Every year nearly 18,000,000 Americans experience identity theft.

Identity theft is when someone uses your personal information without your permission. Usually they do this for their own financial or personal benefit. They may be interested in the following information:

- Your name

- Social Security number

- Address

- Credit Card number

- Bank Account information

- Insurance information

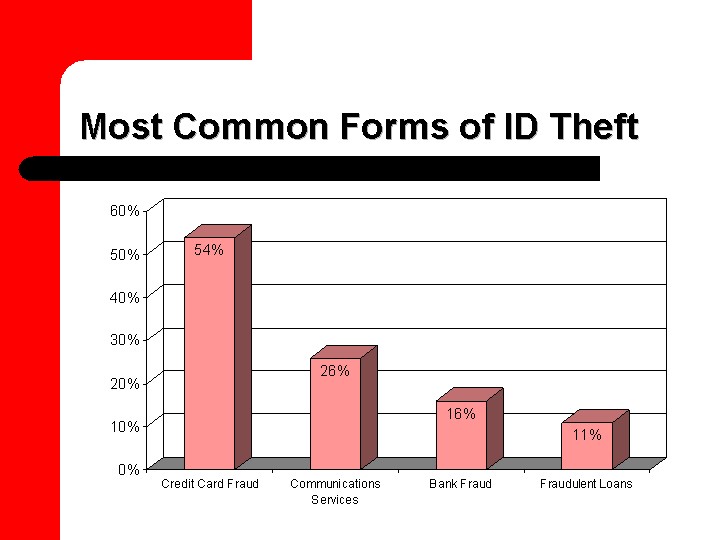

As you can see from the graph below, the most common form of identity theft is credit card fraud.

Often, thieves pretend to be other people and get credit cards in their name. The thief changes the address on the credit card. This ensures that the bills never show up at your house. You’ll never realize that the card is opened, and the bills go unpaid.

In the eyes of a credit card company, this means that you are not paying your credit card bill each month. In return, this will negatively impact your credit score for years to come.

The culprit might also make large purchases, open new accounts, take your tax rebate, or pretend to be you. These things will not only impact your credit score, but they can also impact your driving and criminal record. Therefore, it is extremely important to take a diligent care in dealing with a potential case of identity theft.

How will you be able to tell if you’re a victim of fraud or identity theft? Will there be any signs?

Many cases of identity theft fly by unnoticed until it is too late. The culprit will always take great care to make sure that the victim does not find out about it. So the victim may not find out until their credit is severely damaged.

However, in some cases there are a few telltale signs which should be a clear warning that you may be a victim of identity theft. Any one of these signs should alert you to the fact that there is suspicious activity you should investigate.

If you should see any of the signs, please contact your lenders, insurance providers, banks, or other relevant parties to begin sorting out the issue:

- Unfamiliar charges

- You are not getting your bills

- You are bouncing checks

- IRS lets you know that you have filed multiple tax returns

- You are receiving unfamiliar bills

- You get debt collection calls

- Your credit report is not accurate

Your insurance might give a clue towards identity theft

One of the more obvious signs of identity theft is issues with filing claims with your insurance company. Often times a culprit will use the victim’s information to file insurance claims on their own behalf. That means that when the real person goes to file an insurance claim, they may be notified that their claim is rejected.

It is also common that a victim of identity theft will spot a crack in the culprit’s plan when medical bills are sent to their home address for procedures which they did not undergo. A healthcare provider or insurance company may refuse service to the real person because their medical records now show that they have a condition listed that they don’t actually have, due to the tempering by an identity thief.

Look in the mail for signs that fraud may have occurred

If you keep a close eye on your mail, especially mail that you may think is junk mail, you may spot suspicious bills or other documents which could alert you to potential identity theft. Therefore, it is important to read all of your mail, especially if you are suspicious that your identity or credit card information may be compromised.

So what might you find in your mail that will alert you to identity theft?

You’ll want to be on the lookout for:

- Bills for services which you do not actually receive

- Unfamiliar accounts being billed to your address

- Credit card statements for accounts which you did not open

- Unfamiliar charges on your own credit card statement or bank statement

Debt collection calls can warn you of fraud

If you are getting calls from a debt collector, make absolutely certain that you truly owe the debt.

You may be called about charges which were fraudulently made on your account. These are very dangerous, because debts that are sent to collections are extremely damaging to a credit report.

The bill may not have been yours to begin with. But, it has your name on it. So as soon as you “fail” to pay it, it will wreak havoc on your credit history.

Another sign you may have fallen victim to credit card fraud is when you get a message from your bank saying that your account is flagged due to irregularities or suspicious charges.

This may occur if you are traveling to a new state or you are making bigger purchases than usual, in which case you should let your bank know that there is no cause for concern.

Other times, it is because someone else has been making fraudulent charges to your account.

However, it’s very important to make sure that alerts of potential fraud are legitimate and from your actual bank or lender, and not a phishing scam, which are infamous for using potential cases and warnings of fraud to rope victims in to giving them their personal information. It is always best to call your bank and make sure that the message is actually from them, as opposed to entering your information onto a potentially suspicious page on the web.

Do you know the ways identity theft can impact your credit score?

There are many ways in which identity theft can affect your credit score, including:

- High balances on your accounts

- Late or non existing payments on fraudulently opened accounts

- Increased number of credit inquiries

- Increased number of overall accounts

Your debt-to-credit ratio gets way worse after identity theft

Much of your credit score is made up of your debt to credit ratio. This refers to the amount of credit you are utilizing proportional to your total available credit.

In an instance of identity theft or credit fraud, the balances on your accounts can become very high due to fraudulent charges. That means your debt to credit ratio becomes much higher, causing you to have a lower credit score. This is particularly problematic if the culprit uses your card and maxes it out beyond the limit. This is a major red flag to credit card companies and reporting agencies.

Late payments will have a strong negative impact

A portion of your credit score comes from responsible payment history.

Obviously, if someone opens a credit card in your name, they have no intention of paying the bill. This will appear on your credit history and make it look like you are unable to pay your bills on time.

This makes lenders and landlords less likely to trust you.

Have you noticed a lot of hard inquiries?

A large amount of hard inquiries on your credit history causes your credit score to temporarily go down.

If the person who has stolen your identity is opening multiple new accounts, each of these accounts requires the lender to do a hard credit check into your history. Each time this occurs, it decreases your credit score.

This accumulated effect over many accounts is enough to reduce your score by hundreds of points.

An increase in the total number of accounts will ding your score

Finally, the number of total accounts which are open in your name also impacts your credit score.

If the number of accounts in your name skyrockets, your credit score will plummet.

You’ll need to prove that your identity was stolen, and that these charges are not due to your own financial irresponsibility. If you can do that, credit reporting agencies will fix your credit report and the theft will have no impact on your score.

However, it is not always so easy. Sometimes it can be difficult to prove that the charges are not your own.

Unfortunately, many people try to get out of a tough financial situation by claiming that their own behaviors were actually those of a credit card thief, which makes it hard for people who are actually victims of fraud to be believed.

How can you prevent identity theft from happening to you?

Sometimes, even the most diligent of consumers still get their identities stolen, and ultimately nothing you do will fully protect you. However, there are some steps which anyone can take to be more conscientious of what happens with their information.

The following strategies can help you take care of your financial health and protect you from a lot of stress and damage to your credit history in the future.

Shred all of your mail with any of your information on it before you throw it away

Investing in a quality paper shredder might be the most important thing you do to help protect your financial health in the long term. Shredding all of your paper documents can make sure that no one finds important information such as your credit card account numbers, your address, or any of your insurance information.

Even though many important interactions occur only online these days, sometimes it is easy to forget how much information is contained in papers you get in the mail.

Never throw away important pieces of mail without shredding them first.

How safe are your passwords?

Building a strong password is also very important to make sure your financial information stays safe online. You should make sure not to make your password something obvious.

Don’t use simple things like your pet name, your birthday, any aspect of your Social Security number, or the names of people you know. The best password is completely random, has upper and lower case letters, numbers, and special characters, if allowed.

It is also ideal to make sure you use different passwords for every count. If you need to write them down, that’s OK, but keep the piece of paper in a safe place. Never create a document on your computer and online with your passwords on it, because it is too easy to find and take advantage of.

When was the last time you checked your credit score?

Everyone is entitled by law to a free credit report from each of the three major credit bureaus each year. You should take full advantage of this and check in on your credit score so that you can catch any errors or warning signs relatively quickly.

You should watch out for:

- New accounts you do not recognize

- Overdue bills

- Closed accounts

- New accounts with insurance or medical claims

It’s also important to check out any potential new student loans that may have appeared on your report without your knowledge, as well as accounts with debt collection agencies.

The obvious: Don’t give out your SSN unless absolutely necessary

It is very important to never to share your Social Security number, even with members of your family. This may seem straightforward, but many websites unnecessarily ask for your Social Security number. It is very important to be careful with who you give this number to, especially over the internet. If needed you can always call and ask the website why they need the information, what they plan to do with it, and if you absolutely have to provide it.

Read your credit cards statements!

A lot of people don’t realize they’ve been the victim of identity theft because they don’t actually read their credit card statement every month. To best protect yourself, you should read each statement in detail every month.

It may seem overwhelming, but it is nothing compared to the stress of dealing with credit card fraud.

Be sure to keep track of your bills every month to make sure that no new medical bills or insurance claims have appeared that you did not file. This also goes for utilities bills and any other account you may have.

It is very important not to post your personal information online. Obviously, don’t post pictures of your credit card statements, your bills, or even information about your address in a place where people can publicly access it.

This is especially relevant in the realm of social media, where people routinely post their addresses and locations which makes it easy for fraud to occur.

Set up alerts to notify you when fraud may be taking place

Many credit report agencies allow you to sign up for free for fraud alert services which alert you when they believe credit fraud may be taking place. Most banks already place automatic freezes and alerts on your account when suspicious activity has taken place.

These automatic alerts can protect you in many areas, like monitoring new accounts, new debt collection accounts, and other possibly fraudulent claims. Be sure to always read notifications from credit reporting companies, because they often contain very important information which will protect you from stress and financial damage in the future.

Leave A Comment