Everyone knows that your credit score has a serious impact on everything from your ability to take out a mortgage to the cost of buying a car.

But did you know that, in some cases, it can actually impact your ability to get a job?

It can be surprising how far-reaching the influence of your credit score can be.

Luckily, your credit score doesn’t impact your job prospects in every field.

However, there are some areas, such as financial advising, military, government, and others, where a low credit score can make you less hirable.

Here are six potentially surprising types of jobs where your credit score will have an impact.

1. Accounting

A good credit score is crucial if you want to be hired as an accountant.

The reason for this is that if you are an accountant, the company is trusting you to keep track of their finances, which could make or break the success of the company.

A poor credit score reflects on your personal ability to keep track of your finances.

If you cannot repay debts on time and make other important financial decisions responsibly, it is likely the company will think you cannot manage their finances well either.

2. Military

If you plan to enlist in any branch of the military, be it Army, Navy, Coast Guard, Marines, or Air Force, you should plan on undergoing a credit check at some point.

Some branches are stricter than others, and each branch has their own credit requirements.

Again, recruiters want to see that you have the ability to make responsible decisions, financial or otherwise, for the future.

Planning is essential for any military enlistment.

- In the Air Force, for example, the “40% rule” applies. This means any debts not including deferrable debts like student loans cannot surpass 40% of anticipated military pay. Otherwise, you are not eligible for enlistment. Presumably, this is to ensure enlistees truly want to enlist, not just find an easy way out of debt.

- In the Navy, on the other hand, they consider total debt instead of monthly payments. Debt obligations should not exceed half of annual salary in the future. You can also be disqualified due to a history of writing bad checks.

- The Marines have a different system, where a financial background check is only required if the enlistee needs a dependency waiver. The Army has the same requirement.

3. Politics

It makes a lot of sense that a job in politics requires you to be in excellent financial health.

Again, here the credit score is a reflection of your ability to plan for the future, and that is the whole job of an elected representative.

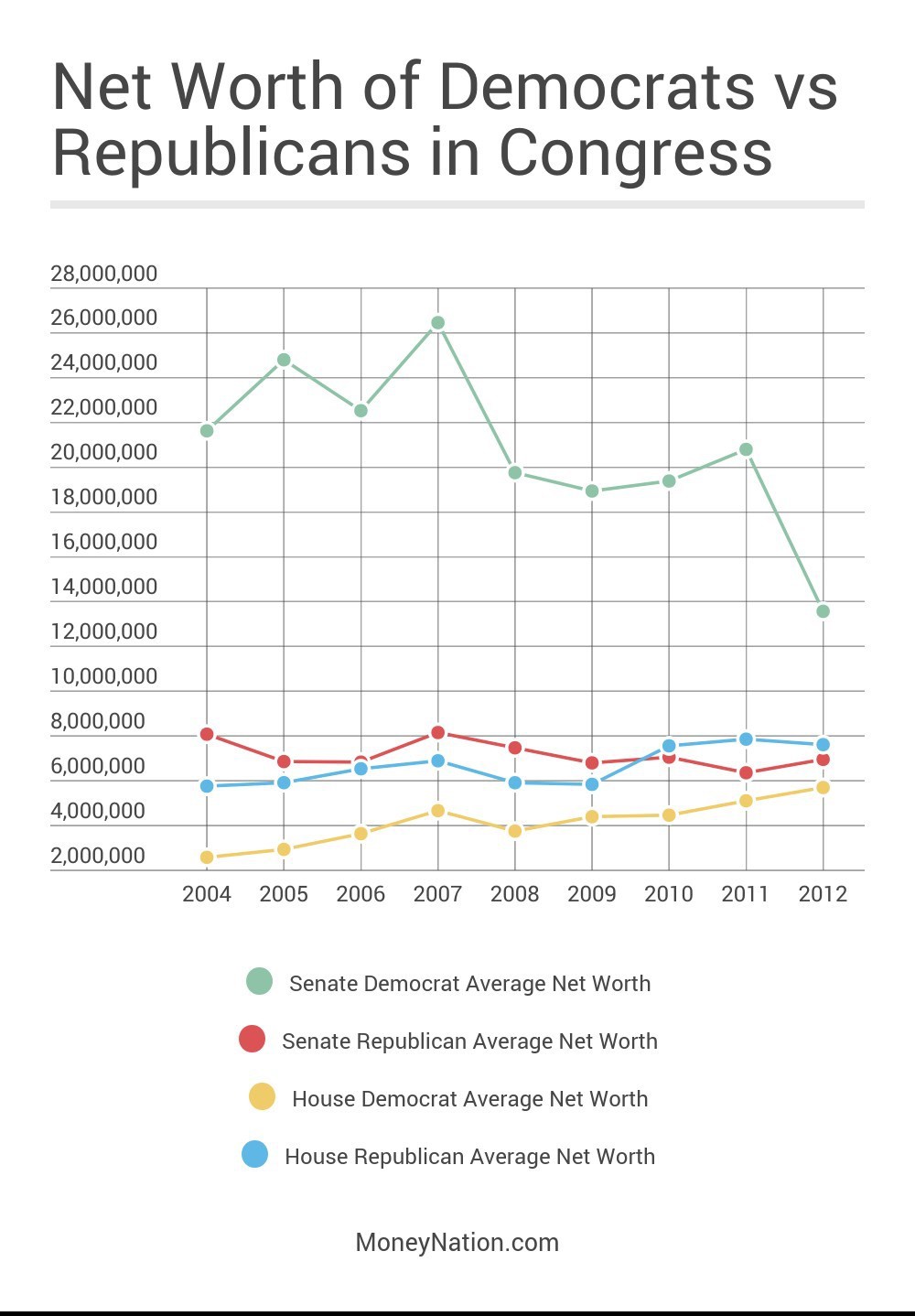

You can see by the chart below that members of Congress have an exceptionally high net worth compared to the general population.

This makes them at risk for mismanagement of such a high salary.

If it is known to the public that you have a poor credit history, it is pretty unlikely that anyone would be willing to elect you.

For example, Marco Rubio experienced some serious trouble in recent elections after his financial background was scrutinized in detail.

4. Security

Although not all jobs in the security field require credit checks, many still do.

So it is better to expect that you will have to undergo one, rather than be unprepared.

Most security firms do this in order to evaluate the integrity of the applicant.

They want to be sure that you don’t have a poor credit history so that you will not be likely to accept bribes or engage in other criminal activities for monetary gain.

One famous example is the TSA, which performs credit checks on all employees on a regular basis.

They want to be sure the applicant is trustworthy and reliable, an area where a credit check is often a good indicator.

5. Government

Similar to security, not all government jobs require credit checks.

However, many do.

Some examples include jobs in transportation, the Internal Revenue Service, and others.

There is no blanket policy regarding debt, but many employers for the government believe those with poor credit are more likely to steal or accept bribes, something the government is clearly hoping to avoid.

Government workers often have to jump through many different hoops to get hired due to security and safety purposes.

6. Financial Professionals

This is the most obvious area where a credit check makes the most sense as part of the hiring process.

If you are in charge of advising others on their finances, you certainly need to get your own finances in check first!

Here, a poor credit score doesn’t just reflect on reliability and trustworthiness, but your actual ability to carry out the responsibilities of the job in a reasonable way.

Organizations usually perform credit checks on employees throughout different levels of management as well as lower level employees.

Leadership positions have more stringent rules, usually with the expectations that management will have extremely excellent financial history.

Whether you are hoping to be a banker, a stockbroker, a financial adviser, or otherwise, expect potential employers to dig deep into your financial background.

Unfortunately, there are millions of jobs waiting to be filled in America, but a poor credit check result can disqualify otherwise perfect candidates for jobs.

Improving your credit score can be hard, but luckily there are plenty of resources for helping to get on the right track, improving your score and helping you in your job hunt.

Leave A Comment