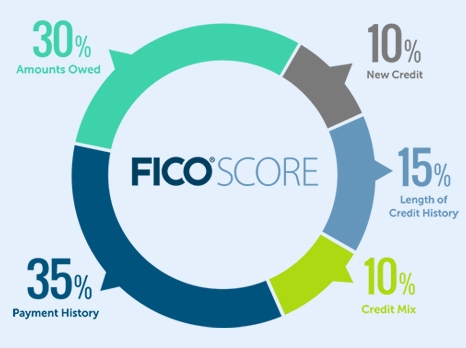

Your credit score is a representation of how well you manage your finances. While there are many factors that contribute to your credit score, your credit utilization ratio counts for nearly one-third of your final score. Your credit score will affect all of your financial endeavors. Whether you want to buy a boat, open a credit card, or even purchase a home, your score will come into play.

How important is my credit utilization ratio?

Very much. Second only to your payment history, your utilization ratio is the next most important factor.

There are five factors considered in your score:

- Payment history

- Credit utilization ratio

- Length of credit history

- New credit

- Credit mix

How can I figure my ratio?

While payment history is fairly straightforward, your credit utilization takes a bit of number crunching. Your ratio is calculated by the sum of your balances, or aggregate debt, divided by the sum of your respective credit limits.

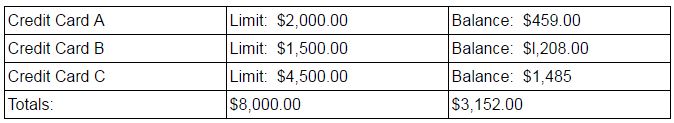

For instance:

Your ratio would be $3,152/$8,000, or 39%. This would be considered slightly high. According to Investopedia, creditors like to see a ratio of 35% or less.

It’s not that simple

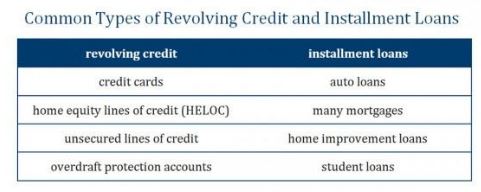

While it’s relatively straightforward to add up your balances and limits, there’s a more complicated formula that takes into account whom you owe money to. In regards to your FICO score, your ratio is determined by weighted balances. Revolving balances carry more weight than installment balances.

Image courtesy of UMB

Revolving balances

Credit and retail cards are the most common form of a revolving balance. Essentially, anything that can fluctuate on a monthly balance falls into this category. Your revolving balances also show a different aspect of credit usage.

For example, if Bob has five open accounts, and all five are credit cards, you could draw the conclusion that Bob lives off credit.

However, if George has five open accounts; one mortgage, one car, two credit cards, and a Home Depot card, you could assume he is much better at credit management.

Revolving balances are weighted heavier in your utilization ratio, and therefore have a larger impact.

Installment balances

An installment balance refers to a larger debt, such as a home or car. Although the balance owed is higher with installment balances, the weight for your utilization ratio is lower. However, they still have a significant impact, as installment balances tend to be much larger.

For instance, let’s say George’s mortgage is for $350,000 on a home he bought last year. Assuming a $1,000 monthly payment, he would now owe $338,000. The ratio for this debt would be 97%.

To get this debt near the ideal 35% range, George would have to pay off an additional $215,500. This is not only unlikely, but unreasonable. This is why installment balances tend to be weighted lower for the utilization calculations.

Make payments more than once per month

You don’t need an exact formula to raise your score. Your ratio is only recalculated when new statements are available, so it’s important to time your payments to reflect positively on your report.

For instance, let’s say you have a $1000 limit on your card, and a zero balance. Then, your car breaks down and needs $800 in repairs. You put it on the card, wait for your statement, and pay it in full. Your true ratio, then, is 0% on this card.

However, when your statement was processed, your ratio was 80%, because you had a balance of $800 at the time it was generated. Therefore, even though you paid in full, your ratio was still affected negatively.

Pay down balances

Paying down balances will lower your ratio, but make sure you’re paying down the right balances.

When paying balances, prioritize them according to which weighs heaviest:

- Pay credit and retail cards first

- Then pay smaller installment debts second

- Finally, pay large installments debts third

- Don’t worry about open debts

However, don’t focus too heavily on reaching a zero balance. Credit scores reflect how well you manage credit and having balances shows you can manage your money well. Try to keep your balances under 30% of your limit, and your score will improve.

Increase your credit limits

This is an easy way to change your ratio quickly and can compound the positive effect of paying off the balance.

Let’s say you have a card with $1,000 limit and a $500 balance. Your ratio is 50%.

You pay $150 towards the balance. Your new ratio is 35%.

Now, let’s say you request a credit increase to $1,500. Without paying a dime, your new ratio is 23%.

Be careful that you don’t request too many increases at one time, as asking for an increase can report as an inquiry, and possibly lower your score.

Finally, remember that raising your score takes time, and that may even be a good thing. The length of good credit history accounts for 15% of your credit score. So, steadily lowering your utilization ratio may be more beneficial than large strides in a short amount of time. And remember, as a consumer, you are allowed one free report per year from each of the three major credit agencies. Pulling your own score does not count as an inquiry, and will only serve to help you make the most of your debt management plan.

Leave A Comment