A good credit score is important for the big things in life, whether it’s a new house, a new car, or an emergency credit card.

We all know the simple ways of boosting our credit scores: pay off your credit card bills on time, don’t spend more than you can pay back, and resolve any existing debt.

But you can give your credit score that extra push in just two simple ways.

Figure Out Which Score You Want to Optimize

A lot of people don’t realize that there are actually hundreds of different types of credit score models out there.

While it may seem confusing at first, it makes sense.

You use your credit scores to do different things: take out a mortgage, apply for a credit card, finance a car, etc.

It’s important for banks and other lending institutions to see your credit history for each type of loan you’ve taken out.

The most popular types of credit score models include:

- FICO 8

- VantageScore 3.0

- Industry-specific scores

- FICO Auto Score

- FICO Bankcard Score

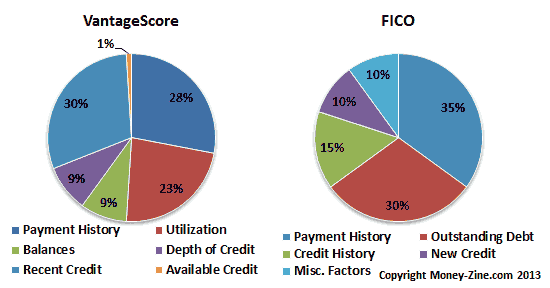

These scores will vary based on several factors, from your credit history to the credit institution’s terms and conditions for late payments.

Your three leading FICO credit scores – through TransUnion, Experian, and Equifax – can vary as well.

It’s possible that you have a different score for each of them.

If you want to take out credit for a new car, take a look at the criteria for the FICO Auto Score.

Then search around for how to improve that individual score, and you’re all set.

Guidelines to Improve All Your Scores

You’re not going to have a perfect credit score for every single type of credit score model that’s out there.

But, if you play your cards right, you can have respectable scores for most of them.

Luckily, lending institutions use many of the same criteria when evaluating your score.

Knowing how to meet those standards is key to improving your score.

Here’s how you can do it:

- Minimize credit utilization. Credit utilization is just a fancy way of saying how much of your credit line you’ve used. If you tend to max out your cards every month and only make small payments, your credit score is going to plummet. What you’ll want to do is determine the maximum percentage of your credit line you can spend in a month. You should be able to pay off this amount each month if you want to improve your score.

Variety is important.

If you want a good credit score, you’ll need to show that you can manage more than one type of credit account.

Most adults of the modern age have several lines of credit, from mortgages to car loans to personal loans.

But be smart – don’t just open accounts for the sake of it.

- Pay attention to your average age of credit. Your average age of credit is the length of time you’ve had all your credit accounts open. It’s meant to show lenders how much experience you have with credit. You can figure out your average age of credit by finding out the ages of all your accounts and averaging them together. You want your average age of credit to be as high as possible. For instance, if you open a new account today, and your other account has been open for three years, your average age of credit drops from three years to one and a half years. This will suggest that you have less experience with credit than you do.

- Don’t close your old accounts. If you pay off a card, leave the account open even if you don’t use it. This will help keep your average age of credit up, as well as contributing to improving your credit score.

Keeping your credit scores where you want them can be a hassle.

But with a little preparation and common sense, you can save yourself from a mountain of debt.

The tricks are simple: know what kind of credit you want, and be careful when spending.

A respectable credit score takes years to build, but only seconds to destroy, so keep that in mind before you sign that credit agreement.

Leave A Comment