One of our main goals for everyone of our clients is to ensure they have a better understanding of how their credit score is made up. We want you to know what you need to, to ensure that you can keep the score we help you achieve and to keep improving it after your program ends.

Remember we included in your membership completely free to you; a fantastic, easy to use budgeting software. If you have never used one, give it a shot. Many of our employees love this tool. Sign up here and check it out.

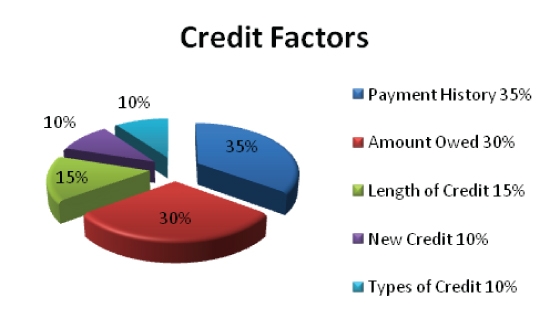

Below we outline how the credit bureaus calculate your scores:

- Payment History = 35%

The figure that most significantly impacts your credit score is the ability for creditors to be able to trust that you will be able to pay back your loans. These are the components you need to consider:

- Are you paying your bills on time every time on every one of the accounts on your credit report

Late payments have an immediate negative impact on your scores. - How late were you if you were late?

30, 60, 90+ days….The later you are the greater the negative impact - Collections, charge offs, debt settlements, bankruptcies, foreclosures, suits, wage attachments, leins or judgements? A major red flag to potential creditors, this shows that you might not pay them back at all.

2. Amounts Owed = 30%

Just behind payment history is how much money you owe. The factors below is how this is determined:

- How much of your balance limits are you using?

Owing a little bit is better than owing nothing at all. Creditors want to see that if you borrow money that you pay it back. Keeping a small balance shows activity on the account which looks better than paying it off completely each month. A good rule to follow is the 30% Rule. Never carry a balance above 30% of your available credit limit, but make at least the minimum payment required but leave a few dollars as a balance so it is reported to the bureaus. - What type of specific accounts do you owe on: mortgage, auto loans, credit cards and installment accounts?

It is favorable to have a good mix of different accounts and being a to responsibly manage them. - What is the total amount owed?

This is one where less is better.

3. Length of Credit History = 15%

Something potential lenders are going to want to know is how long have you been using credit. A long history is good to have, but a short history isn’t necessarily bad either. Just as long as they are not marred with late payments or any other negative items.

4. New Credit Items = 10%

FICO considers the new accounts that you recently opened. Basically the thinking is if you recently applied or opened new accounts you may be at a great risk of not managing them as well.

As a common example, you go to apply for a mortgage, the lenders are wanting to know what your obligations are to make sure you can afford the new loan. Showing a number of new credit cards could be an indication you are planning on using them increasing your monthly payment obligations that could interfere with the mortgage payment.

5. Types of Credit In Use = 10%

The last thing the FICO algorithm looks at is that you have different types of credit accounts. These could be credit cards, store cards, installment and home loans. It also looks at how many account you are carrying. This is a small component of your score so it isn’t necessarily essential that your pay much attention to this area. Don’t open new accounts just so you can increase your mix.

The Bottom Line

In general there are a few things you can do to increase your scores by using the system but the most important things is just to manage your credit responsibly.

Leave A Comment