Credit cards are often difficult for people to manage.

Quite often people misuse them, and this will significantly influence their credit score.

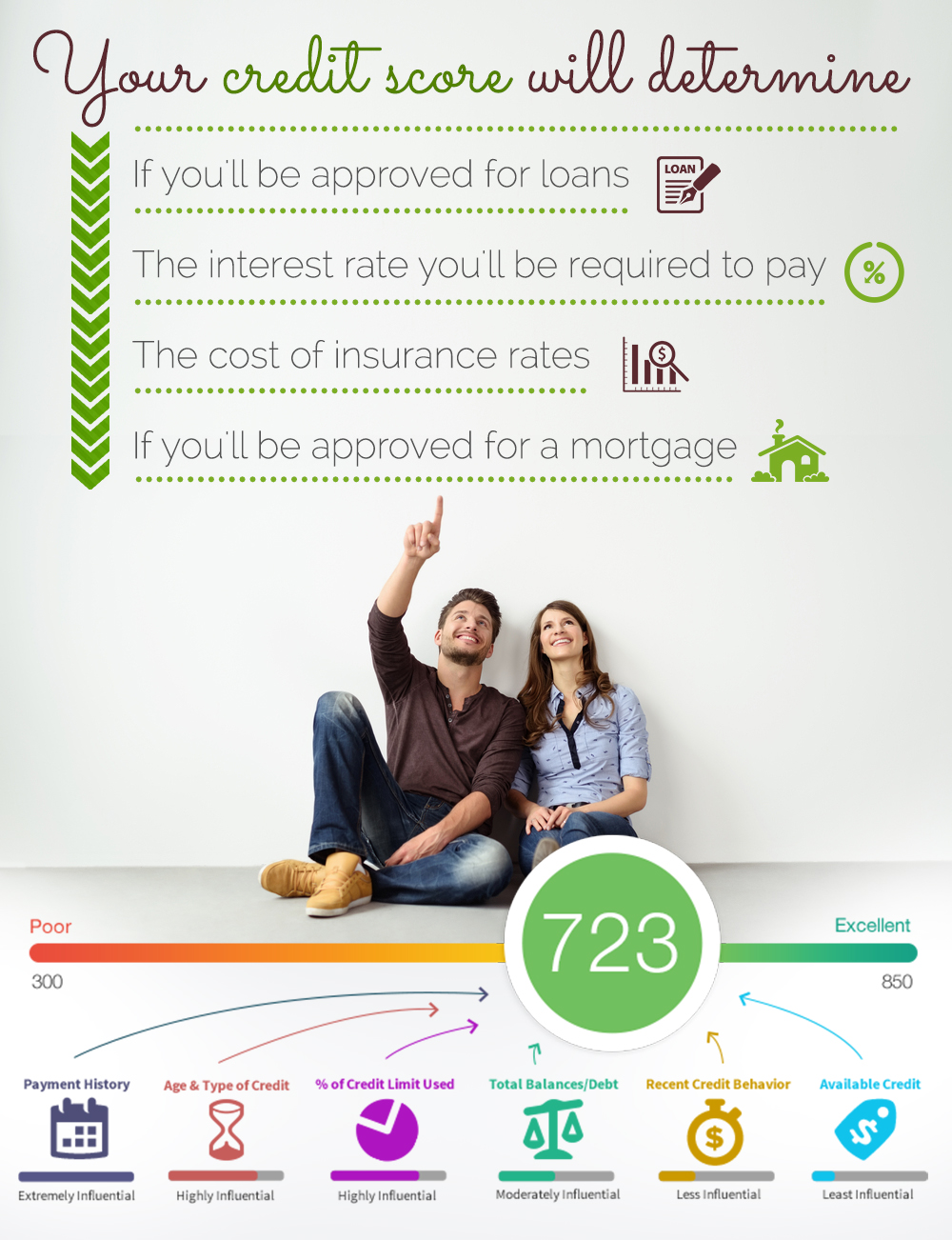

Why should you care about your credit score?

Your credit score is determined by an intricate equation that tells lender how much debt you owe, and how well you pay off your accounts.

Your credit score will let a lender know how much of a risk you are to them, and this will influence their willingness to lend to you.

A credit score of:

- Excellent (750+) means that you are consistently responsible and will most likely be rewarded the lowest rates

- Good (650-750) says that overall you are accountable and will mostly likely make payments on time and keep a small balance on your accounts.

- Fair (600-650) means that there is probably a history of small payments and possibly a default, lenders will most likely refuse any requests for credit.

- Bad/ no credit (600 and lower) means that you have no credit history or that there is significant damage to your credit history. It is, however, possible to build or repair your score.

Your credit score is influenced by these factors:

- On time payments 35%: lenders are mostly interested in your ability to make payments on time and in full

- Capacity used 30%: lenders are next interested in how much you owe

- Credit history 15%: lenders will also want to know how long you’ve had a credit history

- Credit used 10%: lender will look at what credit you currently have in use

- Past applications 10%: lender will also check details of your past applications

There are however many myths and misconceptions, which will affect you, score, these are…

You can build your credit score using a debit card

Credit bureaus do not receive information regarding debit card usage and history, so, therefore, debit cards have no effect on your credit score.

Credit bureaus do receive information regarding credit cards, loans, and bill payments so therefore all these will help build a credit history.

Closing or opening accounts will affect your score

Lenders like to see a long credit history, and when you close an account, it will still appear on your report for years to come.

Opening an account will result in the potential lender opening a hard inquiry on your report, which will affect your score, but not significantly.

However, it is still advisable to avoid opening multiple accounts all at once or opening any accounts when applying for a mortgage.

You are not responsible for accounts you have co-signed to

A co-signer is still legally responsible for any activity that relates to the account.

If the account is in balance and there are no problems, then this will reflect favorable on your score.

However, the other side to this is right.

If there is debt or other difficulties with the account, then this will reflect on your score.

Carrying over your balance is compulsory/ a good thing

A good credit score is dependent on you using your credit responsibly so carrying over your balance will not necessarily improve your score.

If you are spending more than you can afford to pay or are maxing out your credit, then this will affect your score.

However, if you are not using your full balance, and still have at least 70-90% of your credit available, then this will boost your score.

Checking your credit report will negatively affect your score

Checking your credit report will not affect your account as it is a soft inquiry and only hard questions will affect your score.

Multiple accounts are a bad thing

There are certain scenarios where having multiple credits can affect your score.

For example, applying for multiple accounts in a short time frame, applying for more credit than you can afford, or even simply being new and inexperienced with credit.

Lenders like to see you have a high credit availability and a small balance.

If you are responsible, then having multiple accounts can boost your score.

An increase in credit limit is not good for your score

If you can keep your balance and availability low, then accepting an offer from a lender to increase your credit limit can boost your score.

However, if you are likely to max out your cards and are struggling with payments, then accepting an offer to increase your limit will only further negatively affect your score.

It can also affect your score if you request a credit limit as the lender will require a hard inquiry on your report.

A higher income means a higher score

The credit bureau will not have details of your income; therefore, income does not form part of your credit score.

Leave A Comment