Many young people hold a stigma against credit cards, under the assumption that they will get into too much debt.

However, there are plenty of viable credit card options for young people who want to build up their credit history in a healthy way.

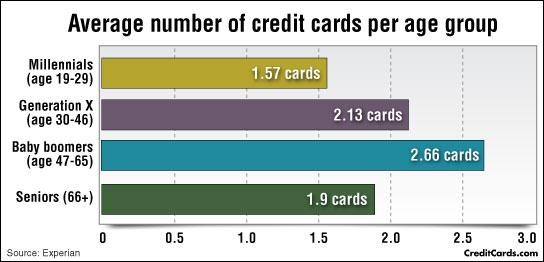

As you can see from the graph below, millennials are currently the least likely age group to use a credit card:

Ever wondered about opening a credit card but been too nervous?

Read on for the top 3 credit cards for first time applicants which will help to help smooth out the process for you.

Don’t give up if you are rejected from your first loan application, as this is common for first time applicants.

In the beginning you may have to settle for a card with low annual fees and not that many benefits so that you can build up your credit history.

After you build up your credit history with these starter cards, you’ll be more likely to be approved for better cards with more benefits.

It doesn’t hurt to make sure you know you credit score before you apply for a credit card.

You have three free yearly credit reports, so use them wisely!

Chase Freedom

The Chase Freedom card has a few real benefits for first-time credit card users.

It starts you out with a helpful 0% APR, which means you do not pay any interest on your use of the card for the entire first year you have it.

Don’t take this as an invitation to wrack up a ton of debt though.

You won’t have to worry about extra fees, but your credit score will take into account your debt-to-credit ratio!

The card also offers free balance transfers for the whole first fifteen months.

This will help you consolidate debt into one credit account if you need.

A major benefit of this card is that once you establish a good credit history with the Chase Freedom card, you can start applying to their more elite cards with more benefits, like Sapphire Preferred or Ink Bold.

Bank of America Student Platinum Visa

The Bank of America Student Platinum Visa is an excellent choice for college students (this was actually my first credit card ever, and I still use it after 12 years!)

The card allows cosigners, which many young adults may need to start an account if they do not have any credit history.

It also includes a useful credit education package, with lessons on how to wisely manage your credit and understand the exciting process.

It takes your part time and summer jobs into account when determining if you are credit worthy or not, so you don’t have to worry if you have never held a full-time job before applying.

The interest rate is usually around 14%, with the average credit limit at a tad over $1000.

This is ideal for building up credit through paying off big purchases or car and rent payments.

Capital One Journey Student Rewards

Capital One Journey Student Rewards is also a great starter card because it has a high cash back rewards points systems, giving a 25% bonus to what is paid back on time.

However, it has a high-interest rate of nearly 20% and a low starting credit limit around $500.

But, the more you use the card, the lower you can get your interest, and the higher the limit.

Some other popular options for student cards include:

● Barclaycard Rewards Mastercard

● Savings Secured Visa Premium Platinum Card

● Citi Dividend Platinum Select Visa Card for College Students

● Citi Forward

● Discover Student More

● Discover Student Open Road

● Target Red Card

No matter which card you choose, it is essential that you educate yourself on the credit process.

It is also important to understand the credit to debt ratio, so you can make sure not to over spend, and try your best to manage your money wisely.

Millennials avoid credit cards for fear of debt, but as long as you are well-informed, plan your budget well, and monitor your spending, you will be able to get significant benefits from your card!

Leave A Comment