Every year, hundreds of thousands of people become the victims of credit card fraud. This can be an extremely terrifying situation. And to make matters worse, the financial damage it causes can last for years. This means your credit score could take serious time to rebuild. Luckily, there are some steps you can take to prevent this. Below are 5 tips to avoid credit card fraud.

Credit Card Fraud

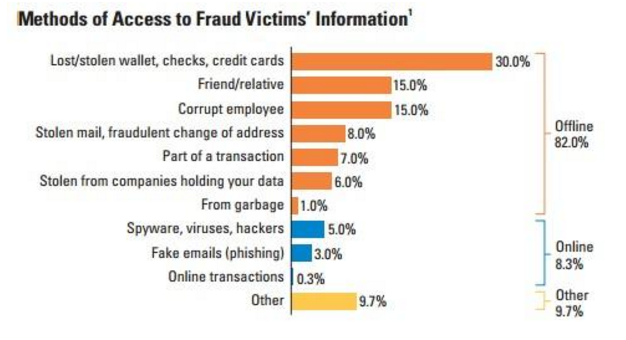

Credit card fraud costs people hundreds of millions of dollars every year. Theft is the most popular way fraudsters obtain your details, but it isn’t the only way.

Source: http://www.myfico.com/downloads/files/myfico_idtheft_booklet.pdf

Fraudsters have many methods to get your credit card details which can vary from stealing your cards to digging through your trash.

- 30% of all fraud is committed via theft or misplaced information

- The next two popular methods of fraud are committed via a friend/ family member and a corrupt employee (15% each)

- 82% of information is obtained offline

- The most popular online fraud is committed via spyware, viruses, and hackers (5%)

Source: http://www.livemint.com/Money/f6EdcYMmXAsy1dkWdkoF1J/Are-you-a-credit-card-fraud-victim.html

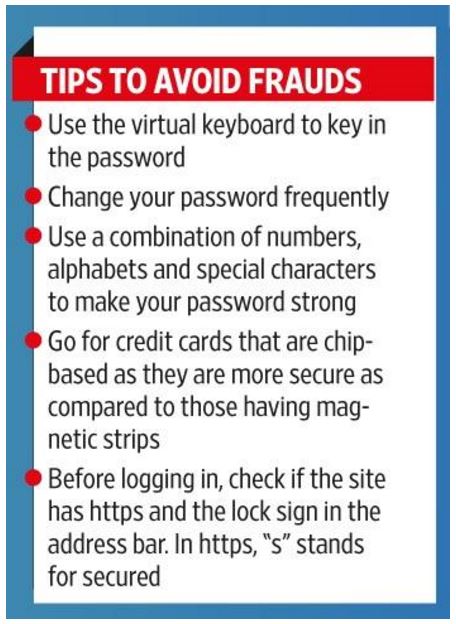

You may not be able to completely stop fraud from happening to you, but there are steps you can take to protect yourself.

Keep your account and personal details private

It is important that you protect vital information. Do not share account and personal details with people that do not have a valid reason for having them. This includes friends and relatives. It is also important to be vigilant and mindful of who can see and overhear your details. Be careful when accessing your accounts in public. Protect your card and pin number when using an ATM, and never conduct financial transactions (including online banking) from public and unsecured networks.

Keep a record your personal and financial details in a secure place or electronic document. Ensure this document holds either all important details (such as account numbers, contact information for fraud, social security number) and keep this information locked up or password protected.

Be wary of giving your details or cards over to people who you are unsure about their identity and how they will use your information. If you are not confident about the credibility of someone, then always contact the organization they claim to be from to ensure they are who they say they are. Communicate with the organization yourself using a number you are sure is correct.

Be extra careful about the information that you share via social media. Anyone can potentially obtain this information.

Keep your cards secure

If you are sure you won’t be needing your credit card, leave it at home.

Do not leave your cards unattended in stores or restaurants, and carefully watch what store clerks and waiters do with your card. If you are signing for your card, ensure that staff is checking your signature against the signature on your card. If your card and the store/restaurant have the capability always opt to pay for items via EMV chip as this carried extra security.

Keep an eye on your accounts and credit report

It is good practice to get into the habit of regularly checking your bank accounts, credit statements, and credit report. Make sure that your receipts and account statements tally up.

You should also check your credit reports regularly as this would alert you to any new accounts that have been opened/ attempted to be opened in your name. If you notice any suspicious activity, you can order a security freeze onto your accounts.

Destroy information that is no longer needed/ relevant

If you no longer require a document or a card, then shred them immediately. To open or reopen an account all fraudsters will need to know are your social security number, your birthday, and a current/ old account number or card.

Report any lost or stolen cards and suspicious or unexpected activity

It is vital that you report everything to the appropriate people.

If your cards are stolen or lost, then you need to contact your card-issuing bank or company as soon as possible. Until a card is reported, you may be liable for any spending that occurs.

You should also report any suspicious or unexpected activity that you notice either on your balance statement or credit report.

Conclusion

It is important that you try to protect yourself as much as possible when it comes to credit card fraud.

You should make sure that you:

- protect your personal and financial information

- protect your cards

- keep an eye on your accounts and credit report

- destroy information that is no longer needed

- report lost or stolen cards and suspicious activity

Although it is impossible to completely prevent yourself becoming a victim of fraud, these steps can reduce the likelihood of it happening.

Leave A Comment