Every year, it gets easier and easier to open a credit card.

As of 2014, 72% of all consumers in the U.S. had at least one credit card, according to the Census Bureau.

In the age of digital commerce, it is very difficult to get by in the consumer world without using a credit card.

Almost every age group in the country makes use of credit cards.

Credit cards have their fair share of pros and cons.

They are convenient, make our lives a lot simpler, and can help us out of tough spots.

However, they can also have bad implications for your credit score if used incorrectly.

Many consumers are misinformed about the basics of credit cards.

Here are some of the most common credit card myths, debunked.

1. If you pay the balance on time, it’s acceptable to max out your card

Just because you pay your balance in full, it doesn’t mean that you are in the clear.

Maxing out your card multiple times leads to fees and a negative impact on your credit score.

Using a big chunk of your available credit each month impacts your credit utilization ratio, the main determining factor of your credit score.

If you keep all of your credit card balances under 30%, it is ideal.

The average household debt for Americans is steadily on the rise, so keeping your balance low is more important than ever.

2. You get slapped with fees as soon as you surpass the limit

This isn’t necessarily true: some fees are avoidable.

Without tracking your spending, it is relatively easy to go over your limit, and in fact, most banks expect people to do this.

Ask your bank how you can avoid overdraft fees when using your card.

Many times, consumers must actually confirm with the bank that they are intentionally surpassing their limit before a transaction is approved.

3. Credit Cards trap consumers into a circle of endless debt

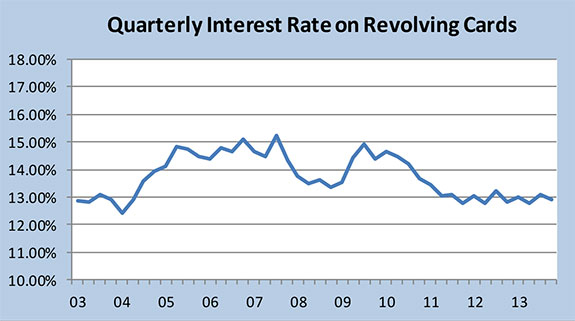

Credit cards are notorious for their high interest rates, and sometimes this can make it difficult for consumers to keep up low balances on their cards.

However, with all the information available on the web, it is becoming easier and easier to make sure you find a card that is right for your own financial situation.

You can plan possible future debt scenarios using useful online tools, and banks often offer free personal credit counseling to those opening cards.

Many credit cards have initial 0% APR offers, which can be taken advantage of if used carefully.

4. Credit Cards are unsafe while traveling

Most cards are actually backed by liability insurance if it is lost or stolen while traveling.

Many banks jump through hoops to ensure that when a purchase is made in a foreign country, it is actually you who is making the transaction.

Credit cards can often be a helpful way of keeping backup plans intact while traveling, and many companies offer travel insurance or trip cancellation insurance.

5. Your initial interest rate is permanent

Depending on your credit utilization and spending trends, you can improve or worsen your initial interest rate on your card.

After your initial 0% APR year has run out, you get kicked back to standard interest rates.

However, cardholders have the right to request changes in interest rates and due dates as well.

The best approach is to call your card company and ask about the possibility of changes to your rates.

Many people do not utilize this possibility to its full potential.

6. Chips are safer than magnetic cards

Not necessarily!

Just because this is a new and touted technology doesn’t mean it is significantly safer than old-fashioned magnetic strip cards.

Don’t let this fool you into a false sense of security, though.

EMV cards were designed to increase security, but they are often vulnerable to hackers, simply because they still usually do not require the entry of a PIN.

They are especially insecure in “card not present” transactions such as online shopping.

Not only does this require your card number, but also a wealth of important personal information, to be entered.

Leave A Comment