Does anyone honestly want to live in a shoe box sized apartment for the rest of their lives?

Who intends to deal with loud neighbors on all sides of their living space?

Exactly, nobody wants to go through that kind of trouble day in, and day out.

This is the reason many people, at some point in their life, buy a house.

There are a lot of things that you have to do in order to find and buy your dream home.

You’ll have to track down a quality realtor, define a price range, and most likely get a loan.

Mortgages are essential in achieving your dream house, and it is important that you understand what applying for a mortgage means.

Your credit score is a primary key factor in determining the different aspects of your mortgage.

You don’t need to worry if you don’t have a perfect credit score!

All the lenders want to see is that you’ll be paying back the money on time, and this is what a good to excellent credit score will show them.

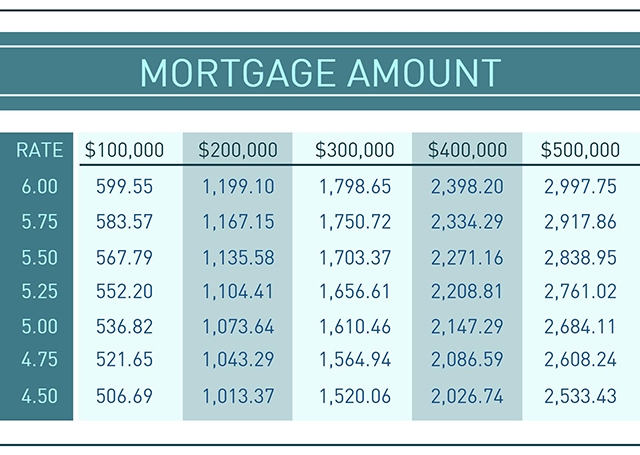

If we take a look at the graph below, you can see that there is a direct relationship between your credit score and the type of interest rates you will receive on your mortgage.

Obviously, the better your score is, the lower of an interest rate you will receive.

<img class=”alignnone size-full wp-image-10778″ src=”https://nationalcreditfederation.com/wp-content/uploads/2016/09/todays-mortgage-rates.jpg” alt=”todays-mortgage-rates” width=”822″ height=”464″ srcset=”https://nationalcreditfederation.com/wp-content/uploads/2016/09/todays-mortgage-rates-200×113.jpg 200w, https://nationalcreditfederation.com/wp-content/uploads/2016/09/todays-mortgage-rates-300×169 sildenafil 50 mg.jpg 300w, https://nationalcreditfederation.com/wp-content/uploads/2016/09/todays-mortgage-rates-400×226.jpg 400w, https://nationalcreditfederation.com/wp-content/uploads/2016/09/todays-mortgage-rates-600×339.jpg 600w, https://nationalcreditfederation.com/wp-content/uploads/2016/09/todays-mortgage-rates-768×434.jpg 768w, https://nationalcreditfederation.com/wp-content/uploads/2016/09/todays-mortgage-rates-800×452.jpg 800w, https://nationalcreditfederation.com/wp-content/uploads/2016/09/todays-mortgage-rates.jpg 822w” sizes=”(max-width: 822px) 100vw, 822px” />

You’ll have a decent credit score if:

- You pay on time

- You pay in full

On the other hand, if we take a look at the graph above, we can pinpoint the ages that may receive the higher mortgage interest rate just based on some very general statistics concerning age and the individual’s credit score.

If you fall in the age ranges that have a low credit score, it is possible that lenders already might have a negative feeling about you, this is why it is important to do everything you can to keep a high credit score.

It is critical to remember that every time you pull your credit score, it takes a few points off.

Click to tweet

However, you are allotted one free credit report a year, so definitely use this to your advantage when applying for a mortgage.

When you finally receive your credit report, it might look like a bunch of random numbers.

Believe it or not, these numbers mean something, and it is vital to know what they’re saying.

Another hurdle you will have to leap in the race to buying your dream home is saving up enough money for the down payment of a mortgage.

Before the market crash back in the early 2000’s, thousands of lenders were allowing people to skip the down payment, and receive their loans right away.

However, after the crash, all of those offers were taken off the table.

Even so, the down payments still can be relatively cheap.

Keep this in mind, though, the more you put down on your mortgage loan, the less your interest rate will be.

As of right now, the lowest amount you can put down is around 3 percent, but this might have an adverse effect on how high your interest rate will be.

As you can see in the graph above, the higher the down payment is, the lower your interest rate will be.

This doesn’t mean you have to give the lender your entire life savings, but you should put down at least 10 percent to ensure a lower interest rate.

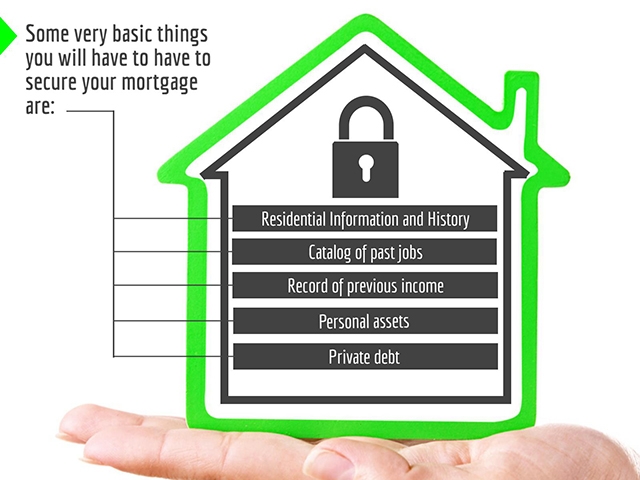

It is always recommended that you have at hand the proper documentation when applying for your mortgage.

This includes income verification, past checks, tax returns, and any other information that is deemed appropriate in determining your mortgage rates.

Having this information handy can make the process of determining your rates and obtaining a mortgage a lot more manageable.

If you can recall this information, or have it documented somewhere, applying for a mortgage will become a much easier experience.

In a final analysis, applying for a mortgage can be a daunting task for anyone, regardless of age or experience.

It’s important that you keep the above elements in mind when preparing to apply for a mortgage.

If you are ready beforehand, it’ll make the experience much more comfortable, and you will be able to move into your dream house faster!

Leave A Comment