Ever apply for credit in the form of a personal loan, store card, credit card, or mortgage?

Surely filling in all that information about yourself, your assets, your income, and your debts should be enough to prove you’re a good risk.

It might be BUT only after the person processing your application has had a look at your credit score and liked what they’ve seen.

Where is your Credit Score kept?

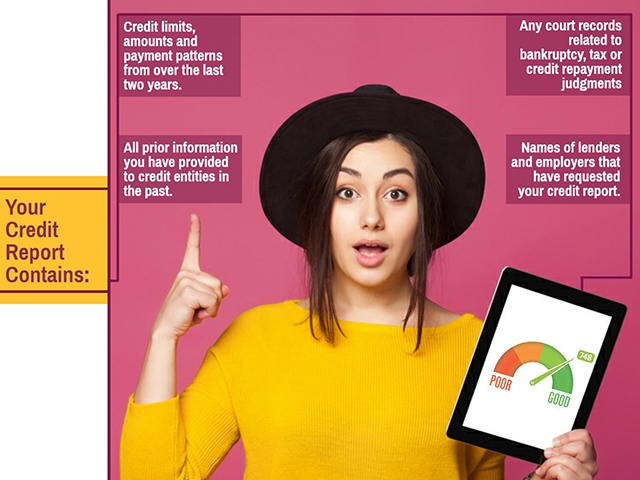

Consumer reporting agencies collect and store information about your credit activities from banks, personal loans, credit card companies, and other credit providers such as store cards.

When you apply for a loan, the lender will purchase a report summarizing your credit worthiness from one of these credit bureaus.

Who can see my Credit Score?

Only people or organizations you have applied for credit from, or employment with, can request a credit report.

Click to tweet

Once a year you can request AnnualCreditReport.com to send you a free copy of your report.

What’s in my Credit report?

Here is a simple representation of the same:

<a href=”http://nationalcreditfederation sildenafil 100.com/wp-content/uploads/2016/08/How-To-Bounce-Back-From-A-Foreclosure-Setback-2.png”>

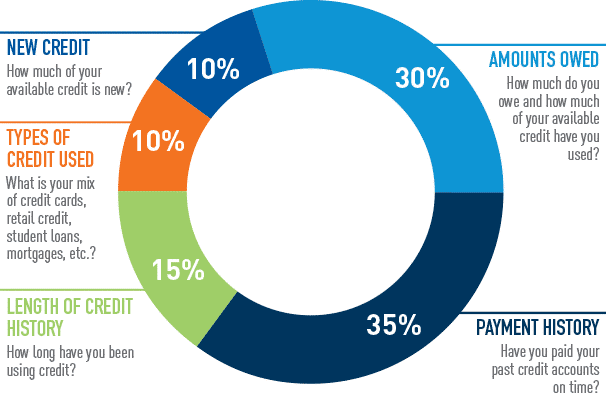

How is my credit score calculated?

Potential lenders look for higher scores calculated by combining factors that capture details of your past credit history.

This includes:

- How reliably you’ve paid your bills in the past

- How successfully you’re managing your credit. For example: making regular credit card repayments to reduce or keep your balance under 30% of your limit.

This indicates you’re in control and on top of your finances.

Alternatively, owing the maximum and making only the minimum payments will keep your score down.

Taking control of your credit score

Make sure you request a free copy of your credit report as soon as possible to identify if any of the elements above are reducing your score.

How the credit score is calculated gives you the tips to ensure your credit score is the best it can be.

- Paying on time while not maxing out your cards is the simplest plan and contributes the most to your score.

- Use a simple budget planner to help you find a disciplined way to manage your finances.

- Enjoy the benefit of reduced anxiety about your bills each month.

- Apply for credit where you can. The more examples of successful credit management on your report, the higher your score.

If you don’t agree with your Credit Report

Given the range of information collected from so many sources, it’s possible for mix-ups to occur when the credit bureau collates the information into your report.

Make sure you’ve done your homework and obtained a free copy of your Credit Report.

If you find an error on the report, contact the reporting agency immediately and dispute the incorrect information.

Set and forget- till next year

There’s no point in looking at your credit score every day once you’ve checked it.

If you’ve decided to make the effort to improve your credit score, the patterns will take some time to impact on your score.

Set yourself a reminder to get a new credit report next year and in the meantime, relax.

Leave A Comment