Ever ask yourself: Do student loans affect credit score?

It’s an important question to ask.

If you’ve got student loans, you’ll want to know what impact they have on your FICO score and how they’ll affect your life moving forward.

I’m doing this, of course, because student loans is a hot topic.

According to the Wall Street Journal more than 3,000 people a day default on their student loans…

That’s more than 1,000,000 people in default.

That’s a big number.

And it’s only growing.

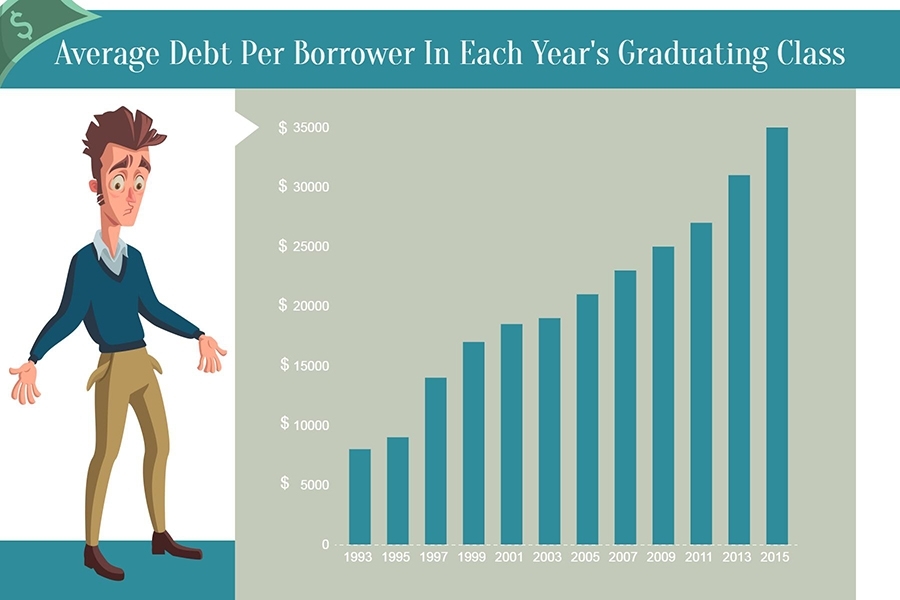

Check out this graph on the amount of debt the average student has upon graduating.

This means one thing. People are graduating with an insane amount of debt.

And it’s no wonder they are defaulting.

According to this, the average student has more than $35,000 in debt before they even have their first job.

That’s a payment of $300-$400 a month.

That’s a big expense when you are just starting out.

Imagine graduating college, looking for a job, and having to make that payment.

How can you make investments?

How can you save any money?

Many can’t buy a house because of student loans.

They remain stuck in an apartment or moving back in with their parents.

That’s one of the reasons home ownership is the lowest it’s been in 60 years…

Here are 5 ways college loans will affect your credit score.

1. Student Loans Usually Start Your Credit Profile

In 2009 congress passed the Credit CARD Act.

This put the brakes on credit card use for college students.

Anyone under 21 years olds cannot get a credit card unless they have an adult co-signer OR unless they can prove they have sufficient income to cover bills.

What does this mean?

Well when you go to college, you’re likely to borrow money from the federal government to pay for that education.

They give you money in the form of a student loan.

When do student loans show up on credit report profiles?

Immediately upon issuing your student loan, you now are in debt to Uncle Sam.

And the government tracks it and reports it to the 3 credit bureaus:

- Experian

- Equifax

- TransUnion

Your credit profile is opened and you’re issued a numerical score called a FICO score.

A student loan “tradeline” will be placed on your credit profile in the form of an installment loan.

So for many, this is the first financial activity tracked.

Sponsored Ad

2. The “Amounts Owed” Portion Of Your Credit Score Is Impacted

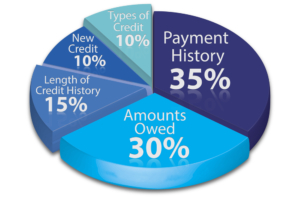

Your FICO profile is broken down including the 5 areas with the weight associated with each:

The amounts owed portion holds a weight of 30% of your overall credit score.

When you borrow money your score typically falls immediately.

The reason for this is you’ve taken on new debt and there is no payment history.

So lenders don’t know whether or not you have the ability to pay on that loan until you prove it by making timely payments.

There’s no history.

Let’s say you graduate college with $35,000 in student loans without ever making a payment.

After your grace period, the lender requires payments to start.

That whole time your in college accumulating debt, it’s adding the amounts owed factor of your credit profile, which you cannot be rewarded for until you payoff.

Adding in a credit card in early college years and paying every month and help offset this.

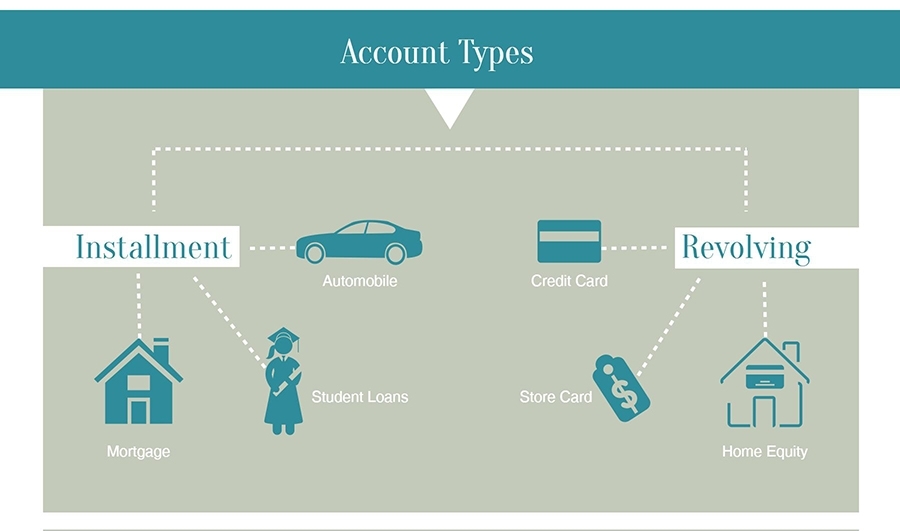

3. Student Loans Add To The Mix Of Tradelines

Your FICO score uses the different types of debt to make up your score.

You’ll want to have a healthy mix of:

- Revolving Accounts (credit cards, home equity lines of credit)

- Installment Accounts (mortgages, auto loans, student loans, home equity loans)

While every type of debt can fall into one of these account types, each has a different impact on your score.

For instance, mortgages have a different impact than student loans even though they are both installment accounts.

Finding the right mix to get the best scores can be tough.

As a rule of thumb, it’s best to have 3-5 revolving accounts and two installment loans in your credit profile, not including your mortgage.

Here’s a good example of a healthy mix:

- VISA – $1,500 Limit

- Mortgage – $150,000

- Discover – $750 Limit

- Student Loans – $30,000

- Macy’s Store Card – $1,000

- Auto Loan – $15,000

You’ll want to consider is the minimum payment required on these cards.

If you’re making $30,000 a year that’s $2,500 a month.

So between your mortgage, gas, electric, food, auto, $2,500 a month gets eaten up pretty quick.

Managing this every month is important.

It shows lenders you can handle a wide variety of debt and your student loan payment is part of that mix.

4. Missing A Payment On Your Student Loans Will Affect Your Credit Score.

This is called defaulting on your loan.

It’s impact on your credit score is substantial.

Often times, many people think they can make up their payment the following month or down the road and it won’t affect their credit score.

The truth is, every time you’re 30 days late on a payment, your student loan servicer will notify the credit bureaus.

Missing just one payment can cause a good credit score to drop 100 points.

That’s a big drop.

If you are 120 days late, they could send your account into collections.

If you’re in default of your student loans, there’s a great article from our friends at The US Student Loan Center titled how to get student loans out of default.

I encourage you to check it out.

Again, your credit score has 5 parts to it:

- Payment History 35%

- Amounts Owed 30%

- Length of Credit History 15%

- Credit Mix 10%

- New Credit 10%

When you default on your student loans, it affects #1 and #2.

When you miss a payment on your student loans, your payment history is affected.

Because you typically have limited credit history at this point, it has a major impact.

It shows lenders you are having a tough time handling your debt.

You now become a “lending risk” in their eyes.

Another thing to watch out for are fees for missing payments.

Your student loan servicers can attach fees for late pays which will increase the amount owed portion of you credit profile.

It’s a nasty double whammy.

Before you make the decision to miss a payment on your student loans, consider the lasting affects it has on your credit profile.

A late payment can affect your credit for years and you’ll pay via higher interest charges over time.

That, right there, is the #1 way student loans will affect your credit profile.

5. Uncle Sam Won’t Play Nice If You’re Not Careful

First things first: The department of education is a collection agency.

Not in the traditional form, but they collect.

And they are vicious.

The Department of Education can sue student loan borrowers in an effort to collect.

And there’s no statute of limitations, meaning they can collect forever…

They can also use whatever assets you have to ensure repayment.

This includes:

- Garnishing your wages

- Seizing your bank accounts

- Taking possession of valuables

- Placing a lien on your home.

Should this happen, not only are you in collections, but you can have a judgement place on you, resulting in a public record.

So here’s the full picture:

- Your credit history shows non payment

- You increase the amounts owed part of your credit profile because of fees and interest

- Your wages are garnished (meaning your employer pays 15% of your check to the government. You never even see it)

- You have a collection account placed on your credit

- You have a public record in the form of a judgement on your credit

That can ruin your credit score for more than a decade.

Conclusion

Student loan debt is out of control.

It’s a bubble destined to burst sometime in the future.

Over 1 Trillion in debt and millions of people in default.

It’s not pretty.

If you have student loans, you’ll want to understand everything detailed out here.

I get the fact most people are living their life and don’t stop to consider the consequences of borrowing money.

But after graduating, that bill comes due.

And when it does, the way you handle your student loan payment will affect your credit score in a big way.

The impact it has up to you:

Can’t get a mortgage because of student loans?

Can’t rent an apartment?

Stuck living at home even though you’ve got a 4 year degree?

Make sure you don’t fall into the student loan trap so many others do. Consider your options, be smart about your finances, and pay them off as soon as possible.

Leave A Comment