Maybe you have a dream of becoming a homeowner within five years.

It’s a hard, but possible goal.

And to many, the most difficult part isn’t finding the right home.

It is affording that down-payment.

Saving up can be a pain, especially if you are paying off loans and debts already.

How do you save without becoming stingy and miserable?

Surely these can inspire you to come up with your own too.

Save, Save, Save!

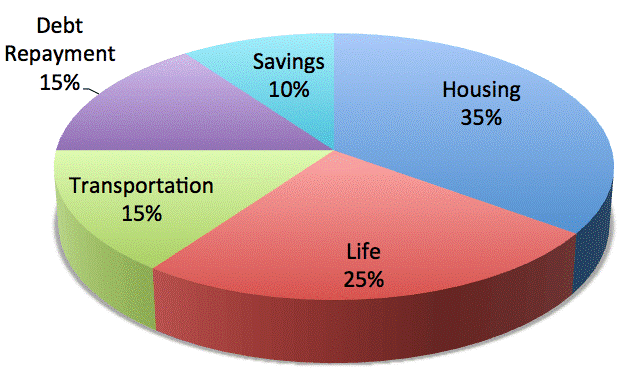

Saving means being a little more organized with your spending.

Write down a budget if you haven’t yet and force yourself to stick to it.

Get rid of the things you want, but don’t necessarily need.

Consider taking the bus, train, or even carpooling for some extra savings.

If you’re tempted to splurge, leave some room in your budget.

If you controlled yourself well, treat yourself at the end of the month.

But only once!

Multiple Streams Of Income

There’s a Chinese proverb: don’t hang yourself on one tree.

Don’t focus on and become stuck to one source of opportunity.

If you have time, try to get a second (or third) source of income.

Maybe you can squeeze in another part time job.

But you don’t have to.

You can consider driving others in your free time.

Try becoming internet famous and score some endorsements.

Use your unique skills and find a freelance job.

The possibilities are endless!

Turn Junk Into Money

One man’s junk is one man’s treasure.

Try selling your old clothes or the collectibles lying around in your room.

Online shopping is such a big thing now.

You can sell on any of the shopping sites, such as eBay or Amazon.

Or you can hold a traditional garage sale for your community.

Not only do you save money, but you can also clean out your house.

It’s preparation for buying your new home too.

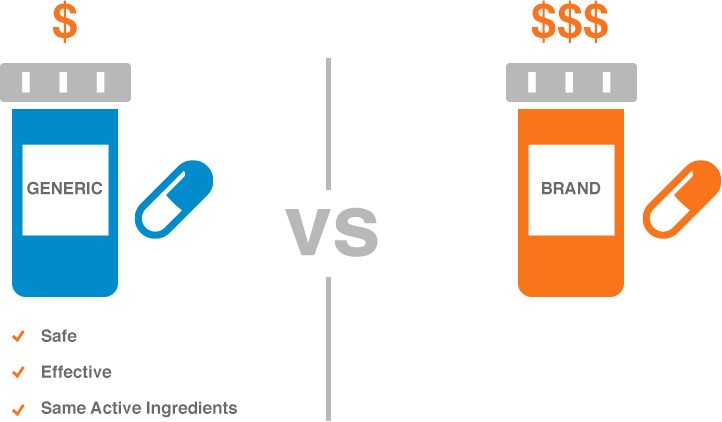

Generic VS Name Brand Debate

Source: basics.ibx.com

Some stick to name brand goods because of their better quality and reputation.

Others say the only difference is the price.

If you are trying to save money, it’s obvious which one you should choose.

(Though for some things, never buy the generic brand. Such as spaghetti sauce. Trust me.)

Save in the grocery store by writing a list before you go. The key point is sticking to it.

Party At My House!

Being on a tight budget doesn’t mean you can’t have a social life.

Buy Quality And Cost Efficient

Make an investment when purchasing essential appliances, such as dishwashers.

It might cost more now to buy a quality one, but you’ll save in the long run.

An energy-efficient washer will save you energy and last many years.

You’ll also save on repair and replacement costs.

Save On Electricity

Replace your incandescent and CFL light bulbs with LED ones.

Source: aadityaled.com

Nowadays, LED is more affordable.

They are also more energy-efficient and last much longer.

When buying LED light bulbs, look at the lumen rating instead of wattage.

Lumen is the measurement of how much light the bulb will emit.

Watts is the measurement of energy used.

Since LED uses less power than others, a lower wattage won’t necessarily mean less brightness.

Know What The Perks And Deals Are

It applies to anything: coupons and clearance, a store closing sale, or even bank accounts!

Take advantage of that.

You might also find a bank with a lower interest rate too.

Here are some other perks:

- Sign up for customer rewards programs

- Use credit cards with reward points

- Take advantage of free trials

- Ask your coworkers about company benefits you might not know about

What To Do With Extra Money

Maybe your grandma still sends you birthday money.

Or you received a surprise bonus at work.

Now you have some cash in your back pocket.

Your first thought might be to blow it on a night out.

But that money would work better in your savings account.

Try setting up automatic deposits into your bank.

If you don’t see it, you’ll be less tempted to get your hands on it.

Don’t Give Up

Some things only work in the long run.

Saving is one of them.

No matter what happens, don’t give up.

And you’ll be one big step closer to saving for that huge down-payment!

Leave A Comment