Many potential first time home buyers are unaware of the risks and mistakes that the real estate market is awash within the U.S.

There are commonly held misconceptions that even experienced property buyers make too.

Detailing the financial mistakes that are possible to make requires a further breakdown of potential missteps:

- Bigger house prices are usually linked to higher utilities which must also be factored into the budget.

- Mortgage lenders sometimes approve loan applicants for a larger amount than they can reasonably afford. It is wise for the borrower not to be tempted by this and to stay focused on the repayment amount that will be comfortably accommodated.

- Shopping around online or talking to an experienced broker when searching for information on various loan products is essential. This will advise the buyer on the differences between adjustable and fixed rate. An expert opinion may be needed to gauge the borrower’s income as to whether a fast 15-year debt payoff is a realistic loan choice with the reflecting higher monthly mortgage commitment.

- Home inspections are extremely necessary for peace of mind but are not a fundamental requirement. This is a step that cannot be rushed through. Some of the problems that can exist in an unknown house are electrical wiring fails; plumbing problems; roof repairs and subsidence in the foundations. Once the deal has been closed – there is no legal recourse and repairs must be paid for by the new owners.

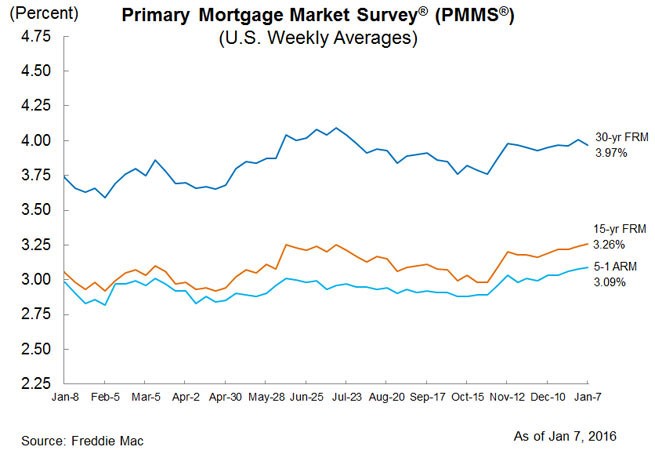

- Mortgage lenders want all the business they can get – and it is worth shopping around for the best deal. There is a considerable range in bank lending rates and closing costs. Down payment percentages, personal mortgage insurance, and possible prepayment penalties differ in costs across lending institutions as well. Below is printed a chart displaying the average primary mortgage rates in America at the beginning of the year. Checking current rates at many banks nearby is easy.

Moving on to the mistakes that can be made by any home buyer, not just inexperienced ones, can include:

- The inability to think outside the parameters of the stipulated home search.

- Not familiarizing oneself completely with the potential desired property

- Relying solely on advertising for realtor referrals and recommendations

Not thinking outside the set parameters when house searching can limit the buyer’s choice of neighborhood, price range, and city.

A commute to work linked to a high resale home value is better than a short drive distance and a lower resell estimate.

Not visiting the house one is contemplating to buy on multiple occasions is an omission frequently made by buyers.

It is recommended that the property is visited a minimum of three times before submitting an offer.

This is not a time to be rushed into a rash offer encouraged by eager sellers, realtors, or family members.

A considered and judgmental decision must be made after much thought and deliberation.

Some recommendations contained in this regard are:

- Drive out unannounced and check the noise levels both at day and at night times.

- Look at schools, amenities, neighborhood watch, patrols and activities online and in person.

- Ask to enter the house and run the taps, flush the toilets, turn on the lights and look for damp, to give one an idea of what the house inspections might reveal.

Realtors have a strong incentive to bombard potential home buyers with an aggressively active advertising presence.

This is the agent’s bread and butter, and in effect, you are vicariously paying their salary.

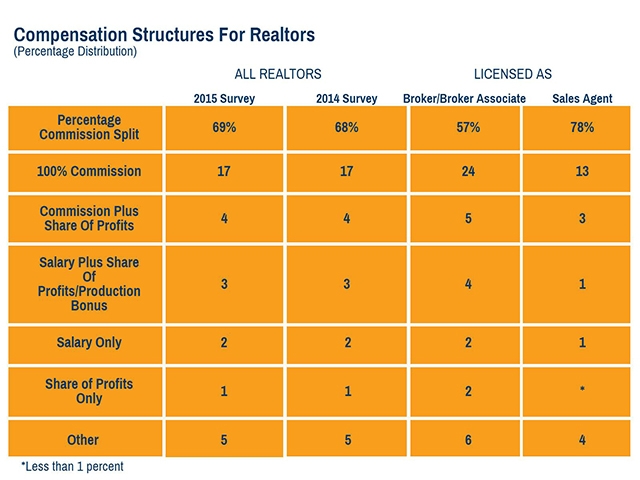

Looking at the chart below, it is apparent that realtors are handsomely compensated for the effort of showing you houses and bringing buyer and sellers together.

This does not mean that all agents are bound by similar ethics and incentives.

It is always an encouraging move to rely on word of mouth or recommendations from close friends and family.

A good realtor is motivated to guide you in the correct direction, assist in the negotiation of your bid, inform you of counter proposals and facilitate the close of sale.

Despite the potential pitfalls that are best to be aware of before even applying for a pre-approved loan, it is a rewarding experience to own one’s home.

Working towards easily paying off one’s most important investment is a beneficial experience.

If you’d like to speak with someone about your credit, and how it may be impacting you financially, reach out to one of our credit consultants here.

We’re located in Tampa, Fl and have helped over 25,000 people nationwide restore their credit

Leave A Comment