Usually, when you search for advice on building, or improving your credit score, most people will suggest getting a credit card.

A credit card, however, is not an option that appeals to everyone.

So what other ways are there to improve your score?

What is a credit score?

A credit score is a number that tells a lender how likely a person is to be able to repay their debts.

The majority of banks and credit card companies calculate a person’s credit score using the FICO model and the credit files held by the three top national credit bureaus:

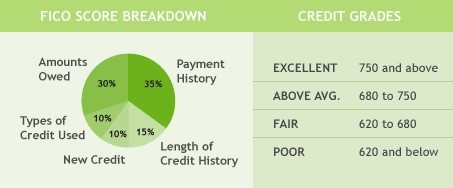

The FICO model looks at five different components:

- Payment history – 35% ability or inability to pay off debts

- Amounts owed – 30% the total sum of money owed on all accounts, loans, and balances

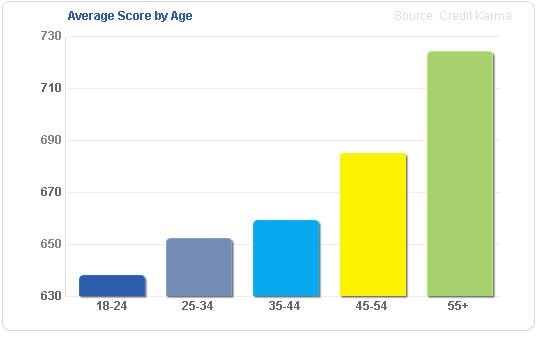

- Length of history – 15% your credit score will improve the longer you have a credit history

- New credit – 10% this would mainly include several hard credit inquiries, although all records of credit inquired will be recorded

- Types of credit used – all kinds of credit acquired will be included

The FICO model has a credit score range of 300 to 850.

The higher your credit score is, the lower of a risk you are to lenders.

Ideally, your credit score should remain somewhere between 690 and 850.

A score less than 690 would flag you up as a risk to lenders.

Just because you have a lower score now, does not mean it will always be this way.

There are many ways in which you can improve your credit score now.

Get a credit builder loan

Small banks or financial institutions will occasionally offer credit builder loans.

These loans are especially made for those with no, low, or bad credit scores.

The bank or financial institution will put the money that you have borrowed into an account controlled by the lender.

You will not have access to these funds until you have fully repaid the loan.

The lender will charge you interest, so it is in your best interest to repay the loan as quickly as possible.

However, be wary as some loans may come with an early repayment fee.

Get a student loan

Student loans appear on your credit history; as long as you don’t miss any payments, then your credit history will grow in time.

If you are struggling with repayments, consider applying for a deferment, as this will be more favorable then missed payments.

A deferment will freeze your payments until a later date, so your credit score remains unaffected.

Missed payments, however, can have a significant impact on your credit score for up to seven years.

Become an authorized user on someone else’s credit card

The majority of credit card issuers report to the major national credit bureaus.

If you have a friend or relative that has a credit card and a good credit score, then you could benefit from this by being an authorized user on their credit card.

Try to get your rent payments reported

If you are renting your property, then you could benefit from signing up with a company that will report your rental payments to national credit bureaus.

You will need to obtain support from your landlord, as they will need to supply proof of rental payments.

Companies that will report your rental payments are becoming more and more common, and the reporting process is becoming simpler and more automated.

Get mistakes removed from your report

Errors on your credit report can cause significant damage; you are entitled to a free credit report every year.

If you notice any errors when you check your report, then you should report these to the appropriate national credit bureau.

A report carried out by the FTC stated that one in five consumers had reported errors in at least one of their three latest credit reports.

Conclusion

Your credit score lets a lender know how much of a risk you are to them based on the FICO model.

The FICO model takes into consideration five aspects of your credit history and awards you a score between 300 and 850.

A score of over 650 is desirable, and score less than 650 considered high risk.

The best range is between 700 and 850.

You credit score can improve naturally over time, but there are steps which you can take to increase your score faster.

These steps are getting a credit builder loan, getting a student loan, becoming an authorized user on another person’s credit card, getting your rental payments reported, and ensuring mistakes are removed from your credit report.

Leave A Comment