So you’ve checked your credit score and noticed that it has dropped.

Should you be worried?

After all, your credit score can affect so many different parts of your life.

The answer depends on the reason your score dropped.

Let’s look at some of the most common reasons a score declines, because there’s no way your credit score dropped for no reason. Then you’ll be able to better understand the issue, and how to resolve it.

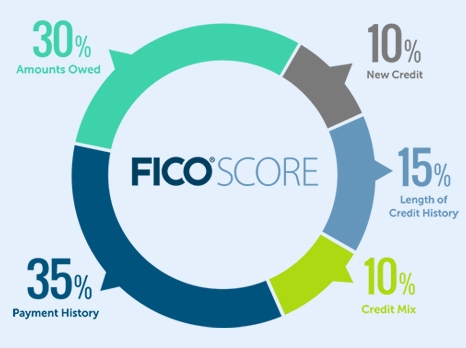

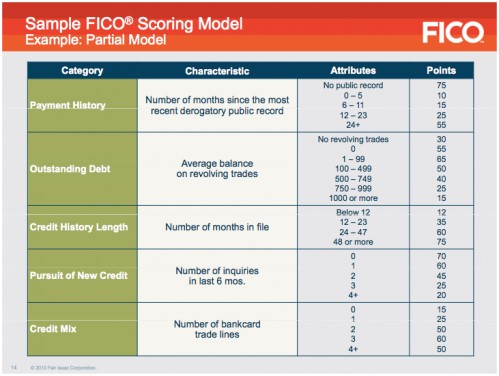

Your FICO score is calculated using a secret formula. However, the essential components of the method are well-known.

As the chart shows, five elements go towards your FICO score. Each of these has varying degrees of importance in the calculation.

These are:

- Your payment history – 35%

- Amounts of money owed – 30%

- The length of time you have had credit – 15%

- New lines of credit taken out – 10%

- Your credit mix – 10%

New information (e.g. changes in your bank account balances, payments you have made, loans you have requested) is regularly fed into your credit report. So it is not unusual for your credit score to fluctuate as a result.

A change of a few points upwards or downwards is normal and nothing to worry about. This fluctuation will happen on a day-to-day and month-to-month basis.

If the drop in your score continues or worsens, it’s worth looking into what could have caused it.

Let’s take a look at what it could have been.

Reasons For The Drop

More than 30 days late on a bill

Late payments are best avoided, we all know that. But sometimes they happen.

If you find yourself in this situation, the best thing to do is to pay the bill and the late fee as soon as possible. Doing so within 30 days will avoid any lasting problems.

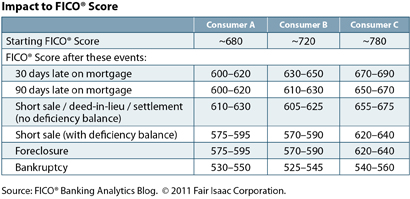

However, if your payment is late by 30 days or more, it will be reported and will appear on your credit report. As the table shows, the effect of a late payment will only get worse the longer the bill is left unpaid.

Expensive purchase that raised your credit utilization ratio

Your credit utilization ratio compares your credit balance with the amount of credit available to you. It is calculated by dividing your total balance by your total credit limit, and expressed as a percentage.

For example: If you have a credit limit of $2,000 and a balance of $1,000, then your credit utilization is 50%.

So what is a good credit utilization ratio?

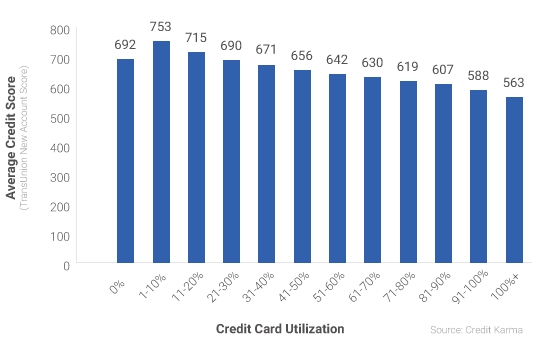

It is better to keep your credit utilization below 30%, as this is likely to have less of an impact on your credit score. The chart shows the results of a survey looking into the correlation between credit score and credit utilization.

If you’ve used credit to buy something particularly expensive recently, that will have raised your credit utilization ratio. As a result, your credit score will be affected.

Account sent to collections

If you are significantly (often more than 180 days) late making a payment, the lender may write off a delinquent debt and sell it to a collection agency, who will then try to recover the money.

When this is happens, it can hurt your credit score.

The extent of the damage will depend on two factors:

- Size of debt – the more you owe, the greater the drop in your score

- Your original credit score – the higher it was, the greater the drop is likely to be

Collection accounts can stay on your credit report for up to seven years, so it is worth dealing with it quickly. Settling the account with the collection agency may minimize the damage.

Under the most recent FICO scoring model – FICO 9 – collections accounts will be ignored once they have been paid in full.

Credit inquiry

When you apply for a new line of credit, the lender will inquire into your credit history. This will appear on your report and may have a small effect on your score.

Multiple inquiries on your account could cause more of a problem, though this will depend on the circumstances. Applying for several credit cards in a short period could make it appear that you’re a greater risk, and reduce your score.

However, inquiries relating to a mortgage, student loan, or auto lenders shouldn’t reduce it as much. This is because these loans tend to be taken out after loan shopping. FICO assumes that there will be several such inquiries in a short amount of time. Therefore, they do not count them as multiple inquiries.

Decreased card limit

If you are not using the full amount of your available credit, it can seem like it would be logical to reduce your credit card limit. Your lender can also lower your limit. They aren’t required to notify you if they do this, unless the new limit is lower than your current balance.

Whether you or your lender makes this change, a lower credit limit will reduce your available credit and affect your credit utilization rate. If you have a balance on that account, you will have a higher utilization ratio for the same amount of debt.

Even if you don’t have a balance on that credit card, your overall credit utilization is also likely to increase, since you will have less available credit overall. And, as we have already seen, higher utilization can be a big problem for your credit score.

Closing an account

In many ways, this is similar to a lowered credit limit, in that it will affect your credit utilization ratio. Losing one line of credit will reduce the amount of credit available to you, with the effects we have already seen.

It may also alter your score because the average age of your accounts will change, particularly if the account that is closed is one you have had for a long time. However, this aspect of closing an account may not have an immediate effect.

In many credit scoring models, closed accounts stay on your credit report for 7 to 10 years. This means that it is possible that a drop in your credit score has occurred because of an account you closed several years ago.

Identity theft

Someone stealing your identity can hurt your credit score in several ways.

Some of the ways identity theft can affect your credit include:

- More items charged to your existing accounts, resulting in higher balances

- New accounts opened in your name and featured on your report

- Late payments caused by the identity thief

- Inquiries for new lines of credit made by someone else

Fortunately, if you realize that your identity has been stolen, the effect on your credit score can be removed easily. The Fair Credit Reporting Act (FCRA) says that credit agencies have to block any information on a credit report that is the result of fraud. You just need to contact your company and explain the situation to them.

Changes in FICO’s formula

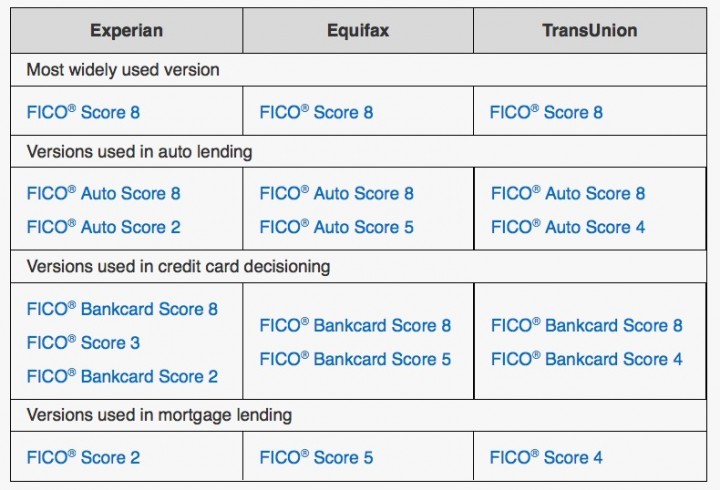

The FICO formula changes occasionally, most recently in December 2016. The purpose is to keep up with the changing needs of consumers and lenders. As well as the standard model, there are also industry-specific versions, such as for the auto-lending industry.

Obviously, there have been several different versions of the FICO scoring model, and lenders have the option to choose which version they are going to use. Since different versions of the formula look at things slightly differently, your credit score may change if a lender begins to use a different version.

The table below shows the wide variation in the versions used by different lenders in different industries:

“Scorecard hopping”

Scorecards are used to categorize consumers into ‘like’ populations, to make credit scoring more fair. Consumers are grouped with others whose credit history is similar e.g. those with bankruptcies or those with thin files. This way each group can be evaluated in a way that is unique to them.

Without scorecards, every consumer would be assessed in the same way. This means that those without a long and clean credit history would suffer.

If something in your financial situation has changed, you may have moved to a different scorecard (known as “scorecard hopping”). If this has happened, everything on your file will have a different weighting. This can have a significant effect on your credit score.

Zero credit utilization

It is easy to assume that having no debt at all is a good thing and that a credit utilization ratio of 0% will have a positive effect on your credit score. But this couldn’t be more false.

Credit scoring is based on a measure of possible risk to the lender.

If you don’t use credit, you aren’t showing that you can use it responsibly.

We saw earlier that zero credit utilization results in a slightly lower credit score than a ratio between 1% and 30%.

This partial FICO scoring model shows that a consumer with no revolving trades or an average balance of $0 in their Outstanding Debt category (i.e. 0% credit utilization) receives fewer points than a consumer whose average balance is between $1 and $99.

This doesn’t mean that you have to carry a balance on your account and accrue interest on it. It is possible to use credit to buy small items and then pay off your balance in full every month. This will raise your credit utilization above zero and avoid the problem.

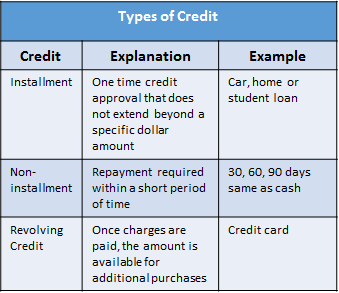

Change in credit mix

Your credit mix – which forms 10% of the FICO formula – is simply the range of credit account types that appear on your credit report. Examples of credit accounts might include your mortgage, student loan, automobile loan, and any credit cards you might have.

Credit is considered to fall into three main categories, as shown in the table below. Having a mixture of types of credit, particularly installment and revolving credit, is likely to have a positive effect on your credit score.

Applying for a new line of credit or closing an existing one will change your credit mix and may affect your score. However, the exact impact of such changes is difficult to assess, because any variations in this area will also affect other factors in the scoring formula.

Change to average age of credit

Your average age of credit shows how much experience you have in managing credit responsibly. Different scoring models calculate this in a variety of ways:

- Finding the average age of your open accounts

- Using the age of the oldest account

- Taking into account closed accounts if they’re still featured on your credit report

If you have closed one of your older accounts, this will have lowered the average age of your credit. This may even have happened several years in the past, depending on which model your lender uses. Furthermore, under some models, opening a new line of credit could also lower the average age, with the same effect.

Authorized user on a now delinquent account

Being an authorized user on someone else’s account can add to your positive credit, but it can also cause problems. Accounts on which you are an authorized user will appear on your report. If the primary account holder misses payments, the effect on your credit score will be the same as if you were the one who didn’t pay on time.

Some scoring models will only accept positive information from authorized user accounts. But, the FICO score includes all data – negative as well.

If you are an authorized user on someone else’s account, check your report to ensure that this isn’t what’s hurting your score.

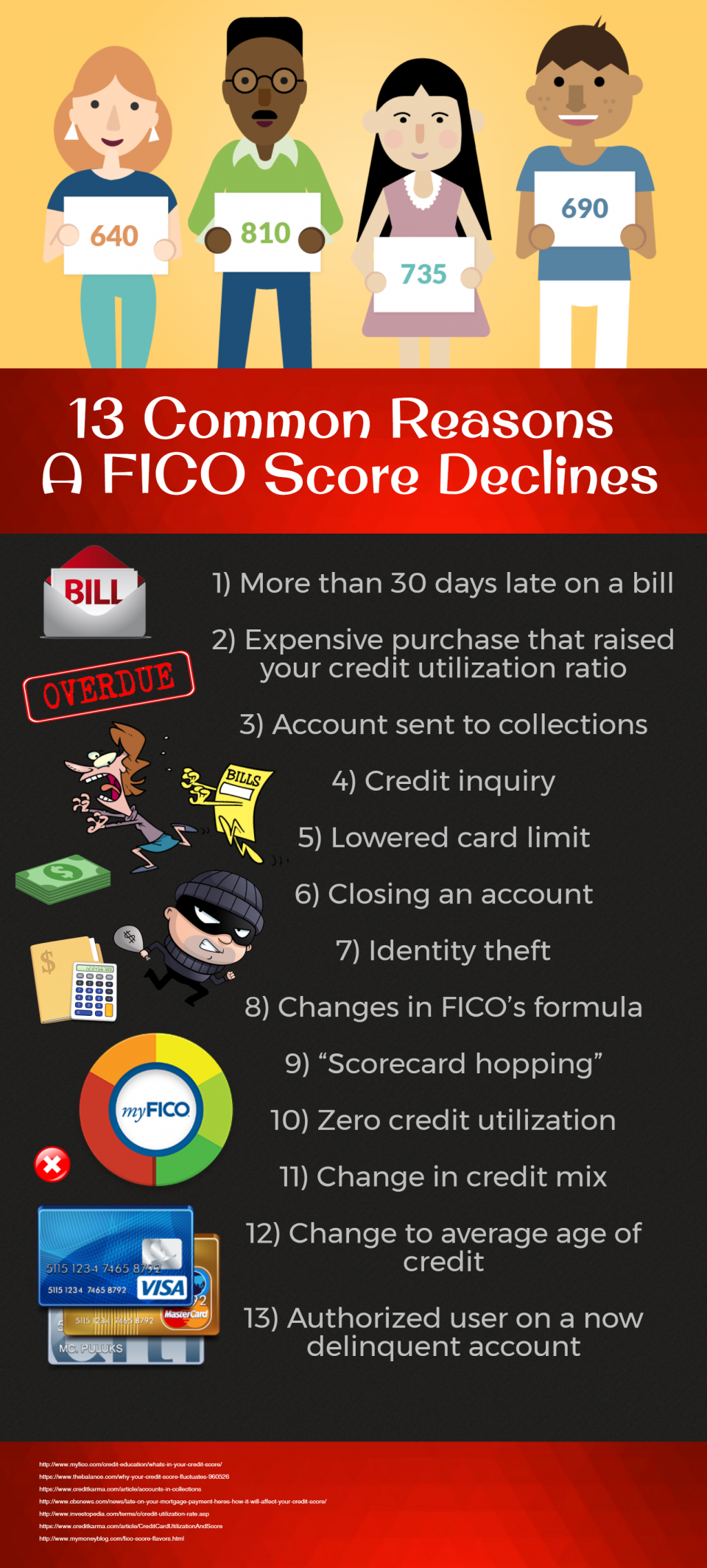

That was a lot of information, wasn’t it? So we put all of it on this handy infographic for you:

What’s Next?

First of all, don’t stress over a small drop. Minor fluctuations are perfectly normal and shouldn’t pose a long-term problem.

The best step to take is to continue credit monitoring, and pay close attention to your FICO score. Hopefully, the drop will correct itself, and your score will go back to normal with time.

If things do not improve, or your score continues to drop, you should take steps to solve the problem.

Remember that you’re entitled to a free credit report every year. Take a good look at your credit report to figure out why your credit score dropped. Many of these problems can be reversed quite quickly.

Whether the problem has to do with your credit utilization, changes in your financial history, or the actions of others, investigating the problem and taking steps to correct it should help you get back to where you were.

Leave A Comment