What is a debt management plan (DMP)?

It’s a payment agreement between you and your creditors, to pay off your debt in smaller installments.

They are typically used by someone when they are swamped in debt, and cannot afford the payments anymore.

The debt agreement can be made with your creditors by yourself, or through a licensed company (for a small fee).

Although this may sound all good, it still does come at a cost to your credit score – it will need careful financial planning before taking one out.

How can you find yourself in debt?

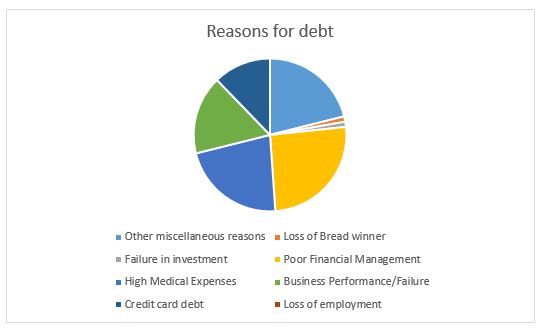

Conducted by a US survey, this graph shows the most typical ways an average American gets into financial turmoil:

There’s a shared popularity between losing your job, medical expenses, and reduced business performance; while losing the household breadwinner seems a lot more uncommon.

Each circumstance can differ though, and no one asks for money troubles – but the good news is that there are always plenty of options.

Will a Debt Management Plan harm my credit rating?

A DMP can hit your credit score, in the same way that maxed-out credit cards or missed payments do.

Take note:

If you use a DMP, then your credit accounts will automatically close – which gives the same impact as you closing the accounts yourself.

It will increase the ratio of your debt usage:

This means the total amount of your available credit limits vs. your outstanding balances – the amount of debt you are carrying is what calculates your credit rating.

Can I access this data?

Many platforms online offer your personalized credit report access, the most popular is: AnnualCreditReport

Always ensure you understand every detail before settling into any debt agreement

You must weigh the pro’s and con’s and definitely be sure a DMP will help you.

For example:

Organizing a DMP when debt is out of control will limit the strike on your credit rating, rather than simply not paying your direct debits.

The latter would have a more negative impact, and can also prevent the drama of bailiffs turning up on your doorstep (plus all the other stress that comes with it).

However, if you are just looking to keep more of your money monthly but not really in any trouble – then this may not be suitable.

What is a debt calculator?

This is an online tool which can show you your lifetime debt, the length of time to pay off, and how it would affect your credit rating.

If you are serious about consolidating your debt in some form, then this will be beneficial for when it comes to making decisions.

However, if you want to go further, and have all your finances watertight – including the age you can afford to retire then consider downloading:

The benefits of this financial calculator:

- Easily compile your assets vs. liabilities.

- Arrange your money actually into savings, paying off debt – while still factoring in your luxuries, holidays and a new car.

- Set targets and change it into a game.

- No complicated Math knowledge required – just the ability to read your bank statements.

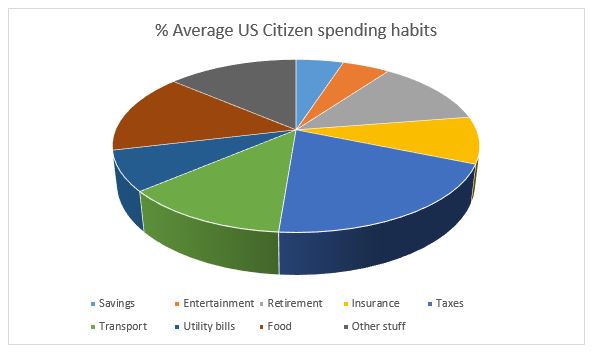

This is a graph showing the typical spending habits of an average US citizen:

With the current cost of living, this chart shows a healthy spending pattern covering all aspects of his/her life – My Money Platform would give you very precise data like this, on how to arrange your money.

By grasping the use of these tools, it would effectively get you out of financial hell very quickly, while making a minimal effect on your credit score.

Conclusion

This doesn’t mean a DMP should be seen as bad, as they’ve helped a huge portion of the population to get themselves out of money troubles – but you should always review the impact that any decision or agreement can have on your finances.

Leave A Comment