Buying a house is an intimidating process.

It’s one of the biggest financial decisions you’ll ever make.

Approaching it can seem like a daunting task, even if you’re financially secure and have a good credit score.

On the other hand, trying to buy a house with poor credit can seem impossible, it’s like the ultimate barrier to buying a house.

But this doesn’t have to be the case. There are ways that those with hurdles can get themselves onto the property ladder and purchase their first house.

You’re going to face obstacles

There are a number of obstacles you’ll have to get past in order to buy your first house. The odds are that as a first time buyer you’ll be relatively young. The average age of the first time buyer is 33.

Being younger poses a few problems.

First, if you took out student loans to attend college, you’re probably still working on paying them back. If the average first time buyer is 33, that means they probably would have graduated college in 2005.

And guess what?

The amount of student loan debt held by people in the class of 2005 is $129 billion, and still growing.

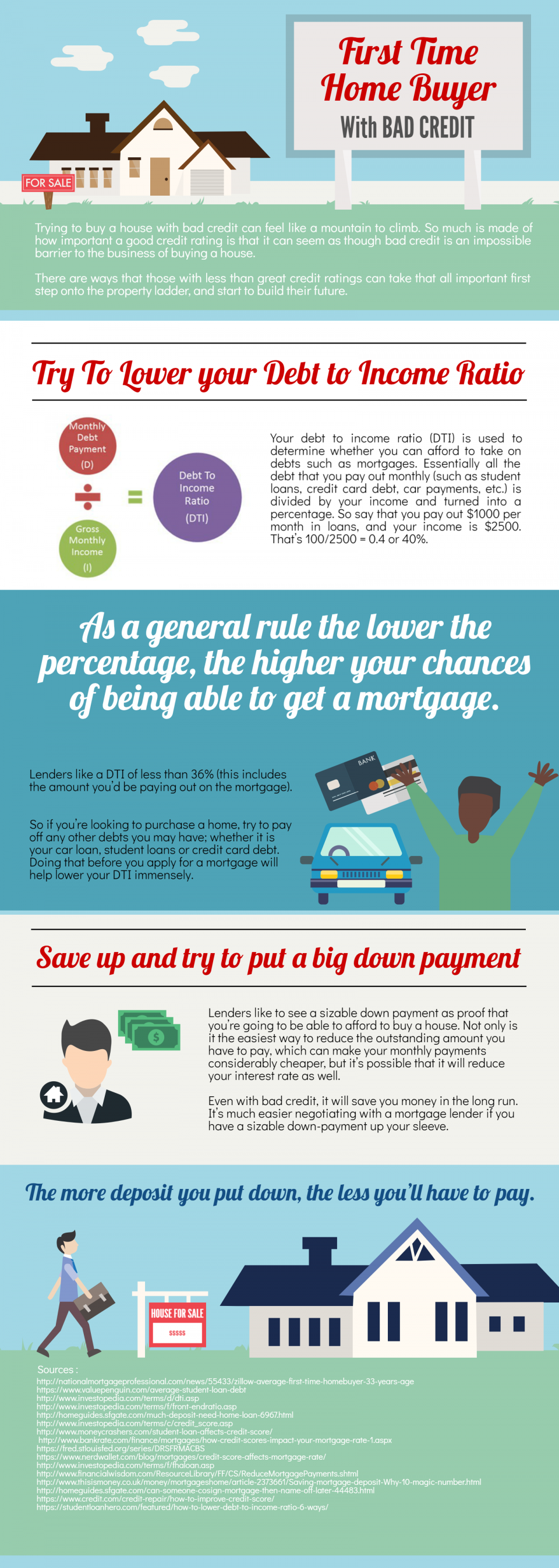

If you’re still paying loans off, then it will affect the key metrics that mortgage lenders use to decide whether or not to lend to you. Your debt to income ratio (DTI) is used to determine if you can afford to take on a mortgage.

Essentially, all the debts you pay out monthly are divided by your income and turned into a percentage. So say that your debts are $1,000 per month, and your income is $2,500. That’s 1000/2500 = 0.4 or 40%.

A general rule is that the lower the percentage, the higher your chances of being able to get a mortgage.

Lenders like a DTI of less than 36% (this includes the amount you’d be paying out on the mortgage.) So as you can imagine, the less money you owe on student loans, then the lower this is percentage is going to be.

In a perfect world they want you to be paying less than 28% of your income on your mortgage (this percentage is known as the front end ratio.)

Have you thought about your down payment?

The down payment is one of the most crucial parts of the home-buying process. If you’re buying your first house at a young age, you might not have had the time to save up the money necessary for the down payment.

Obviously, the more you put down, the less you’ll have to pay over time through your mortgage. But lenders also like to see a sizable down payment. It shows that you’re able to afford to buy a house.

Traditionally, a down payment of 20% was standard. But things have changed as the prices of house have increased relative to income. It’s possible to get a mortgage with 0% down payment. While a smaller down payment is an option, it’s usually not the ideal way to go about buying a house.

Do you know where your credit stands?

Another big hurdle that the first time buyer might have to overcome is their credit score.

If you have had years of regular and steady repayment of your debts, then your credit score will be in pretty good shape.

But first time buyers may not have had the opportunity or the time to build their credit score up. Additionally, they are more likely to have large amounts of student loan debts still on their credit record. While regular student loan repayment is a great way to build your credit score, if you’ve missed any payments in the past it will have a negative impact on your score.

Is your credit score really that important?

Mortgage lenders look closely at your credit score to decide whether not you are worth lending to. This doesn’t only impact whether you get your mortgage, it will also determine how favorable the terms are.

It’s possible to get a mortgage with a credit score below 620, but it’s not going to be at a good interest rate.

Borrowers with a 720 credit score and above tend to qualify for the best rates.

The reason is simple: the lower your credit score, then the more of a risk the lenders sees you as being. Therefore they will charge you higher interest rates to get more money out of you, and give them a hedge against the possibility of you defaulting on your mortgage.

It’s understandable; defaults on mortgages hit a peak of 11% in 2011. Even though that rate has fallen sharply, they’re still running at nearly 5% today. With that many people not paying up it makes sense for the lenders to try to cover themselves. Unfortunately, if you’re the possessor of a bad credit score, it’s you that will be paying that cover.

Interest rates can make a HUGE difference

Given the lengthy repayment period of mortgages, even a small difference in interest rates can make a big difference over the life of your mortgage

An increase of just .25% could make the average mortgage more expensive by $500 a year. Over the course of a thirty year mortgage, the same house could cost one person $15,000 more.

And that’s with people operating at the higher end of the credit spectrum. Those with poor credit scores could be getting mortgages that differ by a whole percentage point or more. When looking at a 30 year fixed rate mortgage, one percent can mean a $100 per month difference.

That’d cost you an eye-watering extra $36,000 over the course of a thirty year mortgage.

Are the obstacles worth it?

We’ve looked at some obstacles in your path to home ownership. But don’t think it’s impossible.

It’s certainly cheaper in the long run to buy your own home than spend your life renting.

There’s a lot of help out there for first time buyers, and there are ways to get mortgages even with bad credit. Equally, there are strategies for mapping out your future to ensure that your mortgage payment won’t put you into debt.

It all depends on when you want to buy.

Do you have to have that house now?

Or do you want to work on your credit rating for a few years and buy it on more favorable terms?

Let’s look at the options.

First time home buyers have options

If you intend to buy as soon as possible, it’s worth looking at applying for an FHA loan. These are federally-backed loans which include mortgage insurance. This gives your lender peace of mind. They have slightly less stringent lending requirements than just going for a private mortgage, including a low down payment of only 3.5%.

A crucial plus side of FHA loans is that you can be approved with a credit rating as low as 500.

Conventional mortgages don’t tend to go lower than 620 (you would require a bigger deposit with a credit score this low, though). The downside is the same as with standard private mortgages though, the worse your credit score, the higher your interest rate. As with so many financial decisions, it’s a judgement call.

Can you afford it?

How can you make your mortgage cheaper?

The best way to bring the cost of your mortgage down is to put down as large of a down payment as you can. Not only is it the easiest way to reduce the outstanding amount you have to pay, but it’s possible that it will reduce your interest rate as well.

The reason for this is simple.

The higher your down payment, then the more attractive a prospect you are to lenders.

The more attractive you are to lenders, then the more competition between them to sign you up.

The more competition there is, the better the interest rates.

So it really does pay to scrape together as much of a down-payment as you can. Even with bad credit, it will save you money in the long run. It’s much easier negotiating with a mortgage lender if you have a sizable down-payment up your sleeve.

What if you can’t come up with a down payment?

A down payment shouldn’t be the impassable obstacle to owning a home.

If you’re desperate to get on the housing ladder, and you’re absolutely certain that you can afford the mortgage, go for it. But you need to be realistic about how much it’s going to cost you, and look at ways to bring that cost down.

Are you concerned about a high interest rate?

Don’t forget that you can always refinance.

You always have the option of getting a mortgage at a higher interest rate, and refinancing later on. Once you improve your credit score, you’ll be able to get a better interest rate and save yourself some money.

What other options do I have for help?

One option available to those with bad credit is to ask someone else to co-sign the mortgage.

In this scenario you find someone that has a sounder financial footing to sign the mortgage with you. They take on all the obligations of the mortgage (though you pay it) and the lender in turn treats the mortgage as being in the name of the person with better qualifications.

This has a number of advantages for the first time buyer.

You get access to all the perks of a good credit rating, and your mortgage is cheaper.

But there are disadvantages. If you miss a payment it shows on the co-signers credit record too. This is only an arrangement to enter into if you’re confident you’re not going to let your co-signer down.

Should you wait longer?

The waiting game is a strategy which may work out best for you in the long run.

There are many ways to give your credit score a boost. There are no quick fixes, but a few years of sound fiscal prudence should leave you in a position to dictate better terms when you’re dealing with your lender.

Not only can you spend time improving your credit score, but you can use that time to build your down-payment and improve your debt to income ratio by reducing outstanding debts. In particular, reducing your DTI can make that mortgage a more realistic prospect. Maybe take on extra work, or get a part time job on the side.

Whatever you do, a couple of years of taking really good care of your finances can move that home purchase into the realms of reality.

So, to sum it all up

Buying a house is a big deal, but you knew that already. Buying a house with bad credit is an even bigger deal.

It’s riskier and it’s more expensive.

There is no way of avoiding the fact that any form of lending is a more hostile environment if your credit is less than great.

But don’t despair.

Make yourself a plan.

Work out if it’s the right thing for you at this time, or if you want to wait a while and get yourself on a sounder financial footing. If you’re determined to go ahead, explore your options and take all the help that’s available to you.

You can do it!

Leave A Comment