Most people think that having a good credit score means paying debts off on time and having a good credit utilization ratio.

That’s true at some level, and certainly is a good approach to keeping your score high.

But there are many other things which can affect your credit score, some of which may surprise you.

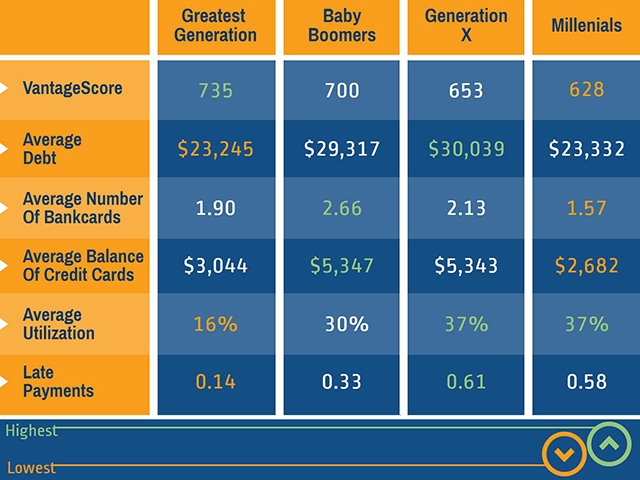

As the infographic below shows, millennials and other young adults have the lowest credit scores of the population.

This is because they get caught with damage to their credit score from these seemingly random, but totally preventable things.

So what are these surprising things you need to watch out for?

Even though parking tickets aren’t necessarily debt, they can be referred to judgment after not being paid for too long.

This shows up as a mark on your record, and a demonstration that you cannot pay fines does not bode well for your credit score.

Library fines, court fees, hospital costs, and many other forms of municipal debt may be reported by your city to credit agencies.

So be sure to pay off these seemingly silly fines quickly.

Business cards require a “personal guarantee” from an individual cardholder to function.

That means if you are the cosigner on the card, even if it is technically a business card, any debt you rack up will affect your own personal credit score.

It might seem like having no debt is a good thing.

However, if you keep your card balances at zero and never use them, it can actually harm your credit score.

This is because creditors reward customers who diversify and hold many active accounts under their name.

It only shows that you do not utilize credit very much in the first place.

Keeping your balance between 10-30% of your overall limit and paying the balance off each month is a good way to avoid this issue.

This is another thing which may seem counter intuitive.

If you have an old account that you don’t use, it seems reasonable to get rid of it.

However, the age of your accounts helps to increase your credit score.

By closing out your oldest accounts, the average longevity of your accounts overall decreases.

Therefore, closing the old accounts can actually hurt your score.

Settling a debt with a credit card may save you money, but in the long run, it can hurt your credit score because it demonstrates an inability to pay your debts off in full.

Instead of settling, try as much as you can to pay off the loan in its original amount, even if it may take longer.

This may save you money in the long-term by helping you get a better interest rate on future loans.

Requesting an increase in the limit of your credit card shows that you do not have good financial planning skills.

Try to spread out your debt over multiple accounts if necessary, rather than asking for an increase on a single account.

It may result in a hard credit inquiry, which can hurt your credit score in the short term.

Here is another instance where it seems something would not hurt your credit score.

After all, it’s a debit card, not a credit card.

If you choose to pay with a debit card, however, car rental companies often reserve the right to pull your credit report.

Whether you have good credit or not, these kinds of inquiries put a ding on your report and cause suspicion.

These hard inquiries cause your score to drop a few points immediately.

Many utilities companies report to credit reporting agencies about on-time payments.

Having multiple late payments will cause a decrease in your credit score.

While moving money from big banks to smaller unions is great for the economic health of the community, it can cause a hard inquiry into your account.

Most financial institutions conduct an inquiry when you open a new account, so opening an account at a big bank or a small credit union have similar consequences for your score.

But, these point deductions are usually not very high, and can be easily built back up through good credit practices.

An auto dealer or furniture store may allow you to set up a payment plan, but this is basically like a loan in disguise.

Since you are taking a long time to pay it back, typically these loans often have negative ramifications for your credit score.

Overall, it is best always to monitor your credit report carefully, and use your three free reports per year to make sure your score has not unexpectedly dropped.

Keep track of small debts and expenses, pay off larger debts reliably, and you should be able to maintain a healthy credit score.

If you’d like to speak with someone about your credit, and how it may be impacting you financially, reach out to one of our credit consultants here.

We’re located in Tampa, Fl and have helped over 25,000 people nationwide restore their credit

Leave A Comment