It is important that you build and maintain a good credit score.

We all know that a bad credit score will put lenders off from lending to you, but what exactly is a good credit score?

So what qualifies as a “Good Credit Score”?

A credit score is a three digit number; you credit score is calculated using a mathematical algorithm.

Your credit score is what credit lenders use to determine how much of a risk a potential borrower is.

The most popular credit score model is the FICO credit score designed by Fair, Isaac, and Company. Approximately 90% of all financial institutions in the US use the FICO model.

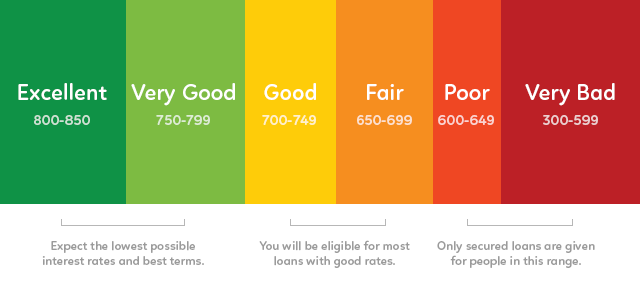

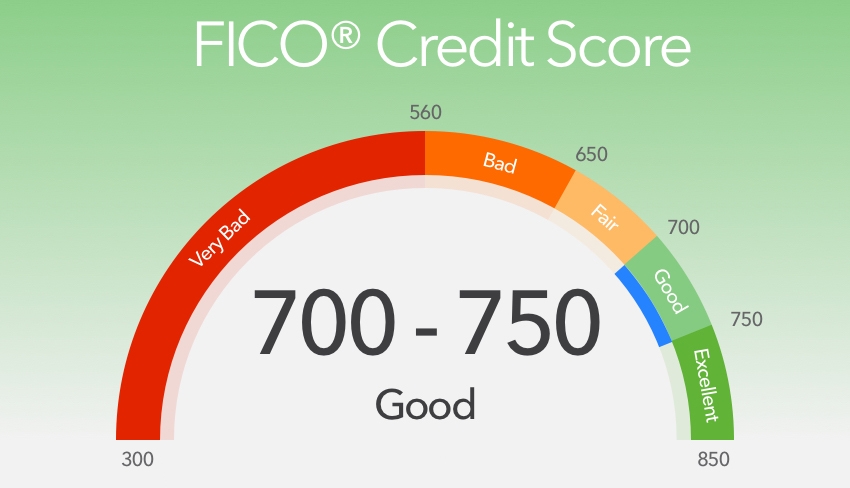

A good credit score is mostly dependent on the model that you are following, the FICO model has a range between 300 and 850.

Ideally, with the FICO model you would want to have a score of at least 700.

Credit Score Models:

- Fico: 300-850

- VantageScore 3.0: 280-850

- TransRisk Score: 100-900

- Vantage Score 1.0& 2.0: 501-990

All of these credit models work on the basis that the higher your score, the less risk you are to creditors.

If you want to get the best offer, you want to ensure that you score as high as possible to the maximum score for each model.

How is my credit score worked out?

Experian, TransUnion, and Equifax are the three credit bureaus that operate in the US.

These credit bureaus are responsible for collecting financial information about an individual to determine how trustworthy they are.

The information they collect includes the amount you owe, the amount you have borrowed, and how efficient you are at making payments.

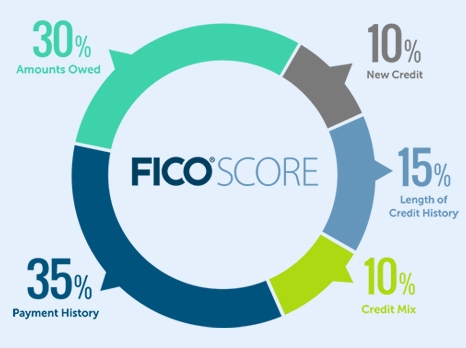

The FICO model calculates your risk by taking into account:

- Length of Credit History

- Payment History

- New Credit

- Amounts Owed

- Types of Credit

The FICO model concentrates the most on your payment history (35%) and the least on the amount of new credit and types of credit (both 10%).

Your credit score will be negatively affected by:

- Late payments,

- a significant accumulation of debt,

- the volume and a quick a succession of new accounts, and

- negative public records

What does my credit score impact?

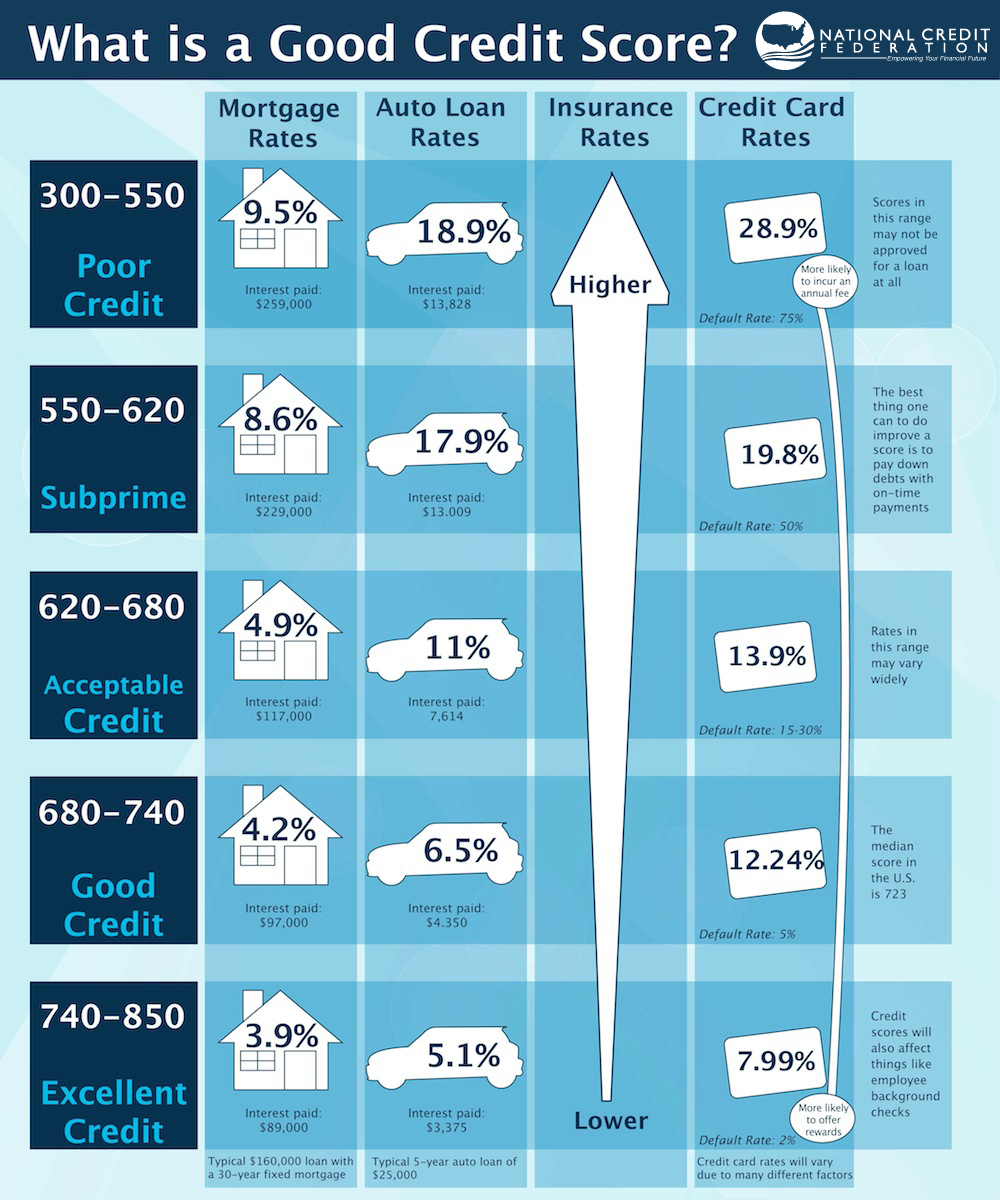

Your credit score will affect if you are approved for, and the amount of interest you will pay on, credit cards, mortgages, cars, and other loans.

The higher your score, the more likely you are of being approved for credit, and the lower the interest rate you will be required to pay.

If you have a low score, you will receive higher interest rates, or you run the risk of being refused credit if it is extremely low.

How can I improve my credit score?

It is important that you keep your credit score as high as possible; there are many steps you can take to build, improve, or repair your credit score.

If you struggle to control your finances, then you will most likely struggle to keep on top of your credit score.

We suggest you create and maintain a budget, balance your checkbooks, avoid overdrafts, and build a safety net in the way of savings and / emergency funds.

If you have not had a credit card before, it is ideal that you look for credit cards specifically aimed at first-time card holders.

There are several types of cards available on the market including student cards, secured credit cards, and retail credit cards.

Once you are more confident with credit cards and managing your finances, you can then start exploring further credit options.

It is imperative that you continue to stay on top of payments, and you only borrow what you can afford to pay back.

The basics of good credit habits are:

- Budgeting

- Spending and

- On time payments

The key to improving and maintaining your score is only borrowing what you can afford and ensuring you pay your bills on time and in full.

Conclusion

- Your credit score is a calculation which lets credit lenders know if you are a low or high risk.

- The higher your credit score, the lower of a risk you are.

- Most financial institutions in the US follow the FICO model, which has a credit range of 300 to 850.

- Ideally, you would aim for a score of at least 700.

- Your credit score is determined from information collected by credit bureaus.

- Credit bureaus are interested in payment history, who you owe, and how much you owe.

- A low credit score will mean that you will face higher interest rates, or be declined credit altogether.

- There are steps you can take to build, improve, or maintain your credit score. These include making payments on time and in full and ensuring you do not borrow more than you can afford.

If you’d like to speak with someone about your credit, and how it may be impacting you financially, reach out to one of our credit consultants here.

We’re located in Tampa, Fl and have helped over 25,000 people nationwide restore their credit.

Leave A Comment