Many families decide that the summer is the perfect time to find a new home.

It doesn’t matter if this is the first time you have ever purchased a home, or if you are simply moving to a new location, there are many challenges involved in moving into a new place.

Some of the many things you will need for your new home include:

- Furniture

- Decorations

- Housewares

- Linens

However, buying these items can prove a difficult task.

How in the world are you supposed to be able to finance the furnishing for your new place after putting all your money into a down payment?

Credit cards can provide the simple solution for new homeowners looking to buy what they need from both department and home improvement stores.

Numerous cards come with additional rewards.

When you are unable to pay off the bill before it is due you face the possibility of having to pay interest on the card.

However, you can find a credit card that comes with an introductory no interest time-frame consisting of zero interest for the duration of the promotion.

Make sure that you check your credit score before you apply.

This is because you are going to need a good score if you want to apply for the better quality credit cards available.

If you apply for a credit card with credit that is not so good, you run the risk of having an inquiry on your report only to have been denied the benefits of the card.

When you apply for a new card, make sure that you read the terms and conditions very closely in order to see which card is the one that you want, and the one that fits your needs.

If you have recently purchased a new home, consider the following five cards:

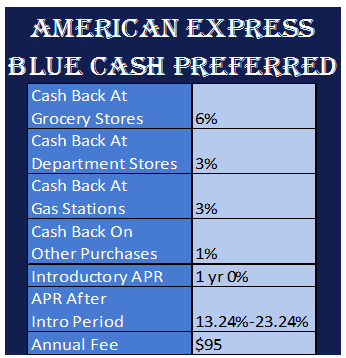

1. American Express Blue Cash Preferred

Strong rewards are not the only thing offered by the Blue Cash Preferred Credit Card by American Express.

This card additionally comes with an introductory financing offer.

This gives new homeowners looking for the best credit cards the ability to receive cash back when they buy the things they need for their new home.

Everyone has to eat. When you buy groceries using this card you have the ability to earn 6 percent of your money back on anything you buy at the grocery store, up to $6,000.

Furthermore, if you need to run to the department store, you can earn up to 3 percent of your money back.

3 percent cash back can also be earned when you put gas in your vehicle and let’s face it, gas prices are high enough that the small percentages will add up.

Anything else you buy allows you to earn up to 1 percent cash back.

When it comes to the dreaded annual percentage rates, they have a good offer as well.

You can earn one year no introductory annual percentage rate if you spend $1,000 in a three-month time span.

Who doesn’t spend $1,000 in three months, anyway?

Once the introductory period has passed, the annual percentage rate does rise.

It goes up somewhere between 13.24 percent and 23.24 percent.

The amount of APR varies based on your credit score.

There is an annual fee associated with this card of $95.

Here is a basic chart in order to show the stats for the Blue Cash Preferred Card.

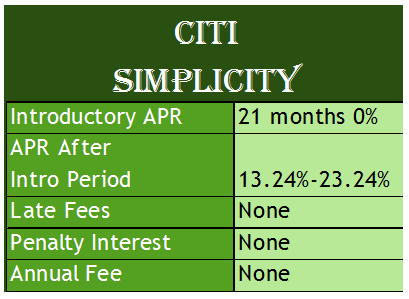

2. Citi Simplicity

If you are looking for a card with an excellent promotional period on financing and uncomplicated terms, the Simplicity card with Citi could be exactly what you need.

The promotional 0 percent financing lasts for twenty-one months which definitely makes it one of the best credit cards new homeowners can choose.

This promotional rate includes balance transfers and purchasing new things for your home.

Once the promotional period ends, the annual percentage rate increases to between 13.24 percent and 23.24 percent.

The amount of APR that you have to pay is going to be based on your credit.

The amazing thing about this card is that users do not have to worry about paying any late fees.

You also do not have to worry about any type of penalty being applied to your interest rate.

Even better, there is no type of annual fee associated with this credit card.

Below are some of the statistics associated with this card.

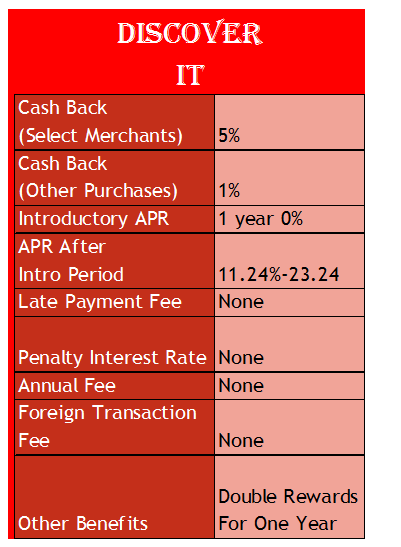

3. Discover It

If you are a new homeowner looking for the best credit cards, you should not neglect to consider the Discover it Credit Card.

This card offers you 5 percent of your money back every quarter, for up to $1,500 of your purchases that fall within certain categories of merchants.

Other purchases can bring in 1 percent of your money back.

From July through September of 2016, Amazon and home improvement stores are two of the categories that are being featured.

This provides new homeowners opportunities to get their money back at the locations in which they are most likely to spend that money.

However, the benefits with this one do not end there.

For the first year of any new account, Discover it will actually match your earned rewards.

This means that the rewards you earn with your card will be doubled for the first year.

This card also comes with an introductory annual percentage rate of 0 percent for the first year you own the card.

This allows you time to pay off the full balance before you have to worry about paying interest on the card, giving you plenty of time to get settled into your new home.

The APR will increase after the first year.

At this point, you will be responsible for paying an interest rate that falls somewhere between 11.24 percent and 23.24 percent.

The total amount of APR that you are responsible for is based on where your credit stands.

Discover it also does not charge you a late fee for the first late payment made. There is no penalty interest rate to worry about with this credit card, either.

Additional bonuses come in the form of no annual or foreign transactions fees.

Below is a simple table to help show the benefits of this card.

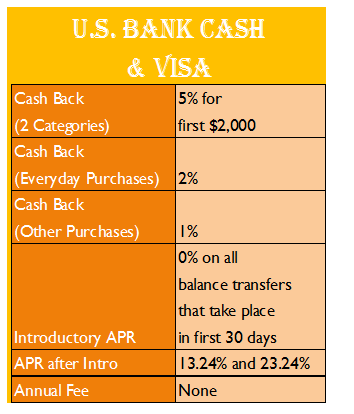

4. S. Bank Cash + Visa

If you are a new homeowner that happens to be seeking an intriguing method to maximize your credit card rewards, the U.S. Bank may be what you need.

They offer an amazing way to ensure that you receive the maximum amount of rewards in return for your spending.

You’ll have the ability to receive 2 percent of your money back on the things that you purchase in order to survive everyday life.

Furthermore, on any other purchase that you make you can get 1 percent of your money back.

When it is the first time you have ever had an account, U.S. bank offers you a one year no interest on any balance transfer that is conducted within the first thirty days that you have held the account.

Based on the amount of credit that you have, the annual percentage rate is somewhere between 13.24 percent and 23.24 percent.

This card comes with no annual fees.

Below is a chart in order to show you the benefits of owning this credit card.

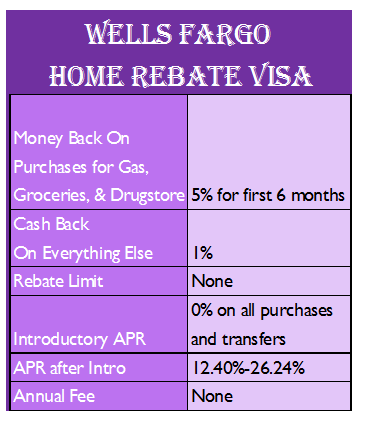

5. Wells Fargo Home Rebate Visa

The Wells Fargo Home Rebate Visa allows new homeowners to put the rewards that they earn toward their mortgage if they have a qualifying Wells Fargo Mortgage.

For the first six months that you own the card, you can earn up to 5 percent of your money back that is spent on purchases in the drugstore, on gas, or on groceries.

Anything else you buy, you can get up to one percent of your money back.

When you have a Wells Fargo Mortgage that qualifies, the money back that you receive is automatically placed toward your home loan each and every time $25 in rebates are earned.

However, homeowners do have the option of requesting a paper check instead.

This card does not limit the number of times that you can get your money back. For fifteen months, you will also enjoy a 0 percent annual percentage rate associated with anything you purchase or any balance transfers you make.

The annual percentage rate once this introductory period has passed is based on the amount of credit that you have and falls somewhere between 12.40 percent and 26.24 percent.

This card does not charge an annual fee.

Below is a chart summarizing these benefits.

Which Card Matches Which Homeowners?

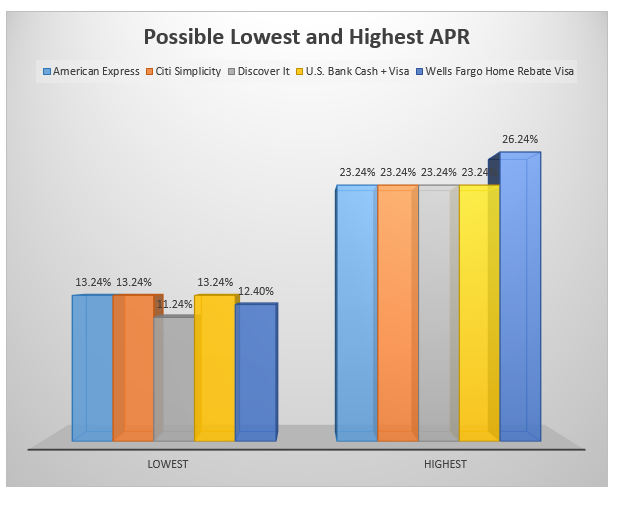

If you are concerned about the annual percentage rate after the introductory period has passed, Discover it has the possibility of being the lowest.

The truth is, however, that you will pay close to the same amount for each unless you have an amazing credit score.

However, the Wells Fargo Home Rebate Card is the only one of the five that has more than a 23.24 interest rate and does not offer the lowest possible rate.

Discover It is more than likely your best bet, depending on your credit range.

If you are a new homeowner searching for the best credit card based on APR, then the first thing you need to do is consider your credit before applying for any of the cards.

The following chart compares the highest and lowest possible rates for each company.

If you are a new homeowner and are looking for the credit card that is best in terms of the duration that new account holders cannot pay interest, Citi Simplicity offers 21 months of interest-free payments.

Of course, if you have a mortgage through Wells Fargo, you may be more interested in their rebate rewards program.

This is because it takes the amount off of your mortgage, meaning that it is help paying off the new home you are furnishing with your credit card.

If you want your credit card to focus more on providing you with excellent rewards, you should seriously consider the U.S. Bank Cash + Visa.

This card provides the cardholder with numerous opportunities in order to earn a percentage of their money back while buying the things they would normally buy anyways.

If you are looking for something that can offer a taste of everything, the Blue Cash Preferred Card is the way to go.

While it does not offer rebates toward your mortgage total, it does offer a little bit of everything else.

This card does not offer the lowest possible interest or the longest introductory rate.

However, it does offer an excellent combination.

This allows new homeowners the opportunity to have a little taste of numerous benefits.

So to recap:

- Lowest Possible Interest – Discover It

- Longest Introductory Period- Citi Simplicity

- Offers Rebates Toward Your Mortgage- Wells Fargo

- Excellent Rewards- U.S. Bank + Cash Visa

- Combination – Blue Cash Preferred Card

Leave A Comment