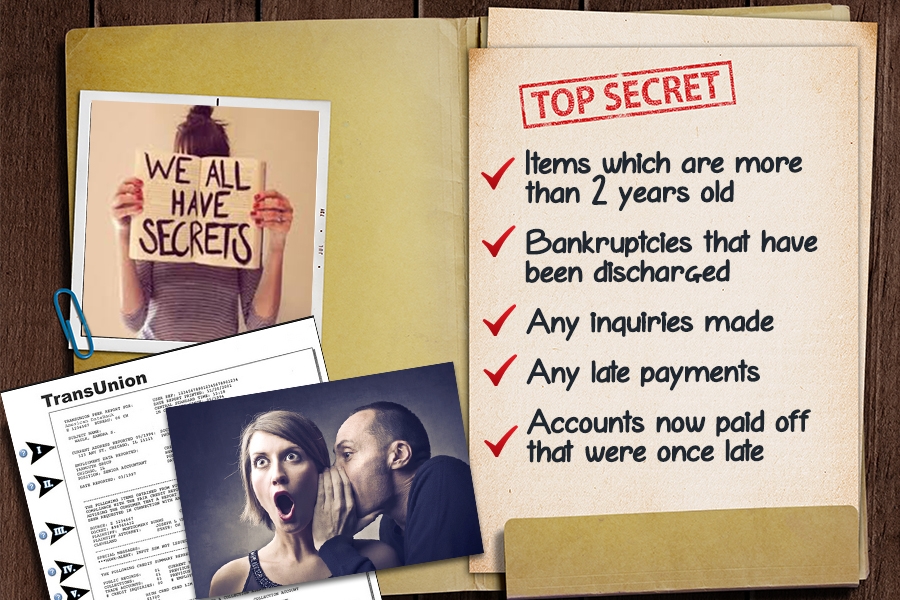

Should you choose to dispute such an item on your credit report, it is worth considering the types of items which are likely to be easiest to have removed.

These should be easily removed from your credit report because creditors are unlikely to have the information to hand or to waste time in searching for it.

Also, accounts that have been paid off will not be very high on the creditor’s list of priorities, since they have already have the money and therefor are less likely to dispute the matter.

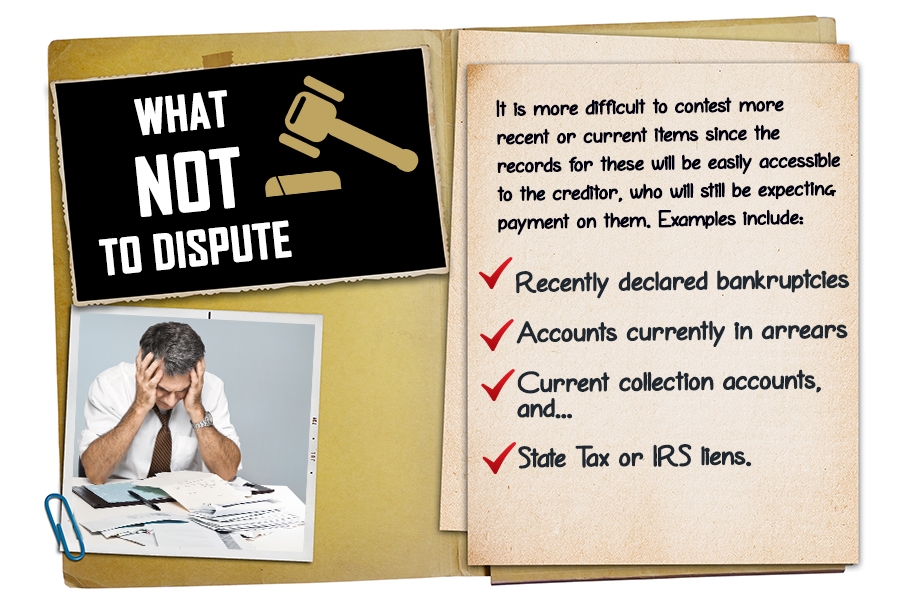

What not to dispute

It is more difficult to contest more recent or current items since the records for these will be easily accessible to the creditor, who will still be expecting payment on them.

How to be certain

Prior to reporting such an item, you may choose to contact the reporting creditor directly to ask for written proof (i.e. a signed copy of the contract) that the account is yours.

With the growth of computer-based data storage, it is very likely that the original contract will have been disposed of and there will be no formal proof.

If the creditor cannot supply this to you, then they will not be able to verify a formal dispute, and the item should be removed from your credit report.

Conclusion

The credit bureaus may seem able to exert a great deal of influence over many aspects of life, but you are entitled to check that the information they hold on you is correct, and to take steps to have any inaccuracies removed.

Doing this will help you in a wide range of contexts in the future.

If you’d like to speak with someone about your credit, and how it may be impacting you financially, reach out to one of our credit consultants here.

We’re located in Tampa, Fl and have helped over 25,000 people nationwide restore their credit.

Leave A Comment