Your credit score is the key to your financial health, both in the short term and the long term. It affects everything from your ability to get hired for a job to taking out a mortgage.

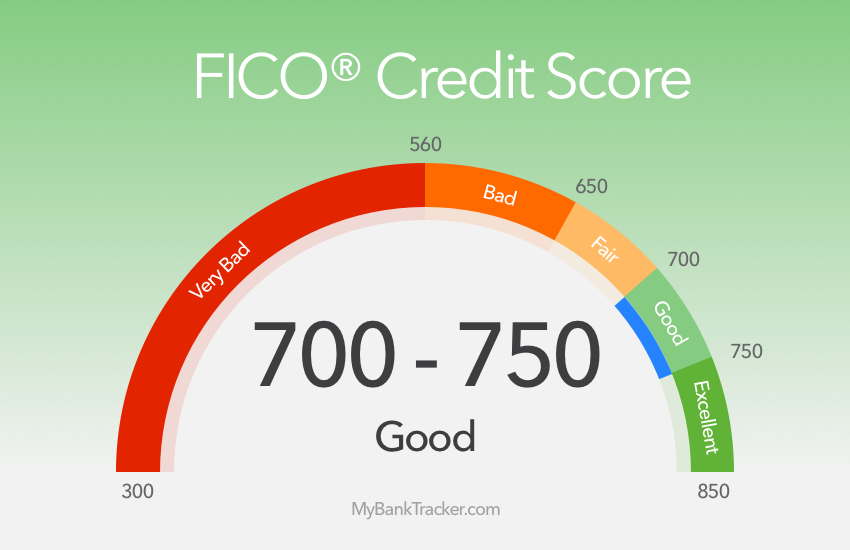

Your credit score is measured on the scale from 300 to 850.

Typically, a good credit score is one that is over 700.

Most importantly, your credit score is used by lenders to determine your ability to apply for something like a loan or a credit card. In general, a higher credit score means a better chance of being approved.

If you have a low credit score, you may not be able to be approved for these things. While having a high credit score is not the only determining factor, it is critical in many senses. This article will help you figure out how you can increase your credit score. This process depends on your current financial state, but it is always possible to improve your credit score.

Understanding Your Current Score

The first step in this process is figuring out what your credit score currently is. You are entitled to a free credit report each year. You can request one online from TransUnion or Equifax. Both of these institutions are mandated by law and do not use your information for any negative purposes. Once you find out what your current score is, then you can develop a plan to improve it.

Why Do I Need To Have A High Credit Score?

Surprisingly, many people are not very concerned with their credit score. However, having a high credit score can improve your financial life in many ways.

The primary benefit is being able to get loans and credit cards with a lower interest rate. This low interest-rate will enable you to save more money over time.

Overstating the value of a good credit score is impossible. Qualifying for special deals on down payments, monthly installments, and interest rates mean that you can enjoy a higher quality of life. This will enable you to plan for retirement, your children’s college, or other long-term financial needs.

So How Do I Raise My Credit Score?

Increasing your credit score is not always quick and easy to do. However, there are a few important steps that you can take now which will improve your score, and make it easier to keep your score up down the line.

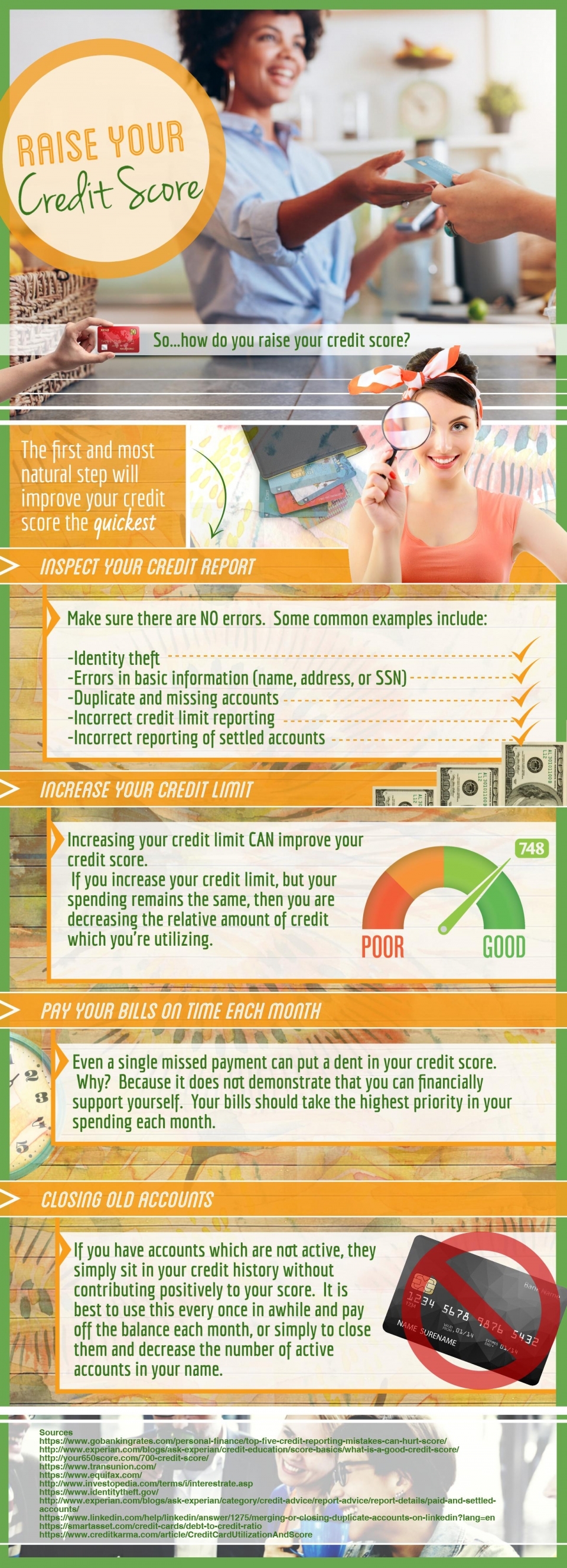

The first step is one that can improve your credit score the quickest and most profoundly. It is important to take a look carefully at your credit report. Make sure that there are no errors on the report which may be harming your credit score.

Some common examples include:

- Identity theft

- Errors in basic information such as name, address, or SSN

- Duplicate and missing accounts

- Incorrect credit limit reporting, which impacts your debt-to-credit ratio

- Incorrect reporting of settled accounts

Basic Information

The most common credit report errors are simple things which can have an enormous negative impact on your credit score. The first is necessary information such as your name, address, and Social Security number. A mistake in one of these areas can make it so that your credit information is not correctly filed under your actual identity.

An error in this information could mean that you are possibly living with someone else’s credit score under a mistaken identity in the eyes of banks and lenders.

You can avoid this issue by carefully examining your credit report and making sure there’s no false information.

If there is a mistake, then it’s vital to contact your credit reporting agency and your lenders to correct it.

It only takes a short time to process these corrections, and it can lead to a huge bump in your credit score.

Identity Theft

You also must stay on the lookout for identity theft. Unfortunately, many people don’t notice it until it is too late.

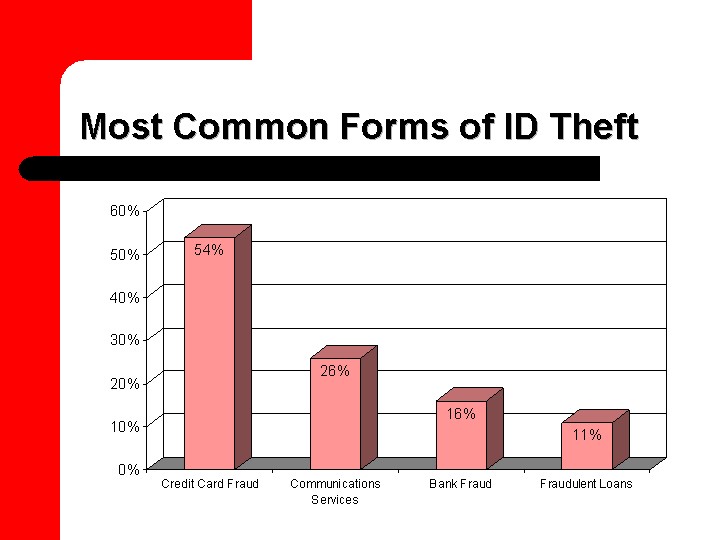

As you can see, credit card fraud is the most common type of identity theft.

Thanks to the internet, identity theft is more common than ever. It’s important to watchout for it as it effects your personal safety and overall financial health.

Incorrect Information on Settled Accounts

Reporting agencies are required to list your accounts accurately, whether they are open or closed. Sometimes people have mistakes on their credit reports where their paid accounts are not correctly represented. If you did something such as file for bankruptcy or fail to pay your taxes, this has a bad effect on your credit score.

But if you settled any of your accounts, like a debt that was sent to a collection agency, the reporting agency has a responsibility to make sure that it is listed correctly on your report.

Increase your credit score by making sure that any negative spots on your report are taken care of.

Don’t hesitate to contact lenders or credit agencies who can help you make sure your report reflects your financial behavior accurately. A negative spot on your report should not continue to have an adverse impact after you have rectified the situation.

Duplicate Accounts or Missing Accounts

Another common error is duplicate reports of accounts, or missing accounts on your report. Duplicate reporting can be extremely detrimental to a credit report since it doubles the impact of any loans you may have. They can also have a significant impact on your credit utilization ratio.

For example, debt collectors often “sell” overdue accounts to each other. This can often result in unfair double-listing of outstanding receivables.

Credit Limit Reporting

Another major mistake that is very common is false reporting of your credit limits. This may not seem that important, especially if you’re not exceeding your credit limit on a regular basis. But this plays into your debt to credit ratio, which is an incredibly important factor in your credit score.

For example, if your actual credit card limit is $10,000, and you only have $2,000 on the card, your real debt to credit ratio is 20%. However, if there is inaccurate reporting where it is listed that your credit limit is $5,000 instead of $10,000, your debt to credit ratio will be much much higher. This will cause you to have a lower credit score and increased interest rates. Obviously, this is not fair since your debt to credit ratio isn’t actually that high.

That leads us into our next point.

Increasing Your Credit Limits will Lower your Debt to Credit Ratio.

It may seem counter intuitive to think that increasing your credit limit will improve your credit score. However, this is a very common method of improving your credit score by possibly hundreds of points.

Your credit utilization is one of the biggest factors that goes into determining your credit score, and it is one of the easiest numbers to manipulate to your benefit. For all of its advantages, the concept is a very simple one.

If you increase your credit limit, but your spending remains at the same level, then you decrease the relative amount of credit you’re utilizing.

If a lender sees that you have the opportunity to be using a lot of credit, but you are only using a small portion, then it demonstrates that you are financially responsible and do not typically overspend beyond your means.

When a creditor sees that someone has a high credit utilization, it does not appear that the person will be able to pay back their loans easily. If your credit usage is relatively small, then lenders can trust that you will repay your debt and be more likely to give you a low-interest loan.

However, it is a thin line which you must walk to make sure that you have not opened too many accounts, or your report will look way too busy.

It is understood that the ideal debt to credit ratio is somewhere around 30%.

You can give or take a little depending on your financial situation.

Keeping Bills on Time Each Month is crucial to maintaining your financial health and raising your credit score

The next important step you can take to increase your credit score is to make sure that you are paying all of your bills on time each month. It is better to pay your bills, and cut down on other expenses, than to risk paying a bill late.

Something that many people do is set up an automatic payment plan. Many companies make it very easy to set up online automated bill payment each month. If you automate your bills to come straight out of your checking account at the right time each month, you’ll never risk paying a bill late.

The only fallback of this strategy is that if you do not have enough money in your bank account, you risk overdrawing your account.

However, as long as you check your bank account balance around the time where your bills are due, you can avoid this issue. Also try setting up alerts on your phone which repeat each month a couple of days before your bills are due. That way you’ll have ample time to organize and make sure you have the means to pay them.

Diversify Your Account

Another significant aspect of your credit report score is how many different types of credit accounts you have open.

For example, a person who only has a couple of credit cards and nothing else is not likely to have a very high credit score.

However, an individual who has an auto loan, a credit card, a mortgage and a student loan payment could have a higher credit score. But, having different types of accounts will not help you if you are not paying them on time. If you fall behind on many types of credit, it is not any better than falling behind on a single type.

How Soon Can I Expect Results?

Unfortunately, you cannot fix your credit score in one day. If you have a full year of completely positive credit behavior, such as paying bills on time and not filing for bankruptcy or other negative hits to your score, you can expect your score to begin to rise.

The one exception is if you catch a mistake on your credit report, and file to fix it.

Since these errors are the fault of the reporting agency and not yourself, the positive effects on your credit report will be immediate, and often be filed within a few days. Something like opening a new account or paying off debts, will also appear on your credit score relatively quickly.

Another aspect that can affect your credit report is a bankruptcy. This will stay on your credit report for ten years. Similarly, debts that are sent to the collection agency can remain on your account for 7 to 10 years, depending on your state laws.

Do not let this discourage you if you start taking active steps to improve your credit history and economic health. You’ll reap the benefits for many years to come.

Leave A Comment