There is no doubt that being turned down for a credit card will have an effect on your credit score. However, how it affects your score depends on a couple of different factors.

Credit scores

Your credit score is a three-digit number that ranges from 300 to 850. The higher the number, the better your credit score is. Your credit report tells potential lenders how ‘trustworthy’ you are. This is why it is important that you try to obtain the highest score possible.

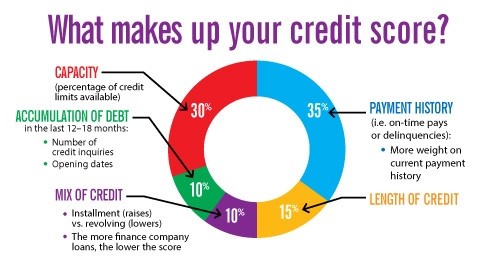

Your credit scores is calculated based on:

- 35% = Your payment history

- 30% = The total amount of your debt

- 15% = The duration of your credit history

- 10% = Amount of ‘new credit’ accumulated

- 10% = The different types of credit you hold

To maintain a good credit score, it is important that you keep up with your repayments, maintain low balances on all your accounts, do not apply for several lines of credit in quick succession, and only open accounts that you need.

It is also helpful to regularly check your credit report, where possible set up automatic payments, and work towards reducing any debt that you owe.

Being declined for a credit card

While it is true that your credit card application being declined will affect your score, it will not affect your score in the way you may expect.

The actual application being turned down will not directly affect your score because lenders will not necessarily be aware that this was the case. Your credit report will show ‘new credit lines’ and ‘accounts held,’ so a lender could compare this list to determine how many ‘new lines’ did not become ‘accounts held.’ But, they will not know why this was the case, you could have turned the credit down rather than the lender turning you down.

How will my score be affected?

The answer depends on how good your score is, and how many ‘new credit lines’ you have applied for recently.

If you have a healthy credit score and have only applied for a couple of cards recently, then the effect on your credit score will most likely be insignificant enough to cause any real damage to your score. Ensure that you wait at least 6-18 months before applying for more credit, and that you continue to use your existing credit responsibly.

If your credit score isn’t great and you have applied for several ‘credit lines’ in a short space of time, then the damage to your credit score will be more significant. If this is the case, then you should focus more on repairing your score than obtaining further credit. The higher your credit score, the more likely you are to be approved for credit in the future.

Conclusion

Your credit score is what lenders use to determine if you are considered ‘trustworthy’ enough to repay debts on time. Your credit score will be in the range of 300-850. The higher your score, the more reliable you are considered.

There are several factors involved when calculating your credit score. However, the biggest influence is your payment history.

This hard inquiry is reflected in your credit report. But such inquiries form only 10% of your credit score.

Other factors are taken into consideration, such as how much you owe, and the length of your credit history.

In case your loan or credit card application is rejected, it is important to look into the reason. Every year you’re able to get a copy of your credit report from the credit reporting agencies. This right is covered under the Fair Credit Reporting Act. Read through your report carefully, and follow up any discrepancies with the credit agencies right away.

Leave A Comment